It’s no secret that early-stage venture valuations in the U.S. have trended downward over the past year. The median seed valuation on Carta declined by 13.7% from Q1 2022 to Q1 2023. The median Series A valuation fell by 17.1% over the same span.

Those year-over-year declines are the big picture, representing a sample of all startups on Carta across all industries. Zoom in, and a more nuanced scene emerges: Trends in early-stage valuations have varied significantly across five of the busiest sectors for fundraising activity in the startup ecosystem.

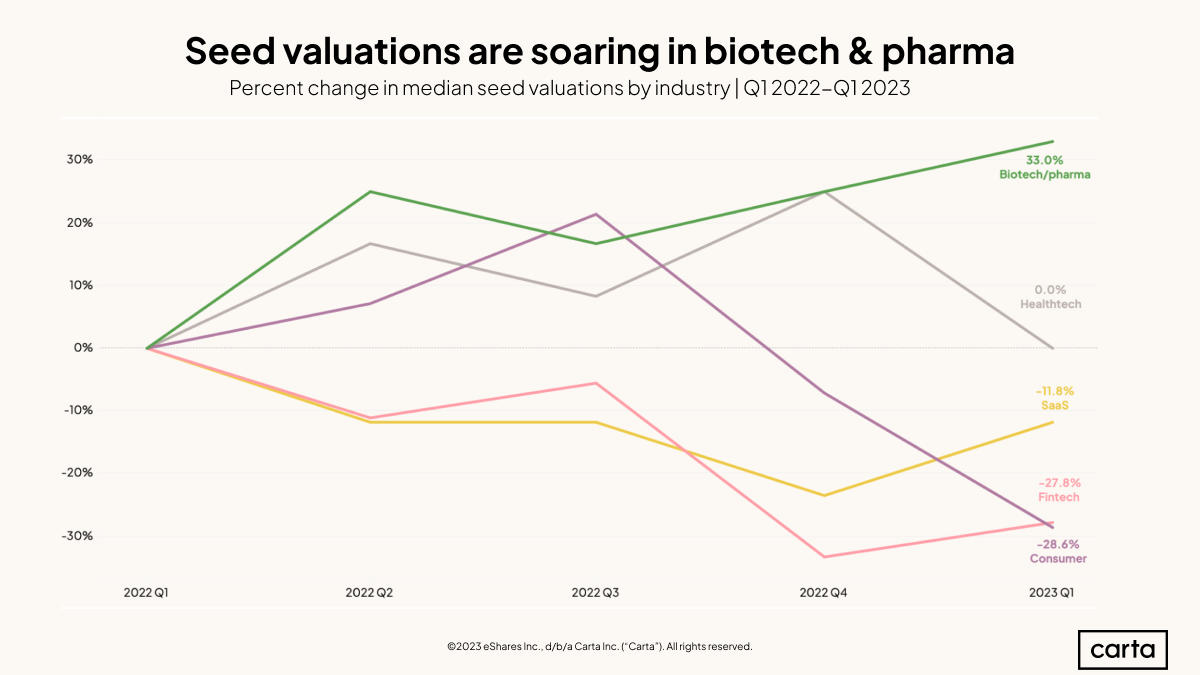

At seed stage, biotech and pharma outperform the pack

Over the past year, it’s paid to be a healthcare startup. The median seed valuation in the biotech and pharmaceutical industry rose from $12 million in Q1 2022 to $16 million in Q1 2023, a 33% increase. The median valuation in healthtech was trending up for much of 2022 and finished flat year-over-year, well above that median decline across all sectors.

Other sectors saw steep year-over-year declines: Median seed valuations in fintech and consumer are trending well below the median across all sectors. These recent shifts represent a real shakeup in the valuation landscape. In Q1 2022, the median seed valuation in biotech and pharma was the lowest of these five industries. Last quarter, it was the highest.

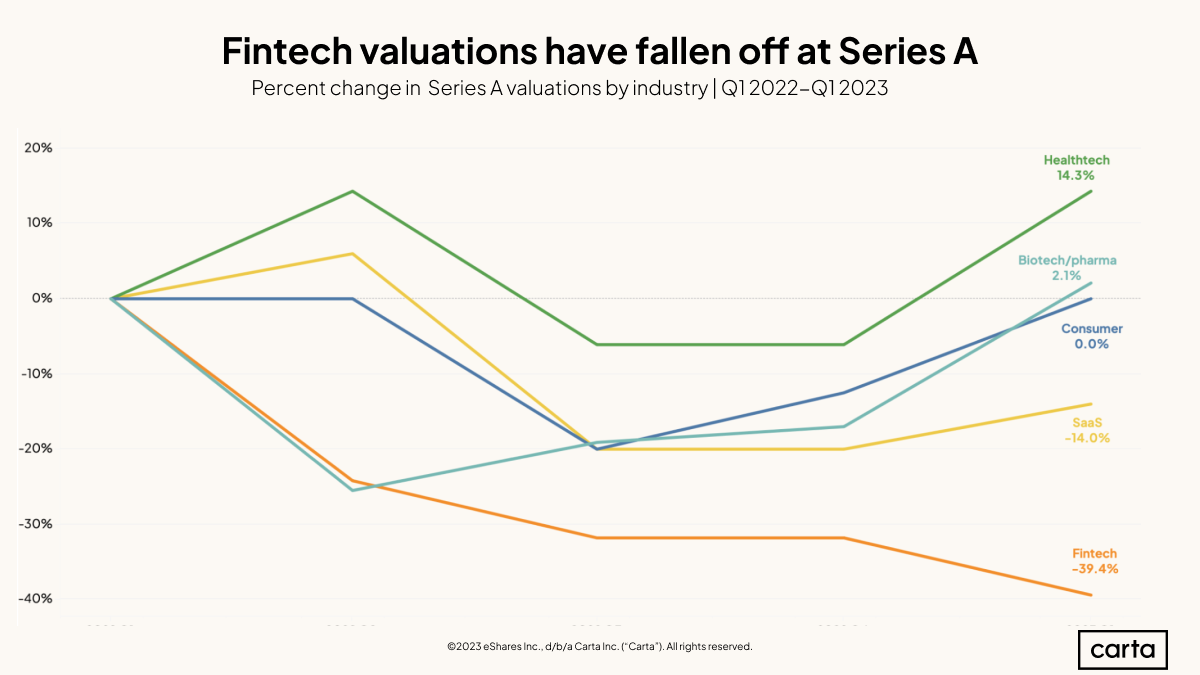

Fintech’s Series A slide

Across all sectors, the median Series A valuation rose by nearly 9% on a quarterly basis in Q1. That’s reflected in this sample, with valuations trending up in four of these five common industries.

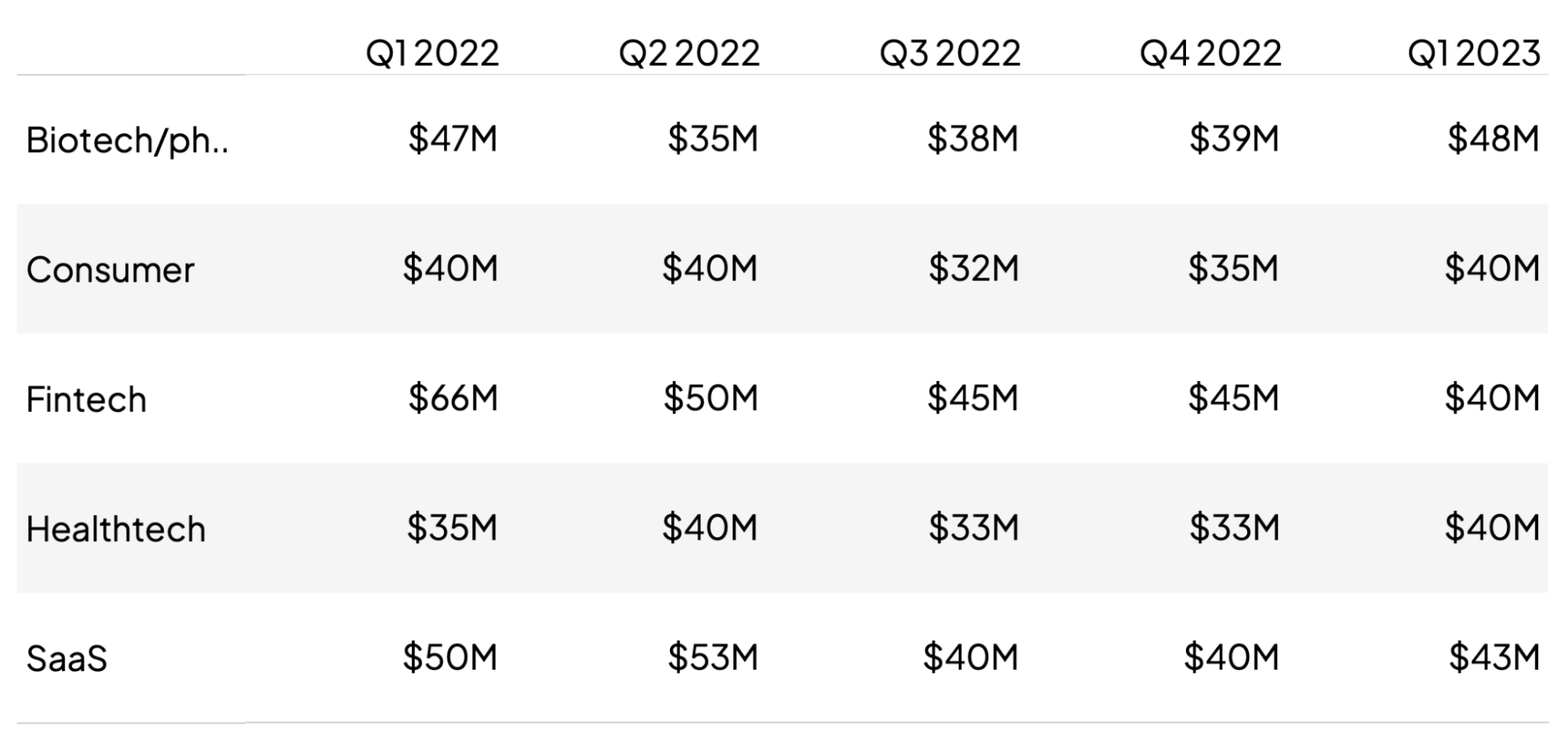

The exception is fintech. There, median valuations continued a descent that’s now continued for a full year. The median Series A valuation among fintech startups has fallen from $66 million in Q1 2022 to $40 million in Q1 2023, clearly the biggest decline in any of these five common industries.

It’s worth noting, however, that in Q1 2022, valuations were higher in the fintech industry at both seed and Series A than any other industry in this sample. The declines of the past year have brought fintech back in line with the rest of the pack, rather than causing the sector to fall behind. For instance, the median Series A fintech valuation in Q1 2023 was still $40 million, the same as in both consumer and healthcare.

Median valuations by sector

Just like at the seed stage, median valuations at Series A are either staying flat or trending up on a year-over-year basis among healthtech, biotech, and pharma startups. In the consumer sector, valuations at Series A are proving much more resilient in the recent downturn than they are at seed.

Explaining the shifts in healthcare and fintech

In terms of venture investment, the fintech sector and the healthcare sector both experienced explosive growth in 2020, the first year of the pandemic. More recently, however, the two industries have traveled different paths.

Back then, fintech flourished thanks to a cocktail of low interest rates, pandemic stimulus spending, and consumer savings bolstered by stay-at-home orders and business closures. Today, the macroeconomic environment looks very different. Higher interest rates mean that it’s now more expensive to issue loans, a key business activity for many fintechs. Declining savings rates mean consumers now have less cash to spend and invest through fintech startups’ various offerings. Add it all up, and investors have become less bullish about many common fintech business models.

As was the case with fintech, the outbreak of COVID-19 created multiple promising tailwinds for healthtech and biotech. The very existence of a global pandemic pushed healthcare to the front of mind for many investors and founders, driving new interest in the space. Creating a widely used COVID-19 vaccine helped drive record-breaking profits for Pfizer, underscoring the upside of investing in healthcare. The pandemic also changed the way many people receive healthcare, leading to an increase in telehealth and other tech-driven methods of care.

Unlike in fintech, rising investor interest in healthtech and biotech has persisted. The macroeconomic factors that made life more difficult for fintech startups haven’t had the same effect in healthcare. Instead, some investors believe the healthcare space is in the midst of a digital revolution, one that will create myriad opportunities for tech-focused upstarts to disrupt incumbent players in the space.

There’s both optimism and pessimism among early-stage investors these days. It all depends on where you look.

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: