SAFEs and convertible notes have become very popular in recent years, with many startups using them to conduct their initial fundraises. There are a number of reasons for this, including:

-

Speed: These agreements are simpler and shorter relative to preferred stock financing documents (e.g. Series Seed or Series A). This usually means the process takes less time to close.

-

Cost: Priced rounds often require startups and investors to invest far more in up-front legal fees.

-

Simple terms: Traditional funding rounds require founders to commit to terms like a fixed valuation, despite uncertainty in the early stages of a company. SAFEs and notes are usually more flexible. (These will convert into preferred stock in a future priced round.)

-

Rolling closings: You can close notes and SAFEs individually as you meet new investors instead of having to coordinate a formal closing between multiple investors on the same day.

-

Speed: These agreements are simpler and shorter relative to preferred stock financing documents (e.g. Series Seed or Series A). This usually means the process takes less time to close.

Despite these benefits, many founders don’t fully understand the terms or potential impact of notes or SAFEs until they convert in a priced round. These impacts—such as additional dilution to a founder—can be material, and unfortunately at that point their conversion terms are generally set in stone.

Free SAFE and convertible note calculator

While notes and SAFEs can be a great solution for founders, it’s important to understand the potential future impact before fundraising. That’s why we’re thrilled to debut the Carta SAFE and convertible note calculator today.

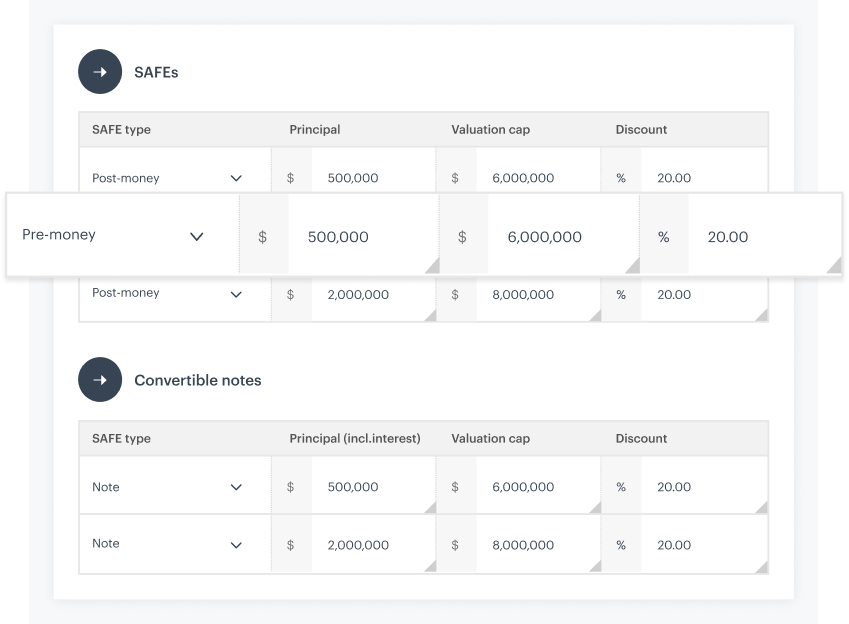

Our SAFE and convertible note calculator will help you understand the potential dilutive impact of pre-money SAFEs, post-money SAFEs (aka YC SAFEs), and notes once they convert in a future priced round. You can set up your model in seconds and run as many scenarios as you’d like—all you need are a few inputs:

-

A few numbers from your current cap table, including your current holdings and the company’s current fully diluted share total

-

Any number of notes or SAFEs (in any mix you like)

-

Figures for a prospective future fundraise

From there, the calculator will reveal a range of outcomes, modeling how ownership in your company may be distributed across a range of priced round valuations.

A few tips and tricks for using the SAFE and convertible note calculator:

-

Observe the impact of post-money SAFEs (aka YC SAFEs) vs. the same amount raised with pre-money SAFEs—you’ll see post-money SAFEs are more dilutive.

-

Assume some additional interest for any notes you model (generally these will accrue interest at an agreed-upon rate from issuance until conversion).

-

Model the impact of the different available option pool percentages in your priced round—this typically dilutes your ownership percentage and drives down the effective price per share for the round.

If you’re preparing for your first note or SAFE financing round, consider joining Carta Launch (free for companies with up to $1M raised and up to 25 equity holders) to set up your cap table. Launch will help you track all the notes and SAFEs you issue while providing you, your investors, and your counsel (if applicable) with visibility.