What 2008 can teach VC

Markets can crash when people become fearful and start holding back on investing, pulling their money out. The uptick in number of investors and ecosystem players relaying their fears is an indication this fear is reaching critical mass. Indeed, Q1 saw global venture funding fall for the first time in a year, from $184 billion to $160 billion.What lessons are there for investors to learn from the previous financial crisis? Let’s dive in:

Seed stage funding did well

In the wake of the 2008 financial collapse, VCs held back from new commitments in most stages except seed stage funding, which did rather well. In parallel, seed funding this year continued to grow in Q1, going from $10.1bn to 10.3bn quarter-on-quarter, and up year-on-year by 45%. Last time, these seed companies went on to form the unicorns of today - in 2009 Yuri Milner made a growth investment in Facebook.

Source: Crunchbase News VC investors in earlier stages are comfortable with longer time-frames - especially seed stage companies who are typically 6-10 years away from a meaningful exit. Market downturns play to their advantage.

The number of angels and startups doubled

In the decade after the financial crisis, from 2009 to 2019, the tally of US venture investors more than doubled, as did the number of startups they funded. Many of those startups who have since exited have become angels who will continue to strongly believe in the asset class.

11) C) Unlike in prior eras, many of the angels we see today are ppl who made their $$ in tech - from working at a big tech co or a startup.They believe in the asset class & also know that it takes 10+ yrs to build a large co. They have patience.

— Elizabeth Yin (@dunkhippo33) March 10, 2022

It's also worth noting that Andreessen Horowitz launched their fund in early 2009. It’s entirely possible to start investing now and become a heavyweight VC investor.

Differences:

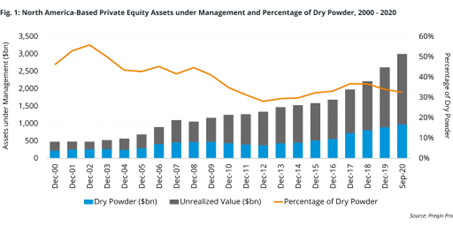

We have record levels of dry powder

Over the past decade we’ve seen a boom in popularity of LPs playing in private markets. In 2020 private equity AUM had more than doubled since the global financial crisis, with firms managing $3 trillion. Dry powder allocated was $1billion – more than double the level in 2008. This availability of cash is a positive difference, there’s more cash to buffer. Cash is the King that’s still here. If a VC has dry powder while others take longer to close their next fund, this gives them an advantage for what deals they can get involved in.

Source: Preqin

Interest rates

Interest rates were much higher at the start of the ’08 recession – around 4% - meaning the US FED could pull rates to zero as an emergency response to support the economy. Lower rates meant the discount on future cash flows were also lower – perfect for VC investing - and they pushed investors up the risk curve when they were looking to make higher returns. The big difference now is we’re going into this current period with rates already starting from close to zero, giving the FED little headroom to stimulate the economy if it needs to.

No Tech Boom

In the words of the brilliant Sebastian Mallaby in The Power Law, the 2008 recession "coincided with the advent of smartphones, cloud computing, and the mobile internet, setting up an opportunity to build brilliant businesses atop the new platforms." While in its infancy, will there be a parallel with Web3 being a similar enabler?

Shifts in talent

Finance and banking received a bad reputation for destroying the US economy. By comparison, tech became comparatively much sexier and drew a lot of talent that would have otherwise flowed into the finance sector. However, with market valuations being down, this will likely reduce compensation across the sector because a lot of compensation in startups is tied to shares and options. This will make it harder to build businesses with top talent from the get-go if compensation becomes lower as concern increasingly grows around profits and returns from investments once “free money” is over.

Hopefully, the lessons learned from 2008 can quell some investors’ fears about where things will head over the next period. It’s worth remembering that a slow-down isn’t all too bad in any case: lower valuations means companies are cheaper. With the shift of power moving from founders to investors, investors can move at timelines more comfortable with them. When previously some deals were so hot investors didn’t have time to do their due diligence, now they can get to know founders and markets on their own terms – and write cheques on their terms too.