In most of the United States, venture capital activity tailed off considerably in 2022 after smashing records in 2021. The combined value of startup investments in the nation declined by 80% from Q4 2021 to Q4 2022, according to Carta data.

That reversal was present in nearly every state that’s home to a significant startup hub. In California, deal value dipped by 84% from Q4 2021 to Q4 2022. In New York, it was 80%. In Washington, it was 89%.

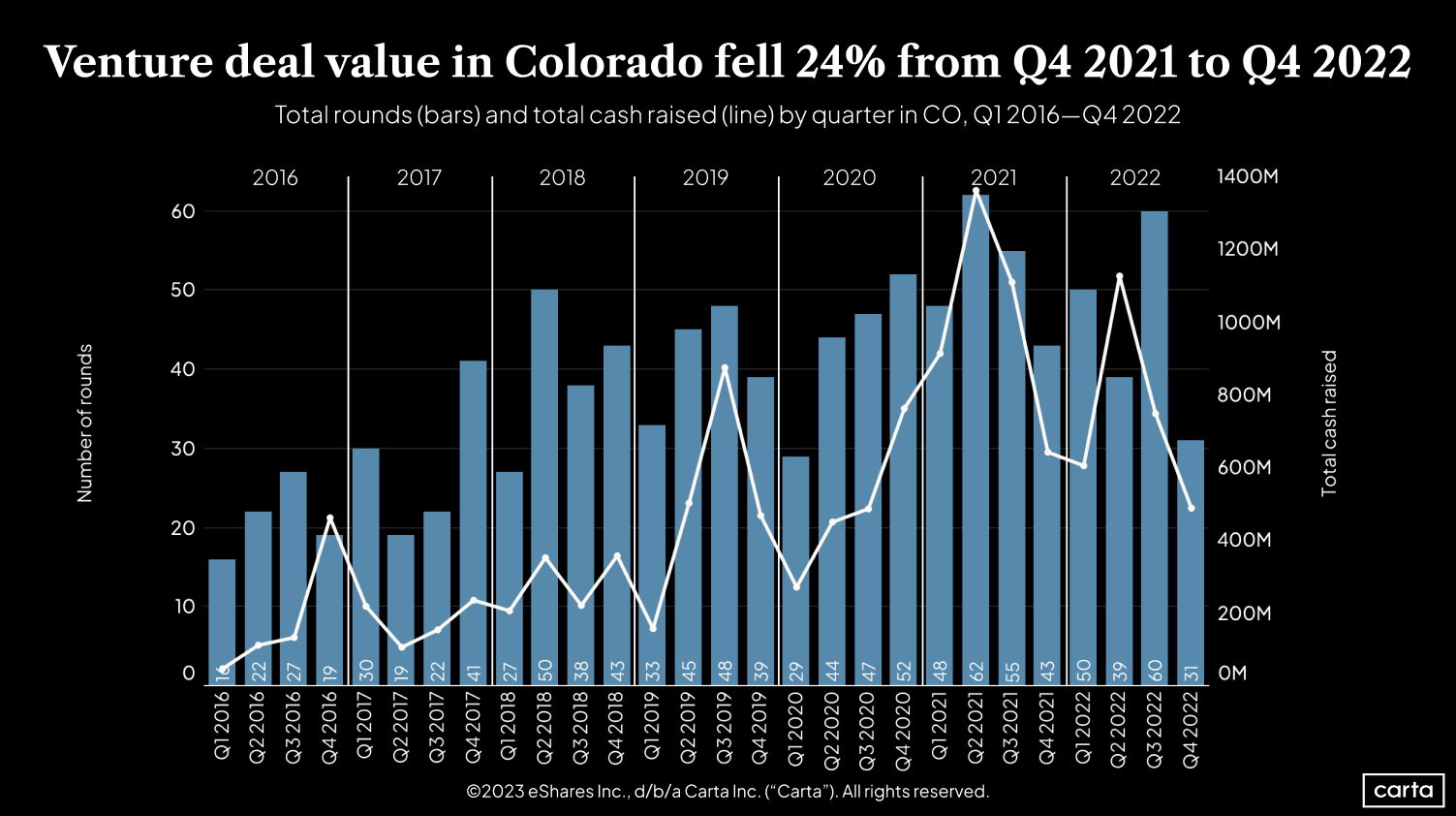

But there is one notable exception, a state that so far has been more resistant than most to the recent venture downturn: In Colorado, the value of startup investments dipped just 24% from Q4 2021 to Q4 2022. That’s far and away the smallest drop among states with at least 20 venture deals tracked on Carta during Q4. The next-smallest year over year decline was Virginia, at 48.5%.

There’s a similar trend in deal count. The overall number of startup investments in the U.S. fell by 56.4% from Q4 2021 to Q4 2022. California, New York, Texas, Washington, Florida and Illinois all saw declines of at least 55%. But in Colorado, deal activity dipped just 28%.

For the full year, venture deal count in Colorado fell just 13.5% between 2021 and 2022, compared to a national decline of 29.2%. The next-smallest dropoff among states with at least 150 investments in 2022 was Florida, at 22.9%. In terms of deal value, Colorado’s annual decline of 26.3% from 2021 to 2022 again compares favorably to a national decrease of 50.8%.

Denver County alone saw $2.29 billion in venture capital raised last year, ranking 12th among all counties nationally. Of that cash, 27% went to the energy sector, while SaaS startups raised another 21%.

In 2022, there was one venture investment in Colorado for every 32,076 residents. That was the fourth-highest density of deals in the U.S., trailing only Massachusetts (1 venture deal for every 16,310 people), California (1 in 17,801) and New York (1 in 23,166).

A magnet for tech talent

A number of factors could help explain why Colorado weathered 2022’s venture downturn better than other states. It begins with the people.

Colorado’s total population grew by 14.8% between 2010 and 2020, the sixth-largest increase for any state. That migration has included a significant segment of tech workers. The number of Denver-area workers employed in high-tech industries rose 18.9% between 2015 and 2020, compared to 8.9% for the whole U.S. over that span.

And that was before COVID. Investors based in Colorado say that the rise of remote work during the pandemic has caused even more tech workers to flock to the region, drawn by the great outdoors and a lower cost of living than Silicon Valley.

“There has been a steady influx of talent over the last decade, but it has accelerated during COVID,” says Colin Barclay, partner at Delta-v Capital, a growth equity firm based in Boulder.

Drawn by the presence of those tech workers, a number of big tech companies have expanded their presence in Colorado. Five years ago, Google opened a $131 million facility in Boulder. More recently, Palantir Technologies shook up the tech world by moving its headquarters from Palo Alto to Denver in 2020. Names such as Marqeta and Wix opened new offices in the region during the pandemic, while Amazon added new office space and around 100 new hires.

Investors also credit several nearby universities for contributing to the Rocky Mountain region’s rise as a tech hub. The University of Colorado, Colorado State University, Colorado School of Mines, and the University of Wyoming—located in Laramie, about a two-and-a-half hour drive north of Denver—all have dedicated entrepreneurship programs. In Colorado Springs, the Air Force Academy is a source of military innovation.

“They play an incredible role in the startup community,” says Brian Wallace, managing director at Access Venture Partners, a Colorado-focused firm based in Westminster. “It’s a really strong ecosystem of universities relative to our population.”

A new generation of startups

Most new arrivals and new graduates go to work at established companies. But some have decided to start companies of their own. It’s these founders who, as they start to draw more attention from VCs, are taking Colorado’s startup ecosystem from infancy into its adolescence.

“Talented technical people are moving here,” Barclay says, “and those types of people attract capital.”

As one might expect for an emerging hub, most of the recent venture activity in Colorado has involved companies at earlier stages of the startup lifecycle. Across 2021 and 2022, about 67% of all venture investments in the state were either seed or Series A. Just 3% were at Series D or beyond.

This has intriguing implications for investors in the region. Eventually, some of those young companies will begin to raise later-stage rounds and draw larger sums of capital. And some could eventually spawn alumni networks of entrepreneurs who go on to found companies of their own.

As a VC might put it, the Colorado region still has plenty of runway.

“As those companies mature, I am optimistic that for us, as later-stage venture investors, that will translate into a more attractive, geographically proximate opportunity set,” Barclay says.

Colorado vs. other rising states

During 2022, Colorado was largely able to sustain its pandemic-era tech growth in ways that other states have not.

Take Florida, home to Miami, which has spent recent years wooing Silicon Valley venture capitalists and Wall Street hedge funds to relocate. Venture deal count in Florida had spiked dramatically early in the pandemic, climbing more than 300% between Q1 2020 and the end of 2021. But 2022 brought an abrupt shift: Deal count in Florida was down 57.4% from Q4 2021 to Q4 2022, while the value of those deals declined by 86.2%. The plunge of the crypto industry, of which Miami was an emerging center, surely hasn’t helped.

Some other state-by-state takeaways:

-

Total VC funding in California fell from $32.5 billion in Q4 2021 to $5.2 billion in Q4 2022, a staggering $27.3 billion difference.

-

Only two states saw annual VC deal count climb from 2021 to 2022: North Carolina, where it rose by 5.2%, and Virginia, which saw a 1.7% increase.

-

Utah was home to 37 VC investments in Q4 2021. That number fell to just 5 in Q4 2022, marking an 86% decline.

The geographic democratization of venture capital was a major trend of the pandemic, with many different regions staking claims as new hubs. So far, it looks like Colorado might have more sticking power than most—and investors in the region are taking note.

“Everybody says, ‘Oh, it will be like Silicon Valley,’” says Wallace of Access Venture Partners. “No, it won’t. But the ability to be at the top of that second tier of markets—that’s an incredible place to invest.”

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: