IPO Advisory

Get end-to-end support on your road to an IPO

Prepare for listing day with guidance from an experienced IPO Advisory team.

IPO-ready, on your terms

Seamlessly transition from private to public

Leverage solutions designed for companies that are 18-24 months from IPO.

From that first confidential call, the IPO Advisory team will provide guidance and support with everything from general cap table readiness to insights that help identify your goals.

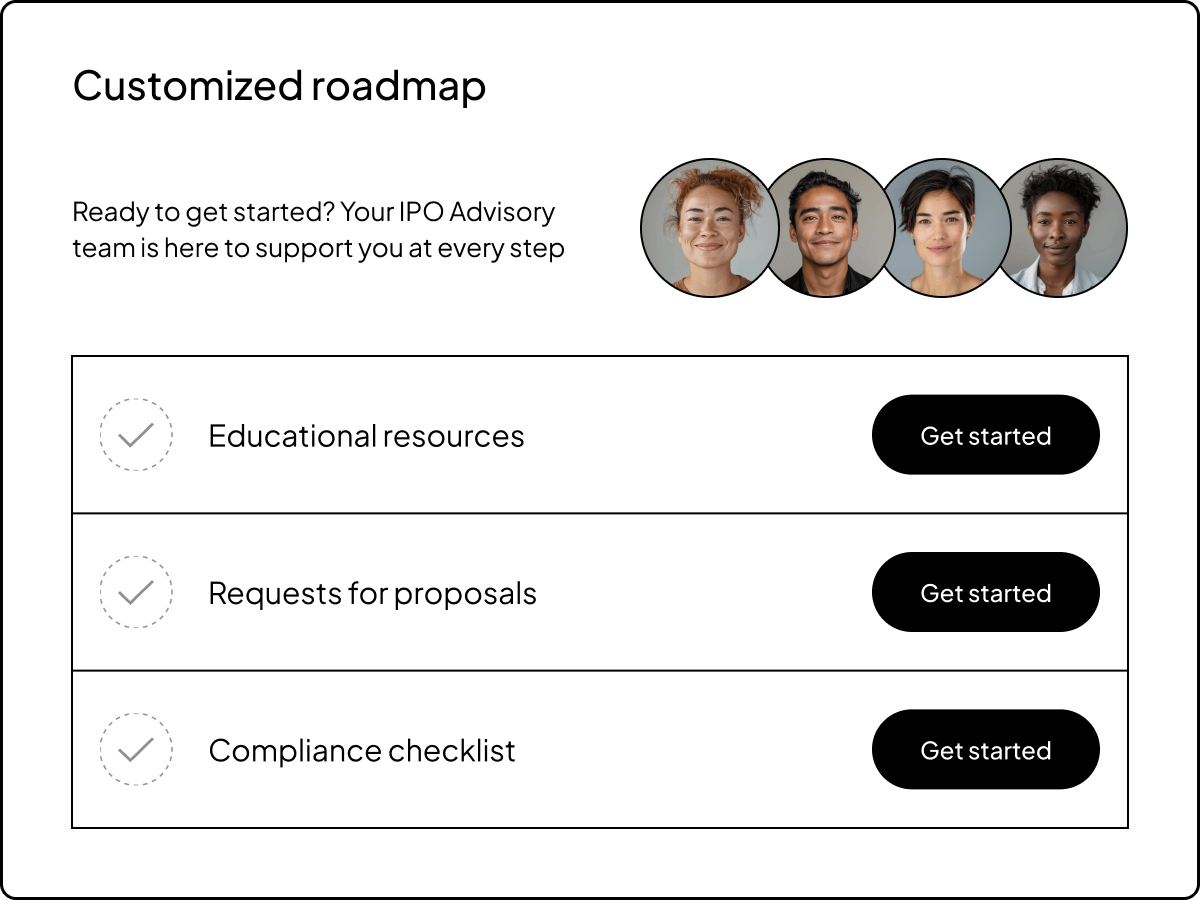

Your team will work with you to develop a customized roadmap to help you find the right transfer agent and plan admin. They will also assist in providing comms and educational resources for your shareholders.

Set your timeline for transitioning to your new plan admin and transfer agent while maintaining a positive experience for key stakeholders—all from one platform.

Trusted by over 40,000 companies

Related resources

FAQs

Is IPO Advisory only for Carta customers?

Yes, having your cap table on Carta is essential to the IPO Advisory service. You can learn more about pricing and plans here .

What services does Carta offer to late-stage private companies?

Discover the services and solutions that Carta can provide check in this handbook for late-stage private companies here .

What should my company be considering for an IPO?

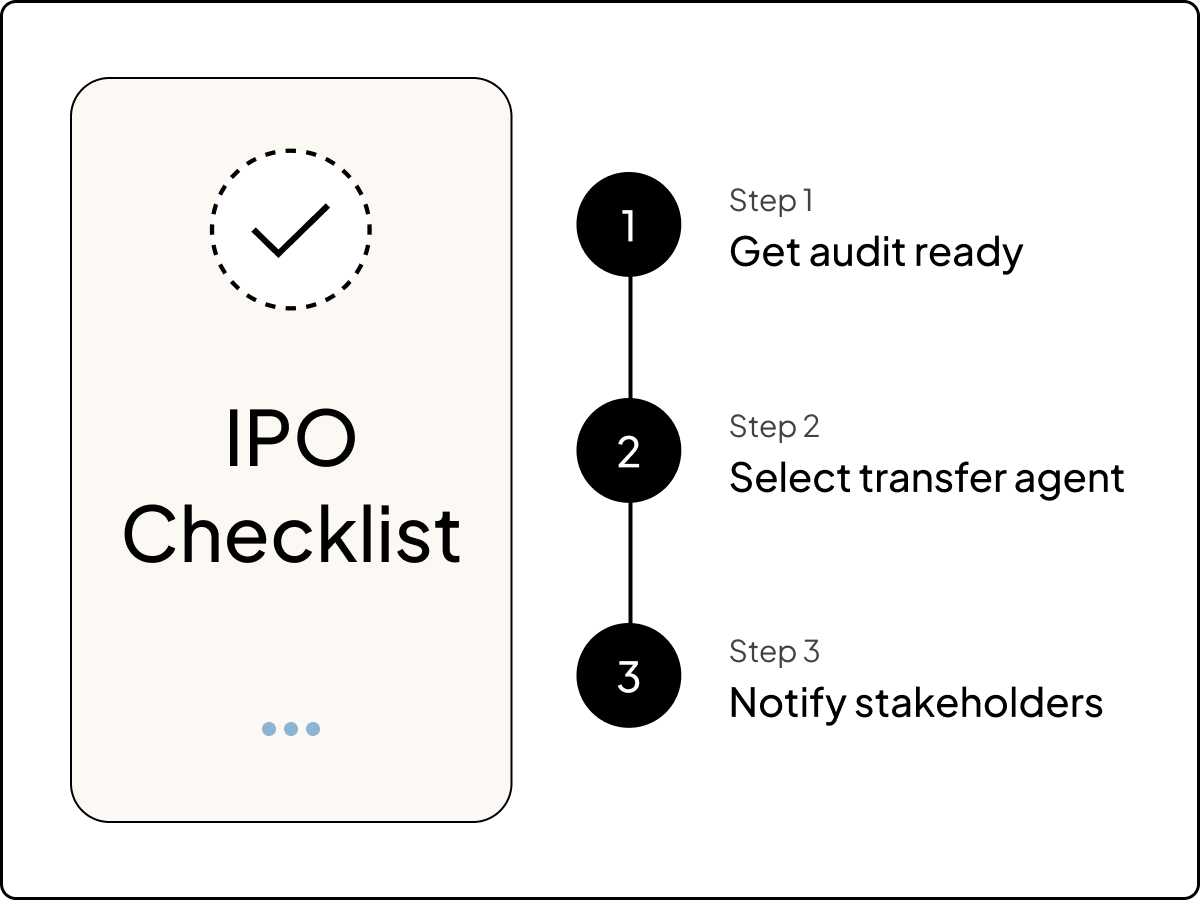

Companies planning to IPO should consider several factors, like vendor selections,drafting the S-1 and audit diligence, to name a few.This can be overwhelming—which is why Carta offers a bundle of IPO readiness reports to streamline the preparation required for audit and S-1 drafting into one download.Learn more and access the bundle here .

When should companies reach out about IPO Advisory services?

We encourage customers at all stages to contact us to learn more about the IPO process and transition, but ideally no later than 12-18 months out from their prospective IPO date.

How can Carta help if the IPO is delayed?

Exit timelines can regularly shift. If your IPO is delayed, Carta allows your company to maintain its status as a private company until it is ready to go public.