With a share scheme to suit almost every private company, the UK is fertile ground for starting a business. The tax advantages associated with EMI and CSOP can help startups take root in a competitive labour market, but what happens when your company exceeds the limits of these schemes – or doesn’t qualify in the first place?

Enter growth shares. As their name would suggest, growth shares can be used to incentivise and reward talent in fast-growing companies. While the concept may seem fairly straightforward, the decisions you make during the granting process can have wide-ranging implications – from tax treatment to potential payouts.

In this article, we'll explain how growth shares work, what's meant by a "hurdle" and why it's important to have an accurate company valuation.

What are growth shares?

A growth share is a type of security that enables shareholders to benefit from future growth in a company's value. The "growth" depends on a specific valuation hurdle; a sale above the hurdle triggers the growth shares to become valuable.

Growth shares are often used by mature UK companies that have outgrown government share schemes, such as EMI and CSOP. The tax benefits that make these schemes a popular choice for early-stage startups do not apply to growth shares. However, since growth shares are taxed as capital gains rather than income when sold, they're still preferable to unapproved options.

What's the difference between growth shares and share options?

Because they don't offer significant tax relief, growth shares aren't subject to the same restrictions as options granted under EMI and CSOP schemes. For instance, there's no limit to the number of growth shares you can issue, and they can be awarded to contractors and advisors as well as employees.

While EMI options need to be exercised within ten years of the grant date to remain compliant, growth shares are owned outright until they're sold. There is usually some cost involved for the grantholder, depending on how their equity is issued:

-

If you offer growth shares as a benefit in kind, employees won't have to buy them upfront; however, they'll probably have to pay income tax on their grant.

-

Alternatively, employees can purchase growth shares at the market value set in your latest valuation report, without being taxed upfront.

Despite their differences, growth share schemes can work alongside share option plans. So, even if your company has exceeded the limits of EMI or CSOP, you can continue to grant equity to employees and other stakeholders. This is one of the major advantages to growth shares.

How do growth shares work?

Growth shares are not part of the ordinary share capital, so you’ll need to add a new class of shares to your cap table and decide whether to grant voting and dividend rights to growth shareholders.

Before you can start issuing growth shares, you need a company valuation to determine the market value of the shares and a valuation hurdle. A valuation hurdle sets the threshold above which growth shareholders would benefit from a liquidity event.

Growth shares example

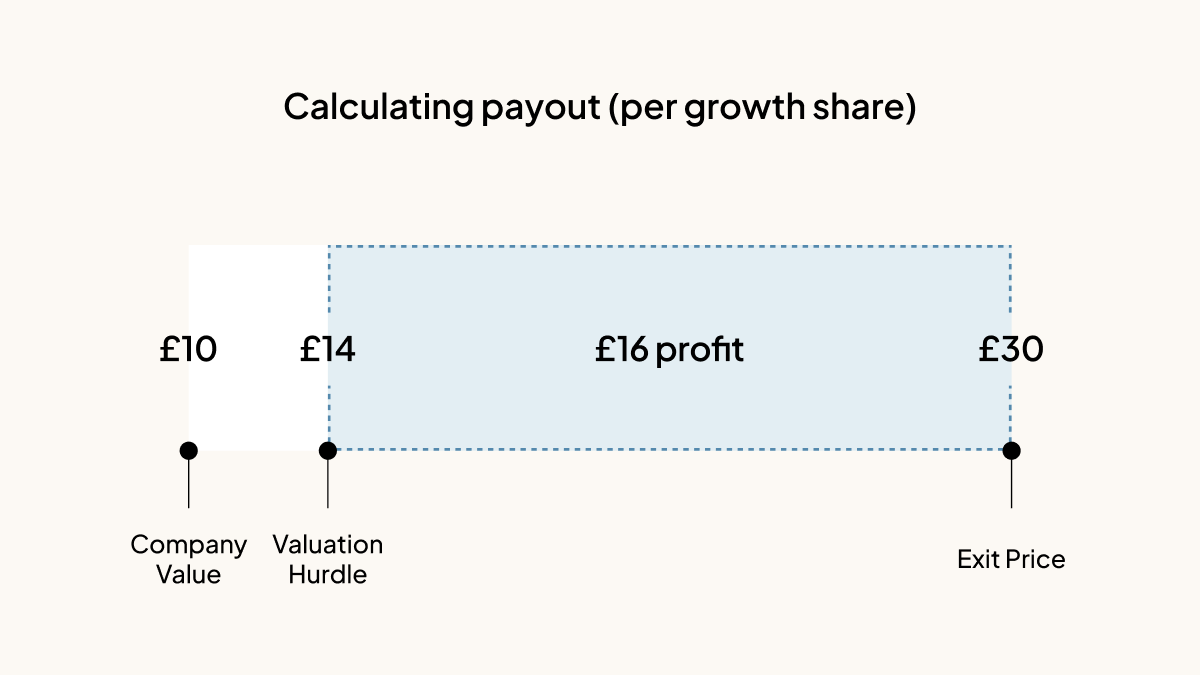

Imagine that your company is currently valued at £10 per share, and you decide to issue growth shares to new hires at a hurdle of £14 per share. The difference between the share price and the hurdle is known as the “hope value”; this premium is added to your company's current value to account for future growth.

A higher hurdle means growth shareholders have less chance of making a profit: the growth shares have a trading value of £0 today, and another £4 to go (the hope value) before they acquire any value in the future. You can therefore justify a lower market value for the growth shares, allowing your employees to purchase them at, for example, £0.001 per share.

Contrary to those holding options or warrants, growth shareholders only participate in proceeds above the hurdle. Let's say that, after a successful few years, your company exits at £30 per share. At this point, an existing growth shareholder could cash out and receive a profit of £16 per share (exit value minus valuation hurdle), which would be subject to capital gains tax (CGT).

However, if your company sells for anything below the hurdle, the growth shares will automatically lapse. As there's nothing to gain from this transaction, growth shareholders won't need to pay CGT.

How are growth shares taxed?

Growth shareholders may be taxed at two separate events: when they first acquire their shares, and if and when they sell them. The amount of tax depends on the valuation hurdle and the price they paid for the shares, as well as individual circumstances.

Acquisition of the shares

As in the above example, if you issue growth shares with a suitable hurdle, your employees won't have to pay income tax or National Insurance contributions (NIC). This is because there's nothing to tax yet; they'll only make a profit if the share price goes above the hurdle, which is typically set 10–40% higher than the value of your company today. At this point, you're also exempt from paying employer's NIC.

However, if employees receive growth shares as a "free" benefit or at a discount, they'll be liable to pay income tax on the difference between the price paid (if any) and the market value determined by your growth share valuation.

Sale of the shares

When it comes to selling their shares, employees may have to pay capital gains tax on the increase in value of their shares (i.e. exit price minus hurdle, which is £16 per share in our example). CGT is charged at 10% or 20%, depending on personal tax allowances and reliefs.

As an employer, you can't claim any corporation tax relief at this point – whereas you could with EMI and CSOP – but you won’t be taxed on any growth in the shares' value.

Why do I need a growth share valuation?

If you issue growth shares in the UK, you need a valid company valuation. Unlike EMI and CSOP, you don't need pre-clearance from HMRC to issue growth shares and your valuation won't expire after 90 days. However, whenever your business undergoes a material event such as a funding round, you'll need an updated valuation before issuing further growth shares because their value may have changed.

Note that in the event of an audit, HMRC has the right to challenge the price set for growth shares. Having a watertight valuation and corresponding report will mitigate the risk of undervaluing the shares and incurring future tax implications for your employees.

What makes growth shares unique, but also complex, is the trade-off between the valuation hurdle and share price. Setting the hurdle at a 10–40% premium to your company's current value makes the growth shares less valuable at the point of issuance. As a result, the cost of acquiring the shares will be more manageable for your employees and they won’t be taxed upfront. However, the higher the hurdle, the harder it is to attain. If there's not much to be gained from a future company exit, the growth shares won't be a strong enough incentive. An accurate growth share valuation will help you strike the right balance.

Growth share valuations from Carta

Given the implications of incorrectly valued growth shares, you need an expert valuation that can withstand a possible HMRC audit. If you're considering a merger, acquisition or IPO in the future, staying on top of your financial records is absolutely crucial.

Carta is an experienced provider of company valuations. Our in-house experts work with your data to calculate the valuation hurdle and resulting market value. You can then issue growth shares digitally through the platform, with all the changes reflected on your cap table in real time.

Growth share valuations are included in the price of a Carta Scale subscription, with no limit to the number of reports you can request. Our valuations analysts will support you throughout the process, including liaising with HMRC in the event of an audit.