What is an investment memo?

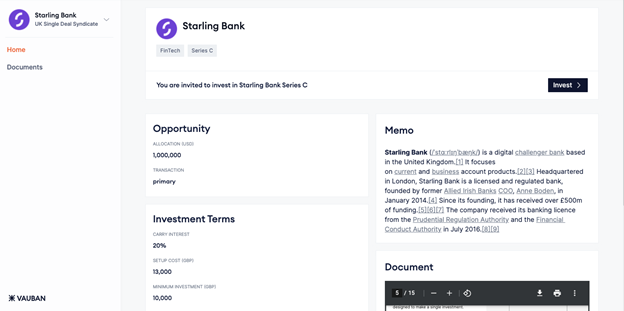

It’s a well-known practice in the venture capital industry for VC firms to write an investment memo to make decisions whether or not to invest in a startup company. This may be a feasible process for a firm that has resources to hire associates and analysts, but what about when you’re a solo deal maker? You are a lone wolf and your time is scarce. You are great at sourcing deal opportunities, you have built a strong network of investors in the ecosystem, and you are able to provide capital and knowledge to founders. But how do you get other investors excited when fundraising for your golden nugget opportunity?

This is where an investment memo can be extremely useful, not only will it allow you to look at the opportunities more objectively, but it builds a level of trust with other investors and demonstrates your level of conviction.

Here are some tips that may help you with your fundraising using an investment memo.

How to write an investment memo

Let’s face it, investors don’t have time to go through a deep due diligence and you are a credible person they can trust. One way to strengthen that trust is providing them with an investment memo that clearly demonstrates you have done your due diligence. The key is to keep it short and concise so that it’s easy to read and able to inform investors.

This is also a way for you to know the deal inside and out and expect there to be questions. Be ready to address them.

You need to have the basics. A lot of the information will likely be provided by the startup but it’s your job to do the additional due diligence to fill in the gap for other investors to make sound investment decisions. There are a plenty of resources that walk you through the details but here’s a few examples that your investment memo can include.

What to include in an investment memo

-

Company Summary: The elevator pitch explaining the Company’s business problem and solution. It should be clear and concise to captivate investor’s attention. There is no one better than the Founder’s themselves to help narrate this information.

-

Market: This section is where most of the work behind is conducted in learning if the Company operates in a big enough market to make sense from a return’s perspective for investors.

-

Business Model & Strategy: Outline how the Company is addressing a problem and its solutions as well as its revenue growth strategy.

-

Competitive Landscape: Key competitors in this sector and what is the Company’s competitive advantage.

-

Founding Team: Who are they, what is their background, and how did you come across them.

-

Commercial Terms: Waterfall distribution, any fees, etc.I’ve provided the classic Y combinator to help you through the process but there’s lots of resources on the web to help you to cater to your investment memo topics.

Use storytelling

Now let’s get to the fun stuff. Your investment memo should always be objective and factual. To make an investment memo an effective tool, connecting the dots with factual information through storytelling and conviction can be the difference between from getting an investor saying “I’ll think about it” to “How much can I invest?” Storytelling helps investors with learning because stories are easier to remember. Research suggest that facts are 20 times more likely to be remembered if they are part of a story. How is it that we can remember the story of Airbnb, Brian Chesky and Joe Gebbia deciding to rent airbeds in their apartment to conference attendees, but can’t seem to remember their valuation at their Series B round?

Storytelling is a serious business for business.

Your goal in every communication is to inform your target investors. Information alone rarely changes any of these. Research confirms that well-designed stories are the most effective vehicle for exerting information.

It’s no wonder that more founders and investors are embracing storytelling as an effective tool to inform, inspire, and teach. Build that connection and engagement with your investors.

Presentation is key

We’re a big believer in simplicity and that’s exactly what we provide to our dealmakers when fundraising through Carta.

Similarly, Bedrock Ventures and Footwork.VC are leading a new way of creating an investment memo and we absolutely love it! It’s called the Screenshot Memo. What's a screenshot memo? It's an investment memo to fit the size of a smartphone. It's simple yet impactful for investors, similar to our dashboard for smartphones.

Bring it all together

In any group of investors, you’re roughly going to have a split of visual, auditory, and kinesthetic learners. Therefore, the most effective method is to provide an investment memo and schedule a Zoom call to discuss the opportunity in greater detail. Bonus points, if you can bring the founder to participate on the call, but that’s not necessary, you already have all the tools you need.If you’re looking to navigate through different investor personalities, I’ve attached a link to the article here.

Post-fundraising round, you can also share the investment memo with your private network or create content around your investment decision process via Medium, Twitter or Substack to demonstrate your track record, credibility, and information about opportunities. Don’t let your hard work go to waste. You may attract prospective investors who would seriously consider your next investment opportunity.