For a founder, convincing venture capitalists to invest millions of dollars into your startup is always a challenging task. Amid the venture downturn that’s dominated the market in 2023, it’s gotten even harder.

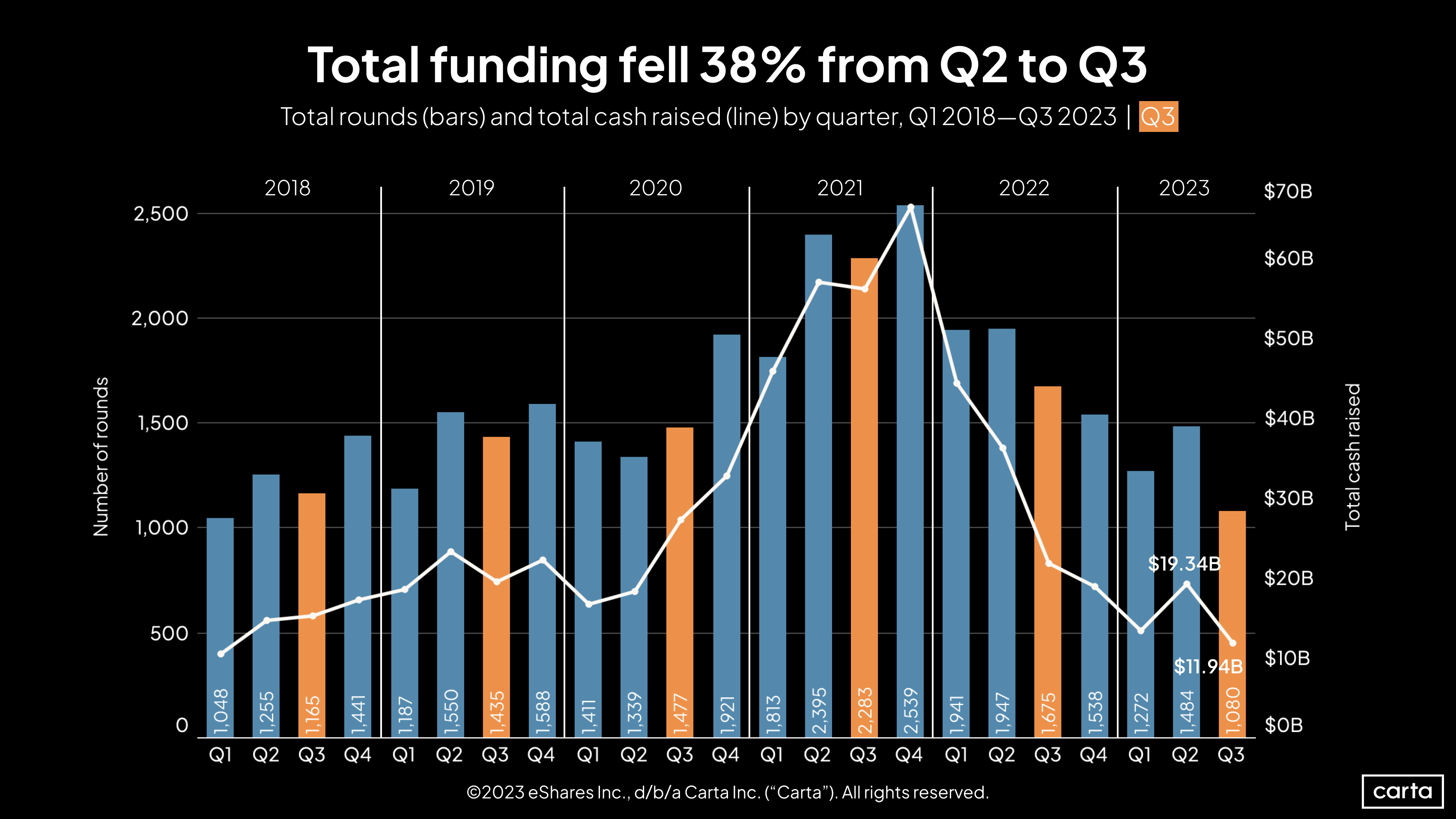

Private companies on Carta raised 3,836 primary funding rounds through the first nine months of the year, a 31% decline compared to the first nine months of 2022. In Q3, startups closed just 1,080 new rounds, the lowest quarterly figure since 2018, when the population of private companies on Carta was much smaller. That’s more than 1,000 rounds fewer than we saw in Q3 and Q4 2021, when the pandemic bull market was at its peak.

Today, venture capitalists are more cautious than they were in 2021. They’re also looking for different things in their prospective investments. There’s less emphasis on explosive growth at all costs and a renewed focus on fundamentals like revenue and profitability. Startups that were built to thrive in an era of soaring valuations and near-zero interest rates have had to adapt to a much tighter funding environment. The deals—and the dollars—have grown more scarce.

“We’re re-evaluating every one of our company’s internal processes and workflows,” says Ben Madick, co-founder and CEO of Matic, a VC-backed digital insurance brokerage. Matic navigated this year’s choppy waters on its way to a $20 million Series B extension, or bridge round, which it announced in October. “We’re trying to be better, so that when the market turns back—which we know it will—we’ll be in a better position. Taking the opportunity of a tougher market to really internalize what we can control has been a focus for us in 2023.”

What was it like to be a founder searching for funding in 2023? Every entrepreneur has a different story. We spoke to three of them about what they’ve seen, heard, and experienced this year on the fundraising trail.

Matic’s Series B extension

Madick knows that he’s one of the lucky ones. His company’s Series B extension this fall was a success, bringing on new capital to work on automation and other ways to make shopping for insurance a better experience for consumers.

But because of the VC market shift, the Series B extension also wasn’t the round that Madick and Matic had planned on raising in 2023.

Matic is no stranger to market chaos: The company raised its initial Series B in the first half of 2020, when the world was grappling with the onset of the pandemic. At the time, Matic curtailed its original fundraising ambitions and opted to raise a smaller round than it first hoped, with plans to raise another round in the not-too-distant future.

“The idea was to bet on ourselves,” Madick says. “Take less money, reach the next milestones, and then you have more proof points to be able to raise in the future.”

In late 2022, the company began to seriously think about raising more capital. But once again, the market didn’t cooperate. With tech valuations sinking and deal activity declining, Madick and his leadership team again had to adjust their plans.

“We initially planned to raise a Series C this round,” Madick says. “But as the market continued to deteriorate, we realized we don’t need a huge round—we just need enough to operate strong until the next milestone."

So Matic’s planned Series C became an add-on to the Series B. The company brought on several new strategic investors in the new round, but ended up structuring the deal as an extension led by the same VCs who led its original Series B in 2020.

“For the existing investors that joined the round, the extension simplified the process,” Madick says. “It was the same paper, no changes to the board, no major changes to the documents—other than that there was a new security with a higher valuation."

Halo AI’s revenue conundrum

Dina Ghobrial is a co-founder and CEO at Halo AI, which is using AI and automation to help financial services businesses monitor and manage their risk and compliance. Ghobrial previously spent more than 20 years at Scotiabank, while her co-founders include a former managing director at RBC Capital Markets and a two-time tech founder.

The group started Halo AI in 2020, initially funding the company with their own capital. This year, they decided to try raising their first outside investment. It proved more difficult than they hoped.

Ghobrial says she spoke to more than 100 investors across the venture ecosystem, including brand-name VC firms, specialized pre-seed investors, and individual angel investors. Many of them said they were interested—but none were interested enough to write a check. The most common feedback, Ghobrial says, was that Halo AI is off to a great start, but VCs wanted to see revenue and customers before investing.

“As a bootstrapped startup, it took us a while to build a product that we’re super-proud of,” Ghobrial says. “But even pre-seed investors are looking for revenue, and that isn't what we expected.”

After devoting hundreds of hours to a fundraising pursuit that was proving fruitless in the current market, Ghobrial decided to channel her efforts in a different direction.

“Where I am right now is like, ‘OK, forget all that,’’ Ghobrial says. “I’m not even going to try and fundraise until next year. And I’m going to focus all of my energy on getting customers. Once we have customers and have revenue, I think we’ll be in a much better position to get outside investment.”

It’s all part of the process for a founder who’s running a company and raising venture capital for the first time.

“This is my first startup,” Ghobrial says. “I am learning a ton as I go along the way.”

Revefi’s waiting game

Like Matic, a startup called Revefi revealed a new round of venture funding this year, announcing a $10.5 million seed deal in August.

Unlike Matic, Revefi didn’t technically raise that capital in 2023. The company—which helps organizations track and monitor their data—actually signed deal documents back in 2021 but waited to publicly announce the funding until this year, to coincide with the launch of its first product.

That gives Revefi co-founders Sanjay Agrawal and Shashank Gupta a different perspective on the fundraising environment in 2023. In some ways, they anticipated the market’s shift. Despite the fact that Revefi raised its seed round during one of the frothier times in recent memory, the founders approached the round with the sort of attitude that investors are advocating in 2023.

“I’m a firm believer that as a startup, you have to be really lean and efficient,” Agrawal says. “The money we raised was completely aligned with that. Because we all know that if we wanted to raise more money, it comes with dilution, right? So we said, ‘OK, this is a good balance.’”

Revefi is not Agrawal and Gupta’s first foray into the startup space. Previously, the two co-founded ThoughtSpot, a cloud analytics company that has raised hundreds of millions in venture capital and was valued at $4.2 billion in 2021. That past experience leading a unicorn startup was a big help in opening doors for their next endeavor.

“We were able to have good conversations with almost any VC we reached out to,” Agrawal says. “We were extremely fortunate.”

As they survey the current market, Agrawal and Gupta are in no rush to raise more cash. But they also know they can’t predict the future. Revefi’s needs might quickly evolve. The venture landscape might undergo another transformation. Having navigated fundraising markets both bearish and bullish, Revefi’s co-founders plan to stay prepared.

“I would say at this point, we are in a good place,” Agrawal says. “But I think partnership with a VC is not just about money. It’s about how things dovetail with the overall velocity and acceleration of the company. So we will always keep an eye out.”

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter: