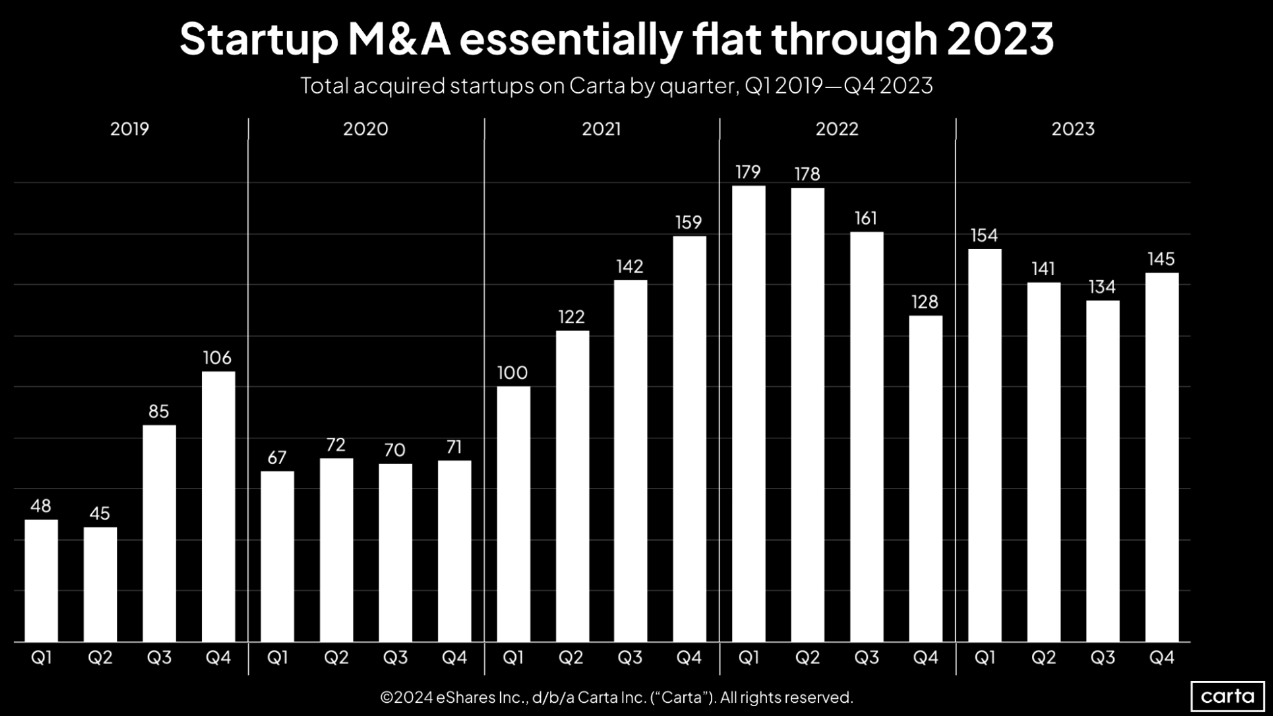

Whether you’re looking at deal count, deal size, or deal value, nearly every metric charting startup transactions experienced a boom during 2021 and early 2022. Acquisitions were no exception. Between Q1 2021 and Q1 2022, the number of M&A deals targeting startups on Carta increased by 79%.

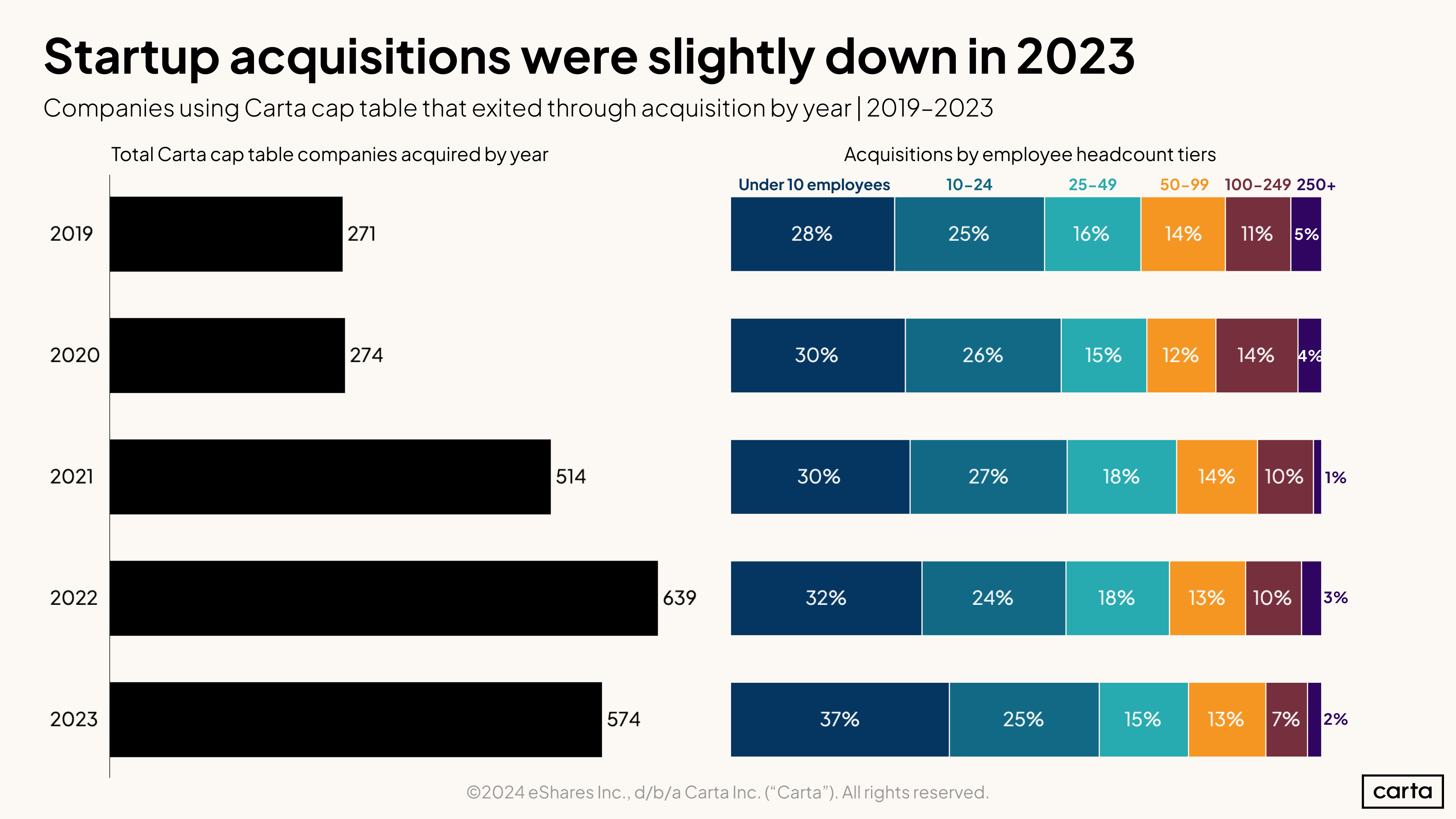

Then, the tide turned. In the second half of 2022 and into 2023, a confluence of rising interest rates, inflation, and other bearish factors drove down deal numbers across the private markets. Again, acquisitions of startups were no exception. Startups on Carta completed 574 M&A transactions in 2023, down 11% from the year before.

Yet even with this decline in deal count, M&A activity targeting startups on Carta is up significantly compared to 2019 and 2020. Part of this is due to the growing population of companies in Carta’s dataset. However, even accounting for that growth, M&A has proven more resilient than other deal types. For instance, venture capital deal count on Carta fell by 24% in 2023 across primary and bridge fundings combined.

The scope of the recent slowdown in startup acquisitions also compares favorably to some other deal types. Worldwide, M&A activity of all types declined by 15% last year. And while the number of new IPOs ticked up slightly in 2023 compared to 2022, activity remains at historically low levels.

The IPO chill

Along with M&A, IPOs are the other main exit pathway for successful startups. Over the past three years, the IPO market has experienced one of the most dramatic boom-and-bust cycles found anywhere on the venture capital landscape. In 2021, companies in the U.S. raised $142.4 billion across 397 different IPOs, exceeding the former decade highs by 67% and 44%, respectively. Then, in 2022, it all went quiet, with IPO proceeds plunging by a staggering 95% year over year.

IPO activity began to rebound last year. Still, it was the third-slowest year for public debuts in the U.S. since 2010. This two-year stretch of sluggishness in the IPO market all but removed one of the most common exit options for late-stage startups.

Some startups have recently opted to run a dual-track process, where they file confidentially for a potential IPO while also running a sale process at the same time. Others have chosen to forgo an IPO and pursue an exit through M&A, instead.

The bridge to M&A

The venture fundraising environment changed in other ways in 2023 beyond the 24% decline in deal count. Among those deals that have taken place, a higher percentage are bridge rounds, and a lower percentage are primary financings. For instance, at Series A, the rate of bridge rounds jumped from 29% in 2022 to 39% in 2023. At Series B, bridge rounds went from 22% of all deals in 2022 up to 36% in 2023.

This could have implications for the merger market in 2024. Compared to a new primary funding round, a bridge round is often seen as a stop-gap measure, one that typically provides less new capital and thus less runway. And investors are often hesitant to make multiple bridge investments in the same startup. If VC activity remains slow in the months ahead, startups that recently raised bridge rounds might find M&A to be an increasingly attractive alternative.

“I’d anticipate a lot more M&A activities taking place [in 2024],” says Marcos Fernandez, managing partner at Fiat Ventures, an early-stage fintech investor. “Because for a lot of these companies, their investors will no longer [provide] the capital to continue to bridge. And at some point, you start to hit the end of reserves.”

Who are M&A buyers targeting?

In short: the smallest companies.

Of the companies on Carta that were acquired last year, 37% had fewer than 10 employees. That’s the highest percentage of single-digit employee counts we’ve seen among acquisition targets in the past five years.

Conversely, the percentage of acquisition targets with triple-digit employee counts is at a recent low. Just 9% of acquired companies last year had 100 employees or more, the lowest rate of the past five years.

The net result of these two trends is clear: Smaller startups are becoming more common targets among M&A buyers.

What’s next for tech IPOs?

Investors and founders with an eye on the exits would surely love to see a return to 2021’s IPO market, when tech startups embarked on a record-breaking run of public listings. But anyone expecting that sort of environment anytime soon will likely be disappointed.

“If you look back at when the IPO market began to close, there were lots of companies that should not have been IPOs,” says Gregory Ho, president and head of social impact at Spring Mountain Capital. “So, is the market coming back to where we left off? The answer is no, it’s not.”

Still, there have been reports, rumors, and regulatory filings indicating that several well-known startups are considering IPOs sometime in the first half of 2024, including names like Reddit, Panera Bread, and Skims. Among some investors, there’s belief that the market could be on the verge of a thaw.

“I think the IPO market will start to open up,” Fernandez says. “The first couple [IPOs] will likely be because of necessity, not because of opportunity, but because they’re running out of options, and so they want to get some liquidity. But I think once that door opens, if there’s positive sentiment, then there are a whole bunch of people on the sidelines waiting to go public.”

Others think the market could follow a different timeline. Ho says that, while a wide range of outcomes are still possible, he thinks it’s most likely that the IPO market won’t fully open again until 2025, with the looming U.S. presidential election and other geopolitical uncertainties providing headwinds that could slow down deal activity, particularly in Q4.

“I don’t have a great expectation that the IPO market is going to reopen this year,” Ho says. “If it doesn’t start to reopen in the next three months, then nobody’s going to try to squeeze in year-end deals.”

The impact of exits

In many ways, IPOs and M&A are the lifeblood of venture capital. When a company has a successful exit, it’s able to return capital to its VCs. The VCs are then able to return capital to their LPs. LPs are then able to use some of this liquidity to invest in new VC funds. The VCs in turn use that capital to invest in new startups. And the cycle begins again.

When IPO and M&A activity slows down to the degree it has over the past two years, it can cause investments in new startups to slow down, too.

“Our [LPs] are slowing down their cadence,” Fernandez says. “We’re slowing down our own cadence. Founders just have less access to capital. I don’t know if that changes a lot in 2024, unless we see some sort of change in the IPO market.”

Everyone has their opinion on whether that change will arrive this year, and every opinion comes with a varying degree of certainty. But one thing seems clear: At some point, whether it’s in 2024, 2025, or some other point in the future, Wall Street will once again start welcoming tech startups with open arms.

“It’s all cyclical,” Ho says.

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter: