Executive summary

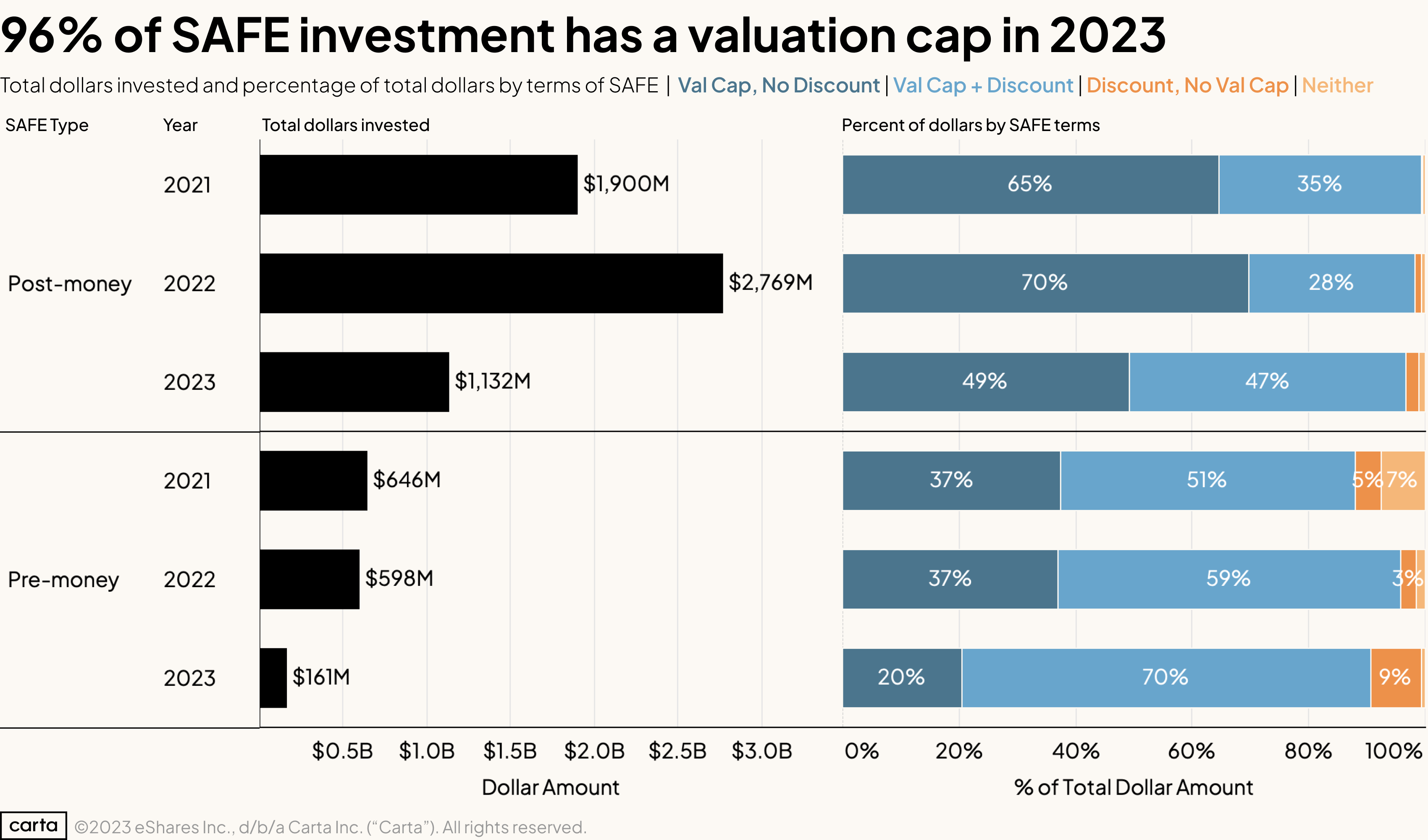

Every startup begins as a pre-seed company. At Carta, we define “pre-seed” as any company that has yet to raise a priced equity round. These nascent businesses usually raise capital with convertible instruments, the most common being SAFEs (Simple Agreements for Future Equity) or convertible notes.

For the first time, we’re diving deep into our pre-seed cap table data to understand how founders at this stage raise capital from friends & family, angel investors, and pre-seed VCs. And there is a lot of data: Tens of thousands of startups that use Carta are currently pre-seed and 2,103 of them raised capital with convertible financings in H1 2023.

In this report, we touch on all the basics of pre-seed financing, including:

-

SAFEs, in all their many flavors

-

Convertible notes and their associated interest rates

-

Valuation caps and discounts

-

Angel check sizes and industry segments

Download the full report for everything you ever wanted to know about how fundraising works for the earliest startup companies.

Q2 highlights

-

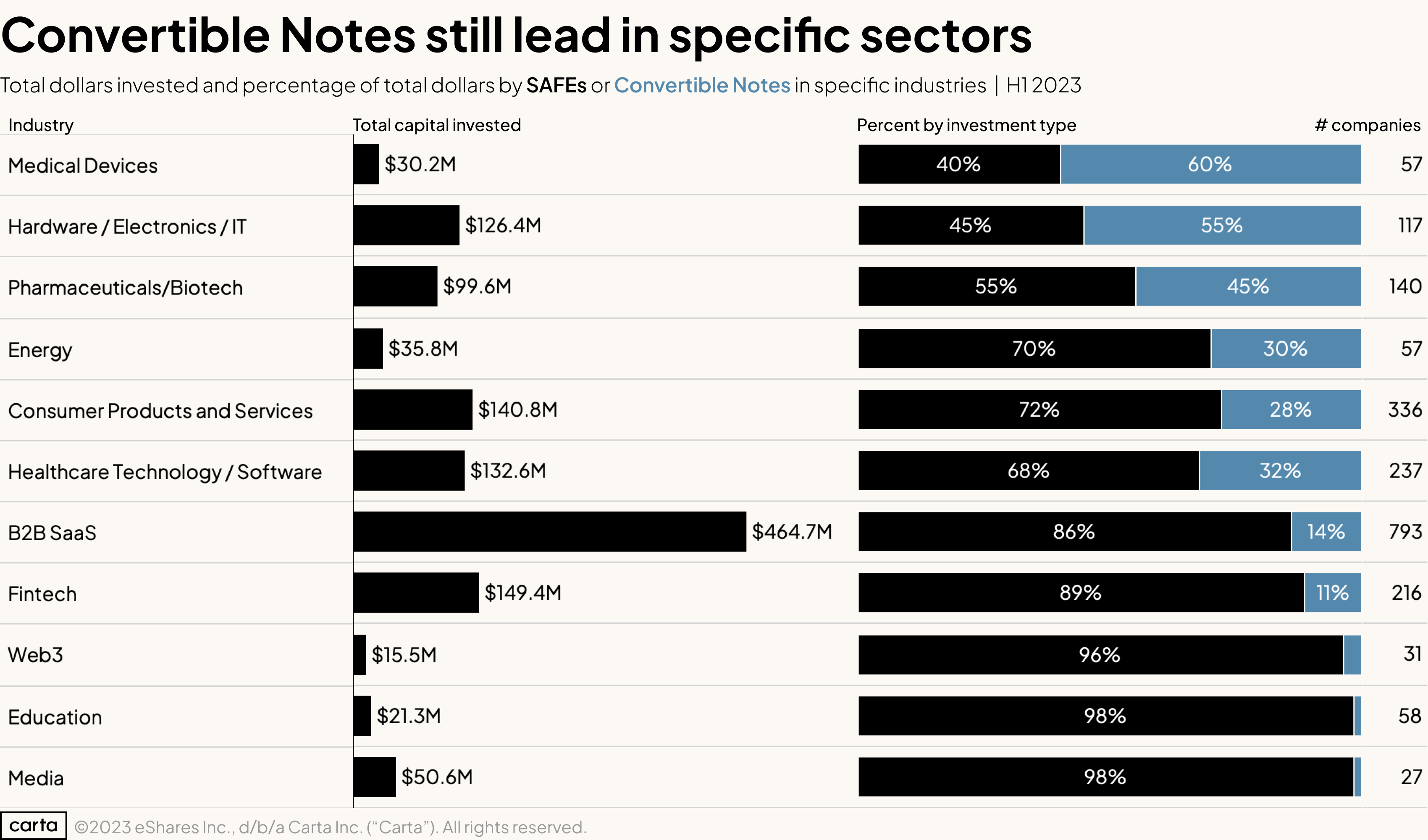

SAFEs have taken over: Investment through SAFEs accounted for 80% of pre-seed invested capital in Q2 2023. However, certain industries such as medical devices, hardware, and biotech still see significant investment using convertible notes.

-

Valuation caps have gently declined: The median valuation cap for post-money SAFEs was $10 million this past quarter, down from $15 million at the beginning of 2022. This median is highly sensitive to round size, dipping down to $6.5M for raises between $250K-$499K.

-

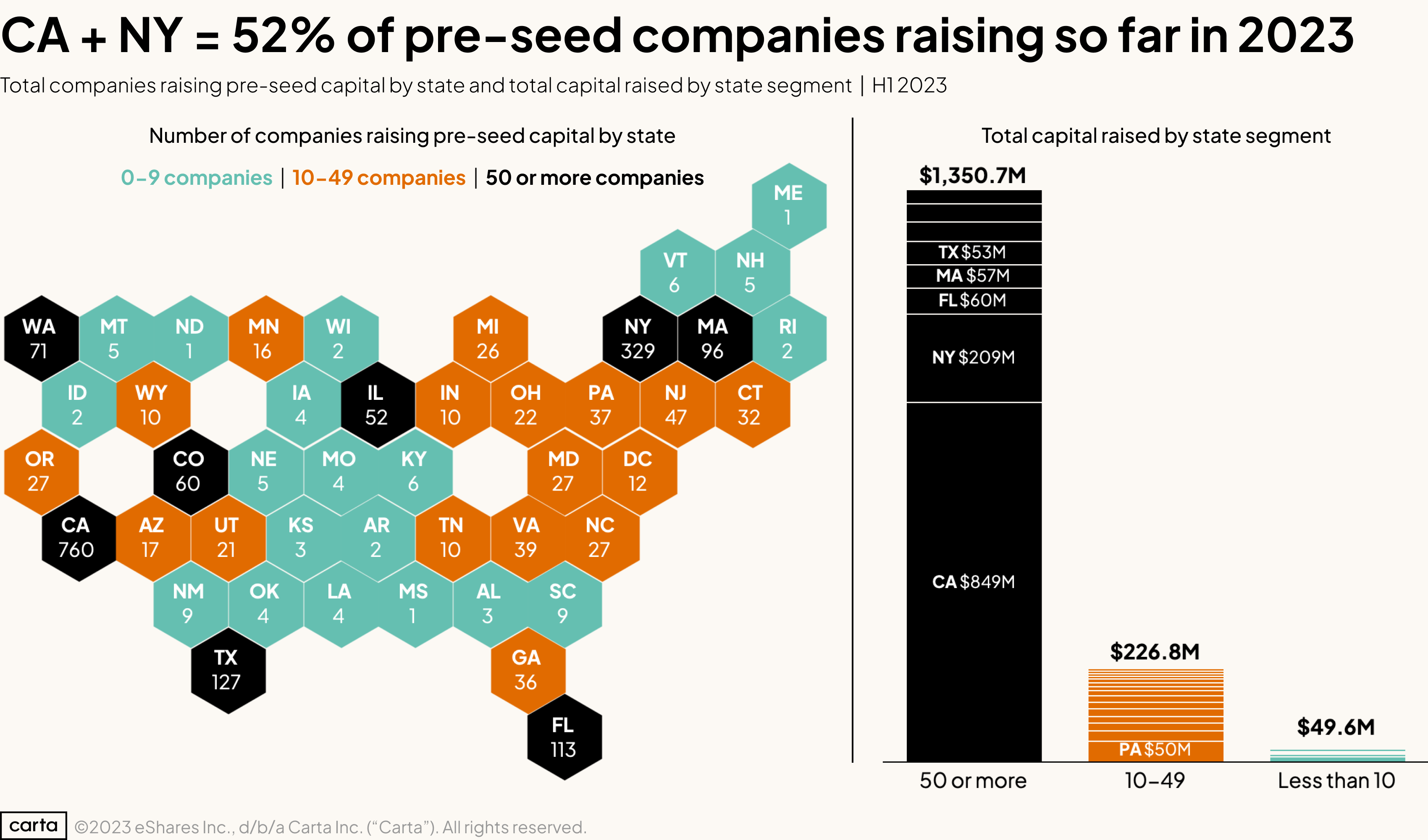

Legacy venture ecosystems dominate the pre-seed stage: Of the 2,103 companies that raised some form of pre-seed financing in H1 2023, over half are headquartered either in California or in New York. Companies in these mature VC ecosystems were also much more likely to raise mega pre-seed rounds ($2.5 million or more on SAFEs).

Key trends

Read the full report

For more data on seed-stage fundraising, download the full report here: