It’s been a tough time to raise money. In the past year, the number of seed rounds closed has slumped, according to Carta data, with deal count down 27% year over year.

Despite the challenging fundraising environment, fintech company Alphathena recently closed a $4 million seed round led by ETFS Capital with Hyde Park Angels (HPA) joining the round. The Chicago-based company, which has built a platform that enables financial advisors to deliver personalized portfolios to their clients, was founded in late 2022 and won the "Best in Show" award at the Morningstar Fintech Showcase Conference in 2023.

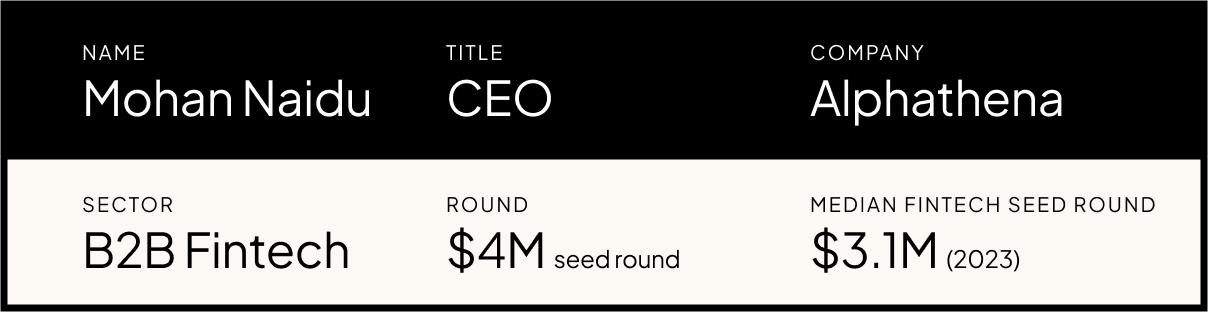

We talked with founder Mohan Naidu in this edition of Carta's "Fundraising Files" to see how he got his deal done and what fundraising conditions are like on the ground.

Highlights:

-

Why Alphathena raised

-

Outreach and narrowing your investor pool

-

Zoom vs in-person

-

Fundraising outside Silicon Valley

-

Pitch deck essentials

-

Unique pitching strategies

CARTA: What was the driving force behind this fundraising round?

MOHAN NAIDU: As we grew, there were some things that we as a founding team just couldn't do by ourselves anymore. As the pipeline increased, we tried to envision what the product would look like in the next six, 12, 18, 24 months. How could we support and sustain our pipeline? We had to build a strong support organization, we needed to enhance our technology team, we needed to create a professional sales organization. So it's not just me and my co-founder doing everything.

So we put together that kind of a plan, and we went into the market to raise between $3M to $4M. And we were fortunate to be oversubscribed and ended up raising $4M.

>> Watch Carta's step-by-step video guide to fundraising: "Startup Fundraising 101"

Before we get into specifics, big picture: What was it like fundraising in the current environment?

It was not an easy process, given the market conditions. We have been in various stages of fundraising for the past two years. We did a very small angel round at the end of 2022, to the tune of a little over $300,000, from industry veterans who understood the problem we were working to solve. We did that small angel round, and then we were working through our startup.

And then we realized we needed to get to the next stage of fundraising to help reach some of the goals that we had.

2023 was the hardest year for fundraising since 2008, as the data from Carta shows. All through 2023 we were at various stages of fundraising. But once we found the right set of investors, things came together very quickly. In a matter of a few weeks, the round was pretty much closed, and it was just paperwork and other stuff that needed to be taken care of.

>> See more data about fundraising trends and the state of private markets

So it was slow, but once we found the right set of investors, the process moved really fast. I guess that's probably the norm. But, you know, when we were doing it, it didn't feel that way.

How do you go about finding and approaching potential investors?

In the beginning it was a fairly unstructured process. We were just trying to look at potential investors who were investing, and tried to find a warm intro to the investor.

Being in the Midwest, it was a little harder, because you see a higher amount of startup investment on the coasts. But we went through various processes to identify the right set of investors, and we probably did well over 150 meetings overall.

Over time we tried to narrow down the type of investors that would be the right fit for us. It became clear that it was hard to explain the problem, or go into the details of it, with a generalist investor. And it was relatively easier to explain the problem to fintech, and especially B2B fintech, investors.

So we tried to narrow down that path, and get warm intros to investors with whom we could have conversations at that level.

You mentioned 150 meetings with investors. Can you tell us a bit about your strategy for those meetings? Was it just you, or you and your co-founder?

Initially we were both doing it, both my co-founder and I pitched together. And over time, I started taking a few more meetings and then my co-founder, Tushad Driver, took the lead on a lot of meetings. Once we got to the second and third conversation, we'd do it together.

We also were part of an OnRamp accelerator based in Minneapolis. And that gave us some intros. We had some good conversations there, and Tushad led that effort as well. And again, the same process, if it was a second or third conversation, obviously we'd do it together.

You mentioned being in the Midwest that it's a little trickier to fundraise. When you were approaching investors, did you meet with Midwest investors or focus on the coasts? Did you meet on Zoom or in person? Did you do any trips out to the coasts to take meetings?

I’d say more than 95% of our meetings were over Zoom. We did not do the travel piece. Again, I think it's probably just the indication of how it was in 2023. It was more efficient to do it on Zoom to just get the first initial 30 minutes to see if there is mutual interest to have further conversations.

For the local Chicago investors, we did in-person meetings. But even those, it was the second or third meeting that we'd do in-person. It was still Zoom for that initial meeting.

It was a lot more efficient to do it on Zoom, and I presume a lot of startups in our situation will also find that to be the case. But meeting in person definitely has value. In fact, our lead investor in the round is actually someone we met in person, before we did the 30-minute call. We met at an industry conference, and as we spent time at the conference, they saw what we were doing, and we had some conversations and that got the ball rolling—“hey, this is interesting and we want to have more conversations.”

I'm not sure we would have been quite as successful had we just stuck to Zoom for that meeting too.

Tell me about the pitch deck. What advice do you have for seed founders putting together that deck—how long should it be, what sort of metrics should you include?

Each pitch deck, and each startup, is so unique that I don't think there is a standard formula to do it. We saw a lot of pitch decks as we were preparing our pitch deck, and ours evolved over dozens of versions too. When we look back at some of the earlier versions we wonder what we were thinking then!

The biggest thing is to know the problem you're trying to solve. And simplifying the problem as much as you can—that's the hardest part. How do we simplify a complex problem, especially for a B2B model?

Then, the team is important. Explaining how you are the right person to solve this problem as a team, that was important to talk about. And early traction, if you have any. We did our fundraising relatively later in the lifecycle of the company. We had been doing some flavor of this for the past three or four years now. So we already had the product at a much greater level of maturity and we had paying enterprise customers already. So that made it easy to showcase our traction, and we ended up highlighting that quite a bit.

Eventually we probably ran with maybe 8 to 10 slides. And we always kept the appendix with more details, in case a particular investor had more questions.

Creating the perfect pitch deck: Download a free template

One unique thing, that I give full credit to my co-founder for, is when we had more detailed discussions and we were explaining the problem, my co-founder and I would role-play. I would play the role of a [potential customer] who is encountering this problem, and I'm having a conversation with my co-founder Tushad, who is trying to explain to me how the Alphathena platform could help address that problem. The role-play would usually take about 6 to 8 minutes, but it really resonated and set up the story, a lot more than simply throwing up and talking through the slide deck.

So doing something unique like that might be helpful, if trying to simplify the problem is difficult.

Now that you’ve closed this round, what’s on the horizon?

We always treated fundraising as not in itself a goal, but more of a means to get to a real goal.

That would be my biggest learning or advice to anybody who's trying to do this: Don't treat fundraising itself as the goal. It’s more of a stepping stone to the startup's goals.

Looking forward, the big thing for us is to continue to gain traction. And we have some specific internal goals that we want to get to, and we set some milestones and three-year goals, since I think our current raise gives us three years of runway. And for us, it's creating that professional organization around our product. We believe we have a strong product, the right product/market fit, and we need to continue to iterate on that. But the service, support, sales organization is so important, which we couldn't have built without capital.

Is there anything else you want to share with fellow founders about fundraising?

It's probably going to take longer than whatever you've planned for, at least in the current circumstances, but maybe 2024 and 2025 will be different.

But persistence, and knowing this is a long game, is key. It's a marathon, so pace yourself and continue the effort. You're going to hear a lot of "no" and it's disheartening to hear so many. But ultimately there is a "yes" somewhere down the road if you work enough to find it.