What is a family office?

Family offices consist of some of the wealthiest families and influential individuals around the world. They have long been the driving force behind wealth deployment and institutional investing.

Over the last ten years there has been a huge shift in family office investment strategies, most notably an increase in asset allocation in venture capital. Campden surveyed 110 representatives of Ultra High Net worth families and their findings show that this trend is not slowing down. According to FON data, family offices invested $38.5 billion last year in Fintech companies backed by venture capital firms alone.

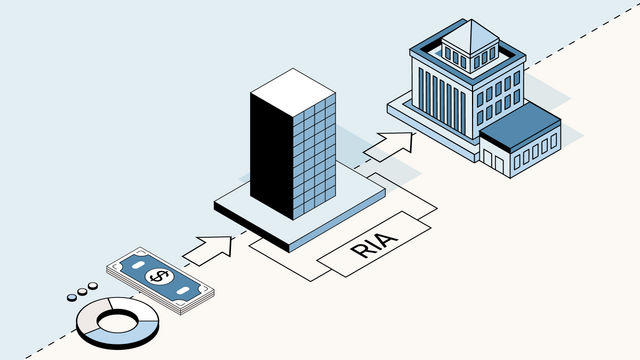

From venture fund investing to direct investments

While family offices are not required to publicly disclose their investments - and therefore reliable data is scarce - what we're also clearly witnessing is the trend of family offices investing disproportionally in direct opportunities (aka co-investments) rather than funds.

What’s behind this? We believe it’s due to a combination of factors:

Co-investments

Global wealth is surging; there are more Ultra High Worth Individuals than ever before and more families are generating enough wealth to warrant setting up family offices or multi-family offices.

This surge in wealth is advantageous for both family offices themselves and for early-stage companies and technology startups that who are raising capital.

Co-investments not only creates exposure to far larger transactions, but it also combines the resources of networks, to be leveraged for more successful return on investments. Family offices bring more than just monetary capital. From facilitating access to their network connections to investment experience, there is a lot they can bring to the cap table.

In addition, the involvement of family offices capitalizes on the resources available to them, in turn benefiting all those investing. Comparing such co-investment returns to investing through venture funds show they are 68% higher (Preqin Private Equity and Venture Capital Report, 2017)

Return on investment

Returns on investments in direct opportunities are very attractive for family offices. Family offices have low liquidity and diversification requirements compared to other traditional investors, which allows them to maintain portfolios that are more concentrated with more exposure to illiquid assets and to reap the increased IRR that comes with it.

Despite the current market uncertainties caused by COVID-19 (or perhaps thanks to it), family offices are investing both in venture funds and in direct opportunities like never before.

This is even more evident with single family offices. Their access to a large amount of capital gives them the patience required to wait out difficult times and yield better returns. The benefit of this increased risk is of course the potential for higher returns.

Campden’s report shows that on average family offices are averaging a 14% return on VC investment in 2020. It’s no surprise that 76% of them are investing direct and 10% of those are increasing the diversification of their portfolio 56%: 46% VC to hedge funds.

ESG – Making a difference

Companies, competitors, investors - every stakeholder in the industry is focusing on the impact they are having on the world around them, and it's no different for family offices. China has vowed to be carbon friendly by 2060 creating a huge benchmark globally. It is no surprise that ESG trends are growing, as are the number of startups in this space. The next generation of family offices are more involved in the decision-making process of their portfolios and they are moving away from the traditional styles of investing, instead becoming more and more concerned about the impact they are making. They are showing more interest in the companies they are investing in and the impact that they have. Not only with the products they provide but how they operate too. 47% of family offices are getting involved in ESG investments in sectors such as healthcare, energy, sustainability and food & agriculture.

Wealth passing generations

Family office’s are all about managing and growing wealth with the main focus on preserving generational wealth.

As wealth passes down generations, these younger members of the family are becoming increasingly involved in the decision-making processes and the investment flows of their family office holdings. Co-investment is proving to be a favorite for them.

At a dinner party, you may want to say "I invested in Klarna" not "I invested in Benchmark Europe Fund IV LP"

They are interested in investing in assets they resonate with on a personal level and that have a positive impact on the world. They are investing in infrastructure not only to create positive impact, but generate greater returns too as opposed to methods traditionally used by older generations.

The co-investment models works really well for all these reasons as such is attracting family offices. As mentioned earlier, family offices are increasing their allocation in ESG initiatives, with 54% of Family Offices increasing their impact allocation over the next 12 months as reported by Campden. This feels a lot more real when investing directly in a company rather than obtaining indirect exposure through a fund.

Transparency

The next generation of family offices are not only more concerned about the types of investments in their portfolio but are also becoming more hands-on in their decision making of the investment processes.

Deal flow and transparency of direct investment makes it more attractive than more traditional methods of investing. Family offices are becoming more and more circumspect in their investment strategies and their entrepreneurial nature makes them a great match for direct investment.

Overall, the trend of family office investing in direct venture capital co-investments is expected to continue to grow over time. It's clear to see that family offices are becoming more sophisticated in their investment strategies. At Carta, we have a front row seat to a lot of the phenomena described here. We’ve noticed how the next generation of tech savvy family office representatives are looking to deploy capital very quickly as a result of their developing investment strategies in venture capital. They have become less tolerance towards delay and particularly delays caused by archaic processes. They want to close deals fast and move on to finding their next great investment.