Note: this post reflects our old vesting schedule, our new one can be found here.

Most companies use the default Post-termination Exercise (PTE) periods from their law firm’s equity documents. PTE periods are 90 days or less because option grants lose their ISO status after 90 days. The attorneys who wrote these plans in the 1990s were too lazy to manually convert the ISOs to NSOs, so they solved the problem by expiring these grants at 90 days.

These agreements have been copied and re-used for 20 years. Today 96% of all option agreements on Carta have PTE periods of 90 days or less. Punitive and short PTE periods are the norm.

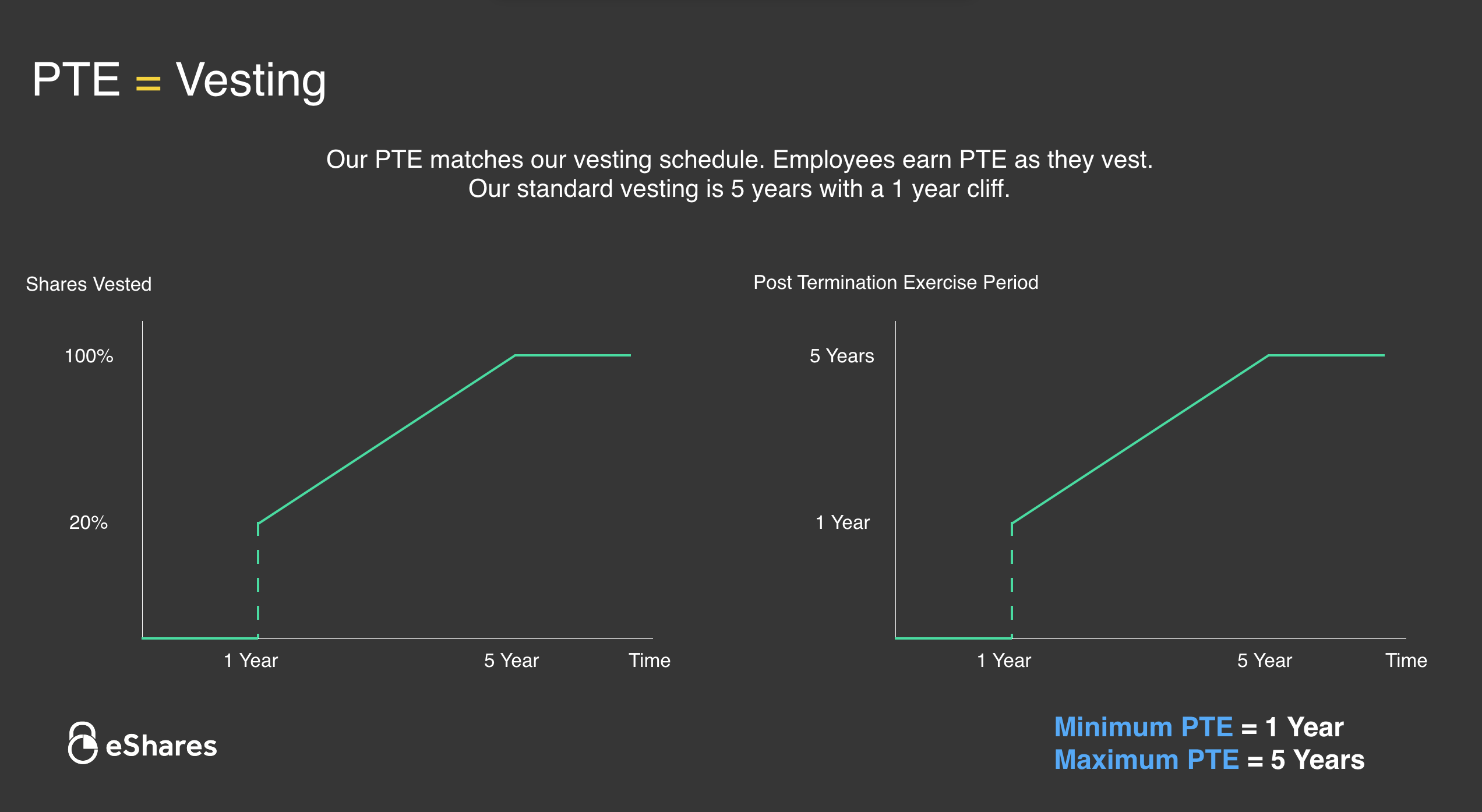

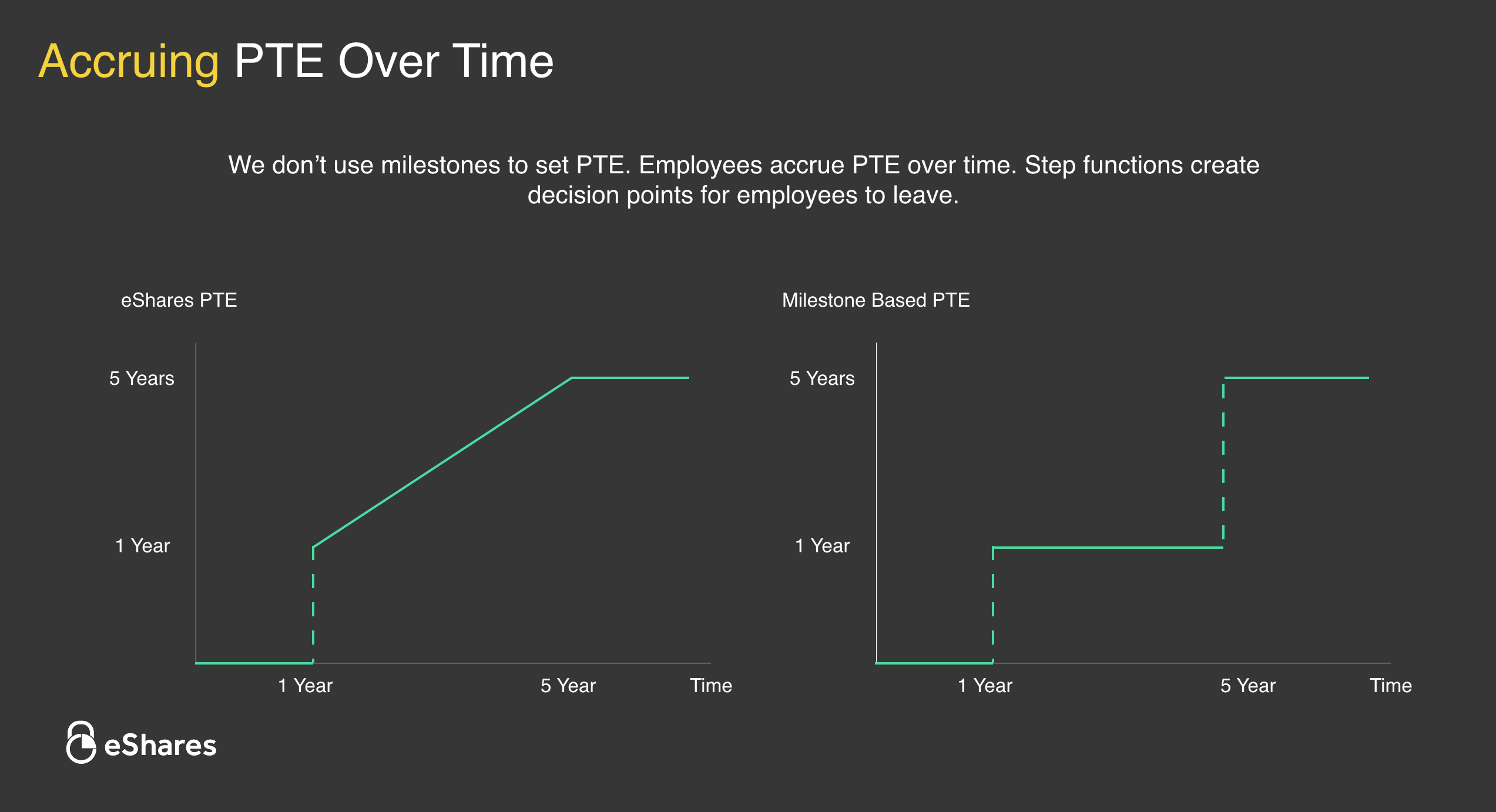

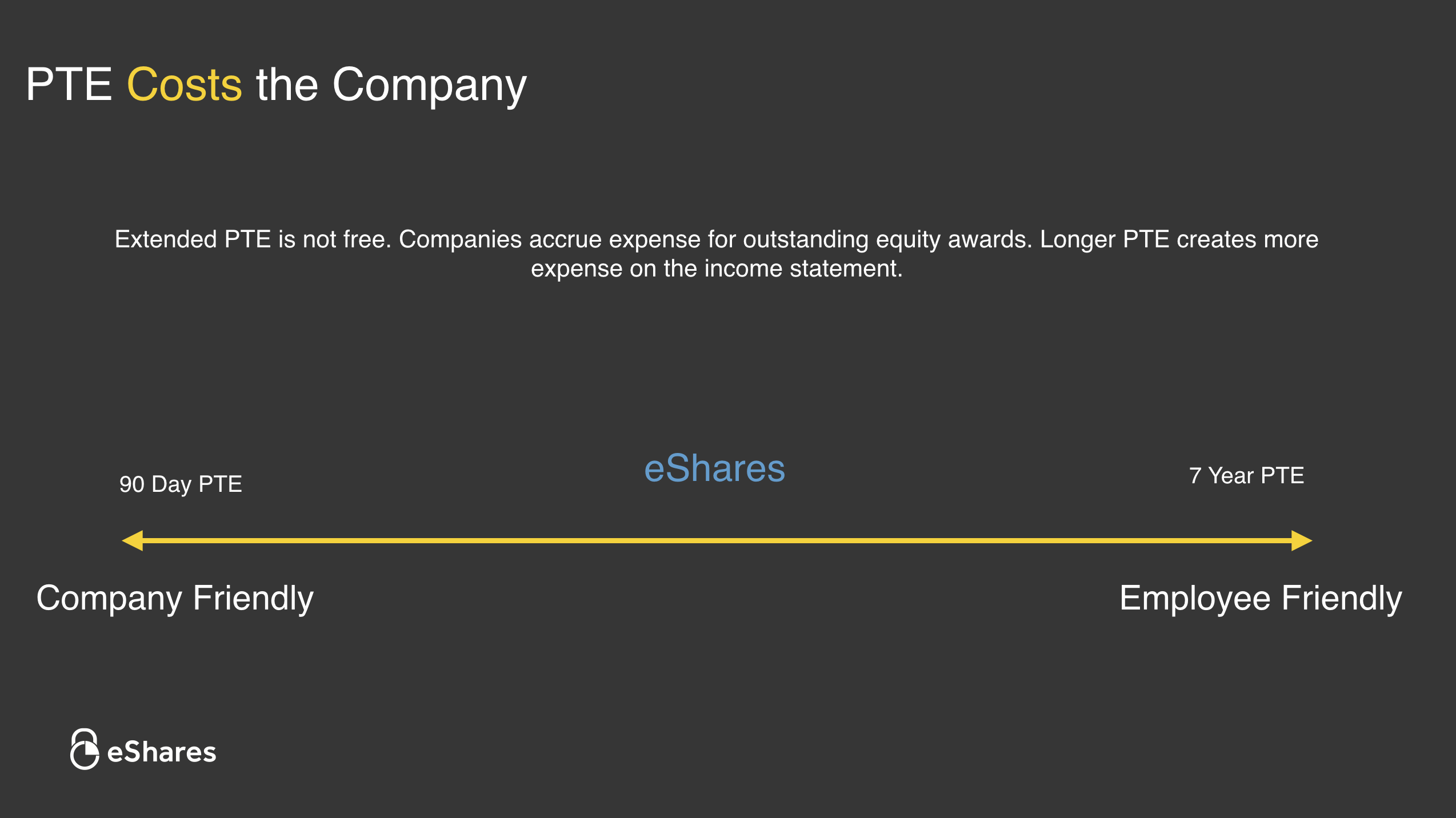

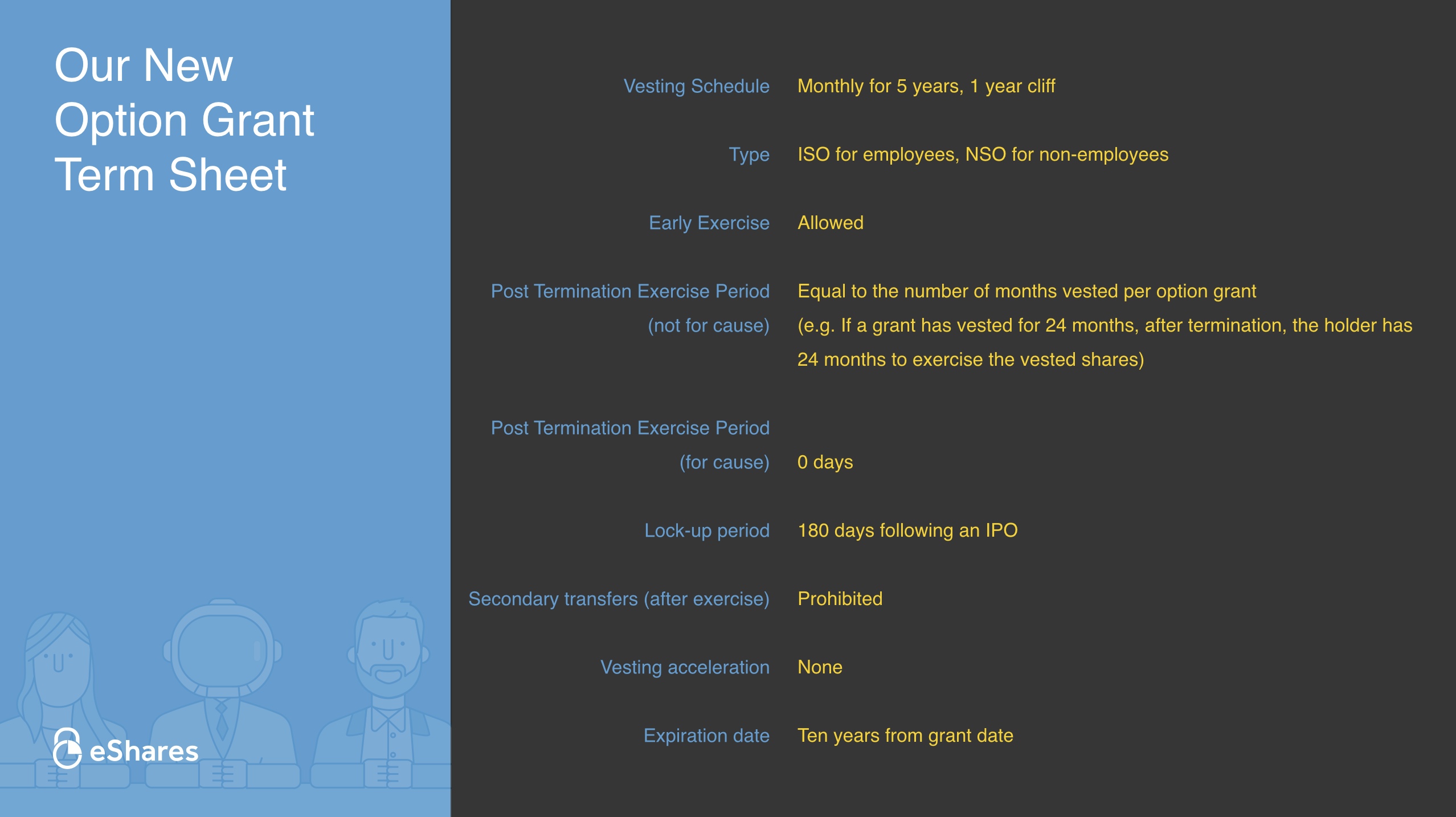

We fixed this at Carta by matching PTE to vesting. Below is an overview of our new PTE. I hope this post will encourage other companies to use our PTE model or create their own.

Note: Our PTE plan requires Carta software. Learn more.

The Old Model

Our New Model

Additional Reading:

Employee Equity by Sam Altman

Startup Stock Option by Joe Beninato

Flexport, Coinbase, and Pinterest posts on why they changed to longer PTE windows.