As the rate of venture capital activity slowed throughout 2022 and into early 2023, new funding rounds on Carta grew more likely to include investor-friendly deal terms. A dearth of deals meant VCs had more leverage in negotiations with startups, and some used that leverage to help shield themselves from downside risk.

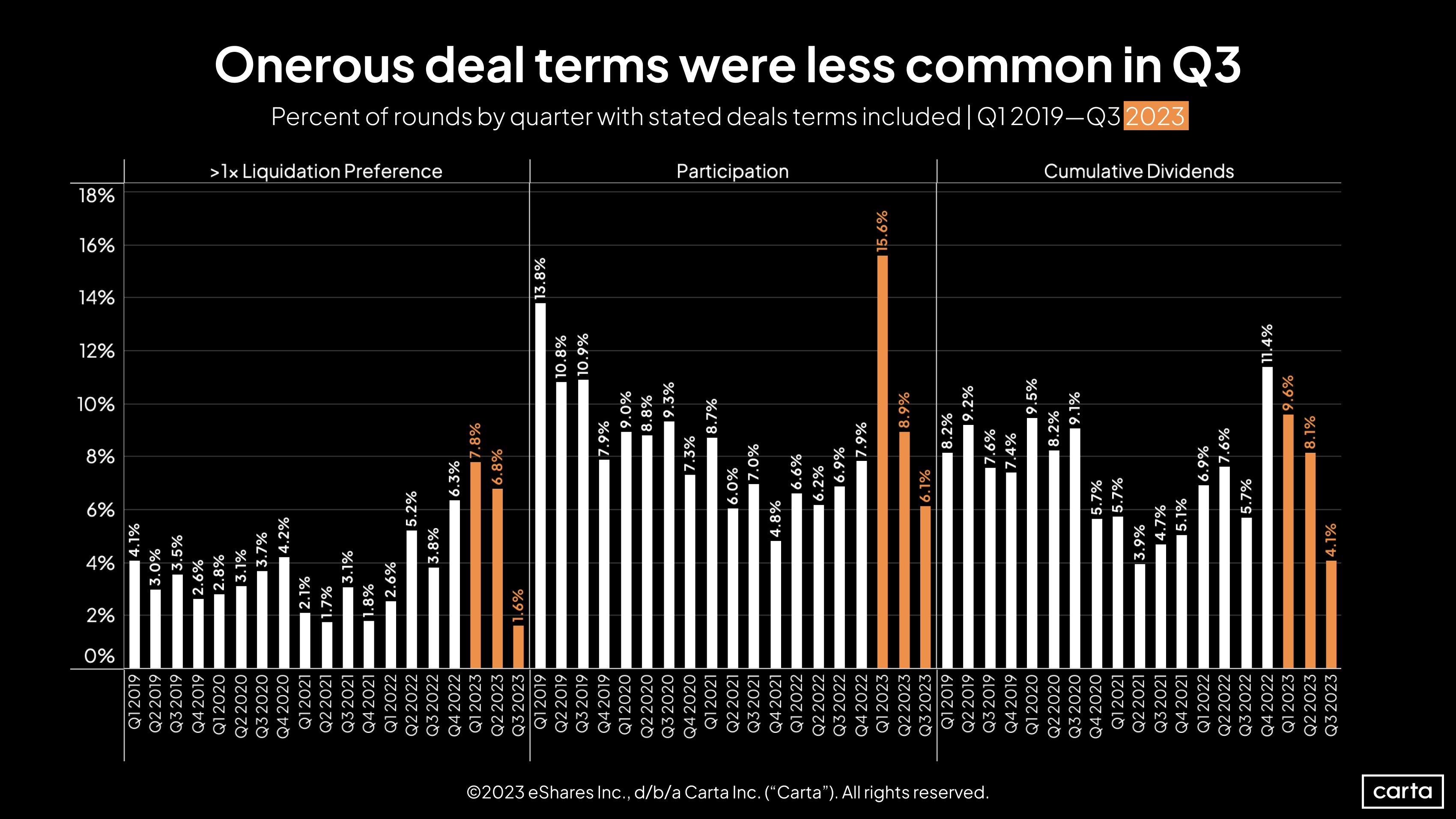

One example: In Q4 2021, just 4.8% of rounds raised on Carta involved participating preferred stock, a special class of stock that both takes precedence over common shares in the event of an exit or liquidation and allows the holders of such stock to receive additional proceeds in a successful exit. By Q1 2023, that figure had increased to 15.6%.

While a vast majority of VC rounds still did not involve participating preferred stock, the rate of rounds that did saw a threefold increase.

In times when investors have more leverage, they may push for participating preferred stock because it allows them two bites at the apple when it comes to returns from a portfolio company exit. In more founder-friendly times, preferred stockholders only get the choice of either getting their money back or taking their pro rata share of the exit proceeds, but not both. Many founders are hesitant to issue participating preferred stock because it can disadvantage existing shareholders—including themselves.

In 2022, VCs grew more likely to gain preferential terms like these. But this trend has reversed course. Primary funding rounds that include participating preferred stock, cumulative dividends, or liquidation preferences higher than 1x have all grown much less common in the past six months.

After peaking at 15.6% in Q1, the share of deals involving participating preferred stock fell back to 6.1% in Q3.

“I haven’t seen much in the way of highly investor-favorable terms lately,” says Alex Civetta, an associate at the law firm Mintz who advises tech startups on fundraising. “There was a little bit of a spike in some of that in Q1 and Q2, but it has tapered off. In the Series A rounds I’m doing now, no one’s talking about, ‘We want a redemption right’ or ‘We want participating preferred.’”

Even at their peak in Q1 2023, these types of deal terms were still quite uncommon. In the past two quarters, however, they’ve grown even fewer and farther between. What’s changed?

Last year’s increase in investor-friendly deal terms occurred at the same time as a steep decline in the number of new funding rounds taking place: Quarterly activity on Carta fell by 57% between Q4 2021 and Q3 2023. In an environment where capital is harder to come by, some companies are more willing to agree to investor-friendly terms if it allows them to successfully close a deal.

One might expect, then, that a move to more company-friendly deal terms would be accompanied by a notable uptick in deal activity. But that hasn’t been the case. The number of rounds raised on Carta increased by nearly 17% between Q1 and Q2, but it then fell off by 27% in Q3. That nets out to a 15% decline from Q1 to Q3.

Deals drying up

A likelier explanation for the shift in deal terms isn’t quite as promising for founders. During 2022 and early 2023, startups without sparkling financial results were still able to raise capital—they just had to accede to some unfriendly deal terms in order to do it. Investors were willing to make riskier bets on less-proven companies if they received some downside protection.

In recent months, however, VCs seem even more focused on certainty and less willing to back a long shot. It’s not that struggling startups are now able to raise capital at better terms—it’s that they’re unable to raise capital at all.

“The companies that I’ve seen that have gone out and raised capital via priced rounds lately have been clients that are very attractive investments, and they’ve done very well from a valuation standpoint,” Civetta says. “There are fewer of those deals happening than I would view as a normal baseline. But the ones that are happening, the deal terms are good.”

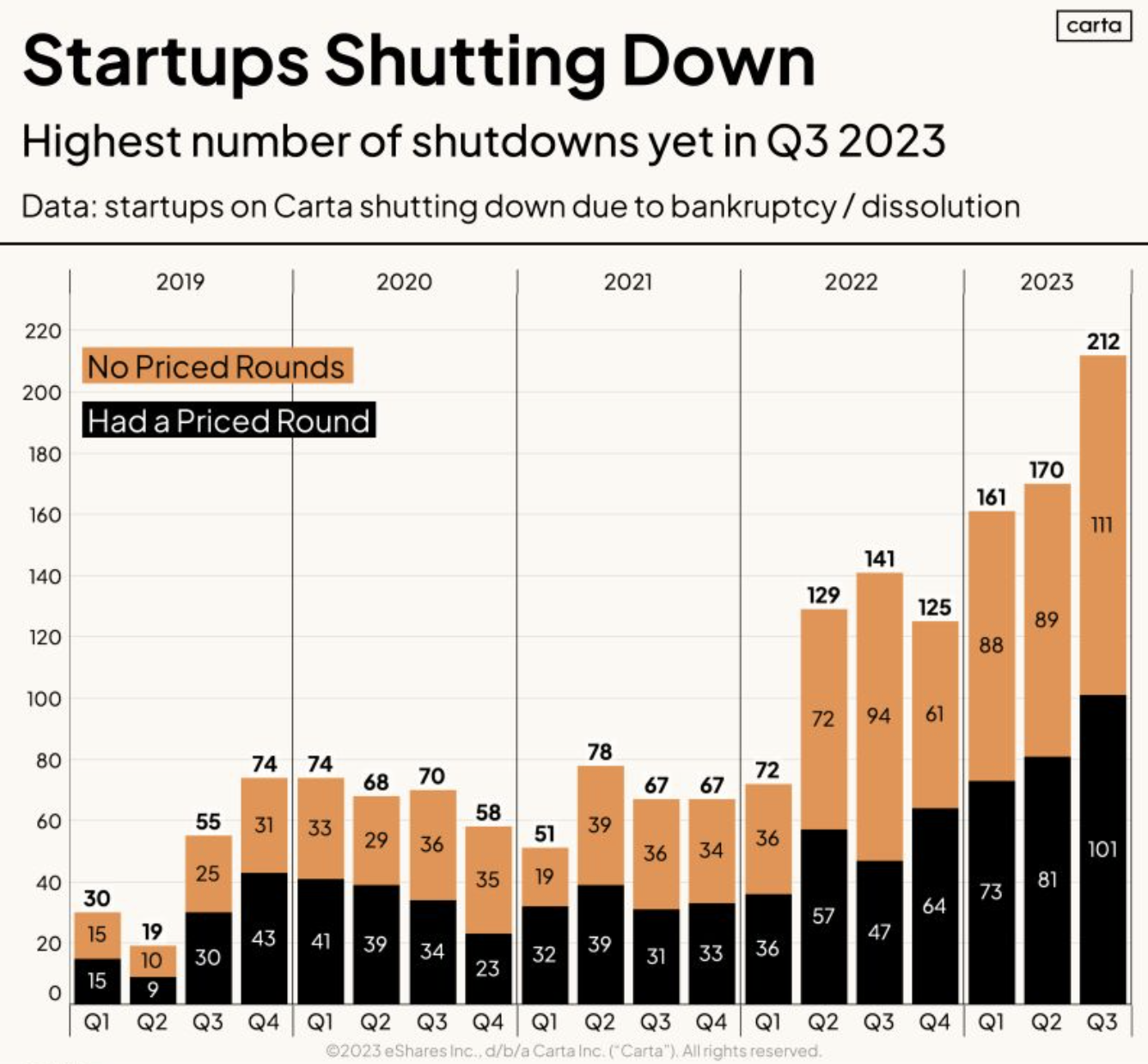

For some startups, an inability to raise new capital even at investor-advantaged terms will prove an insurmountable challenge. The number of startups shutting down on Carta has begun to climb in recent quarters. More than 100 startups that had previously raised a priced round closed their doors during Q3, a 226% increase compared to two years ago.

A bump in bridge rounds

Another factor potentially contributing to the decline of investor-friendly deal terms is that more companies in need of capital are opting to raise bridge rounds, rather than primary rounds.

Bridge rounds allow companies to bring on new capital to get them to the next formal fundraising round. They are typically led by a company’s existing backers, and, if using preferred stock, they often come at a flat valuation on the same terms as the prior round. They’re less likely to involve new investors taking a hard line and negotiating preferential terms.

Bridge rounds accounted for 36% of investments across all stages on Carta in Q3, with the frequency of such investments ticking up at both Series B and Series D. Nearly 40% of all rounds raised by Series B companies in the quarter were bridge rounds.

“It’s very much an investor’s market right now,” says Drew Glover, a general partner at early-stage fintech investor Fiat Ventures. “Depending where the company sits, how vulnerable they might be, certain investors might ask for certain [deal terms] that are historically a little non-traditional. However, for the most part, I’ve seen a lot of very vanilla rounds that are just happening at that previous valuation.”

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter: