As 2023 came to a close, founders faced the toughest market for raising seed funding in nearly five years.

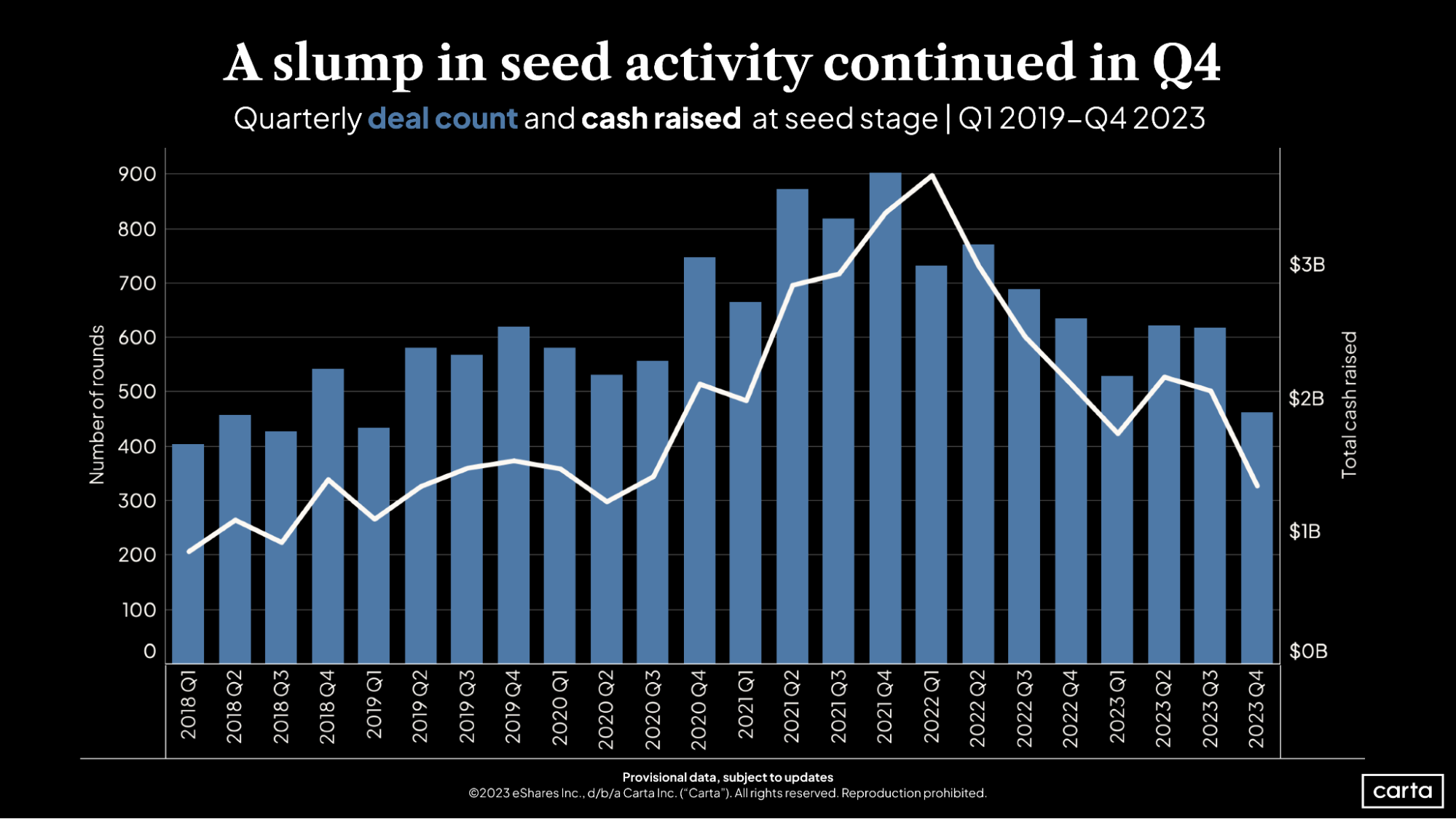

Startups on Carta closed 462 new seed investments in Q4, the lowest quarterly total since Q1 2019. This number will likely rise in the ensuing weeks as companies continue to report additional recent deals. But even assuming a modest bump, the end of 2023 is looking like a quiet quarter.

>>Get sector-specific data on seed fundraising activity.

This reduction in deals wasn’t an isolated trend in Q4. A general decline in the quantity of seed investments has been underway for a while, ever since the market reached a recent high of 902 transactions in Q4 2021. Over the span of those past two years, quarterly deal count has nearly been halved.

Early on, it appeared the seed market might be relatively immune from the venture slowdown that began in 2022. Not anymore.

Founders have noticed. With the number of new seed deals steadily shrinking, some early-stage companies are turning to different funding pathways to get their dreams up and running.

ThinkHumanTV’s fundraising journey

One such example is ThinkHumanTV, an edtech startup led by co-founders Mel Cesarano and Ilya Lyashevsky that’s using content from streaming services to help young people improve their emotional intelligence, or EQ. The company maps its own custom-built EQ teaching materials on top of popular movies and shows, allowing parents, teachers, and mental health professionals to mix entertainment with emotional education. Cesarano and Lyashevsky both come from academic backgrounds: The two are research partners at Columbia University, where they created and teach a class on the cognition of emotional learning. They started ThinkHumanTV in 2018.

Many pre-seed startups seek capital from friends and family, angels, or early-stage venture investors. ThinkHumanTV’s founders chose instead to capitalize on their company’s research-based roots: They raised grant funding from the National Science Foundation in 2019.

With that capital in hand, Cesarano and Lyashevsky were able to postpone venture fundraising and begin working in earnest on their first commercial product, a B2B version of their tool aimed mainly at schools.

“My company is very lucky in the sense that we’ve had a lot of success with grants,” Cesarano says. “We were able to focus mostly on research and development because of the National Science Foundation funding that we had.”

The next steps

A couple years later, ThinkHumanTV was again thinking about ways to refill its coffers. The founders began meeting with VCs to explore raising a seed round, but found they were too early in their journey to meet the sort of metrics that investors expected. Instead, they went back to the NSF and were awarded another $1 million in grant funding in 2022, enough for at least a couple more years of runway.

Eventually, though, for ThinkHumanTV to achieve its ambitions, Cesarano says she knew the company would need to “take the training wheels off” and raise a larger sum of venture capital. Those previous conversations with VCs yielded useful insights about what investors were looking for. To learn more, Cesarano went through multiple fellowships aimed at aiding early-stage founders. As 2024 unfolds, she’s preparing to hit the fundraising trail in earnest.

But she’s also well aware of the recent slowdown in early-stage deal activity.

“I would say the investors we’ve spoken to have been very cautious,” Cesarano says. “They don’t really want to take risks, especially if you’re not getting the revenue or the traction. … If you want to raise a seed round, you need like a minimum of $250,000 in revenue per year.”

So ThinkHumanTV still isn’t putting all of its eggs in the VC basket. Cesarano says her company is also exploring a potential crowdfunding event for a consumer-facing version of its service, with twin goals of bringing on new capital and providing VCs evidence of their app’s initial popularity.

“We’re going to show that as proof of parents’ motivation and excitement for the consumer product when we do try to go raise funding,” Cesarano says.

The full seed story

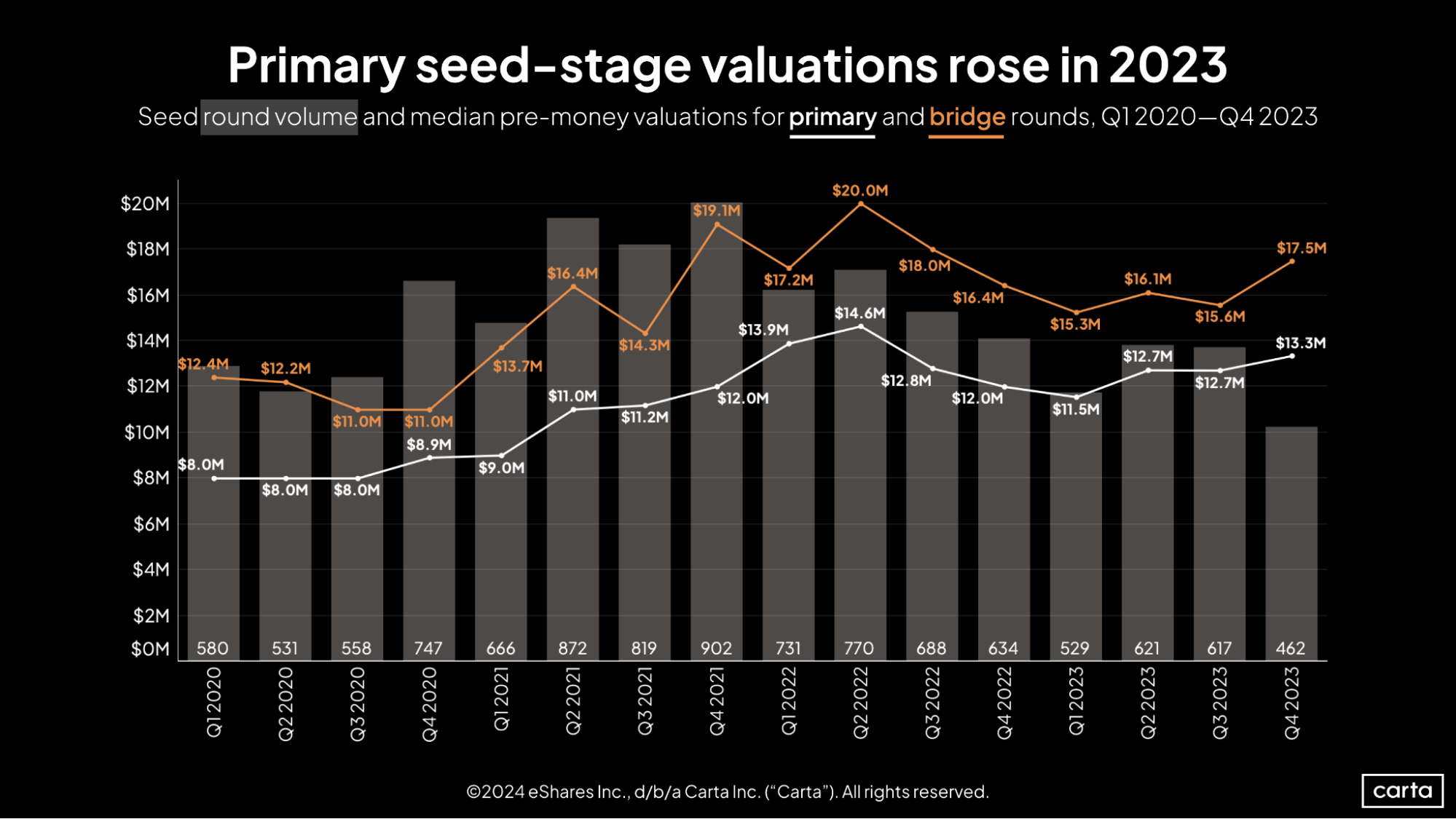

Deal counts and cash raised both declined at the seed stage in Q4. Seed valuations, however, are moving in the other direction. Median valuations on primary seed deals increased steadily throughout 2023, reaching $13.3 million in Q4, up 11% year-over-year. Valuations on bridge rounds raised by seed companies are also trending up.

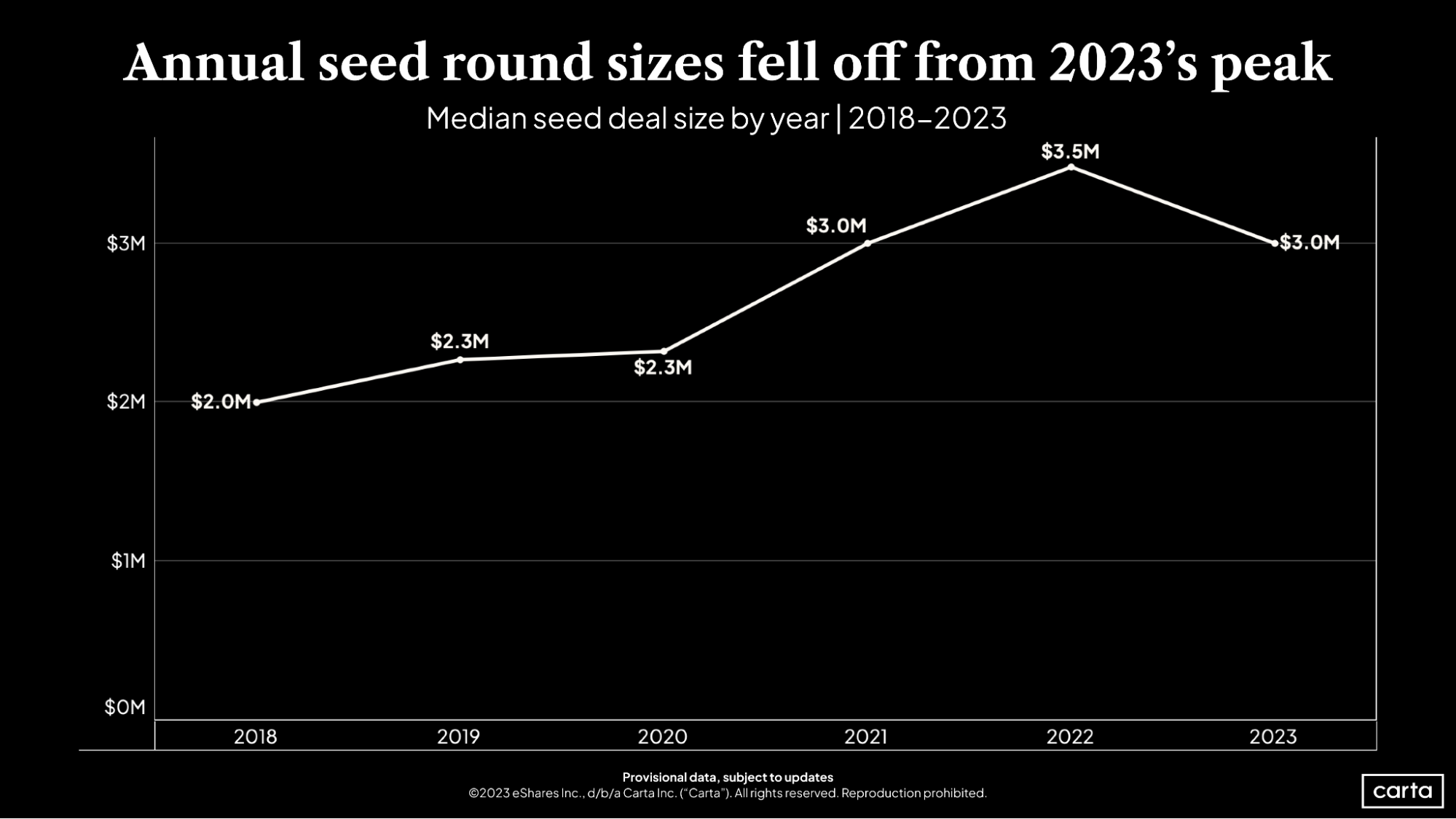

The size of seed investments, meanwhile, has held steady. The median seed round size has landed at $3 million in each of the past three quarters, and it’s now been at $3 million or higher for 11 straight quarters.

On an annual basis, median seed deal size in 2023 was $3 million, down from $3.5 million in 2022.

In the edtech sector, where ThinkHumanTV operates, checks were even smaller: The median deal size there in 2023 was $2.3 million.

But Cesarano and her startup are a reminder that raising venture capital is not the only way to get a startup off the ground.

“There are all these variables that can make raising via the VC route really difficult. But there are other paths,” Cesarano says.

Sector-specific data on early-stage round sizes

In edtech, the median seed round size in 2023 was $2.3 million. How does that compare to other sectors, and to other stages?

Download the addendum below to see full data on median seed and Series A round sizes across eight of the most common industries for startup fundraising: