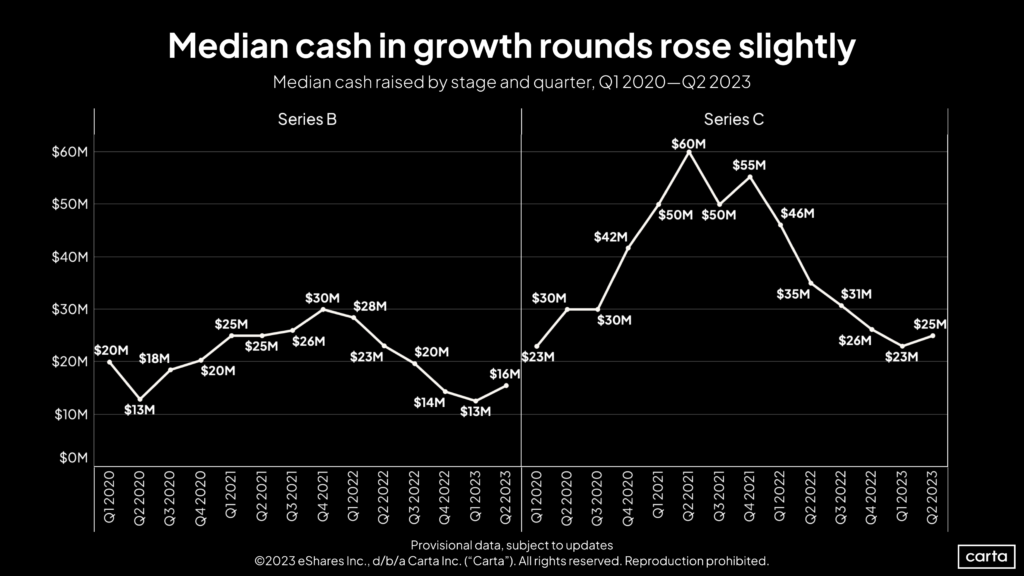

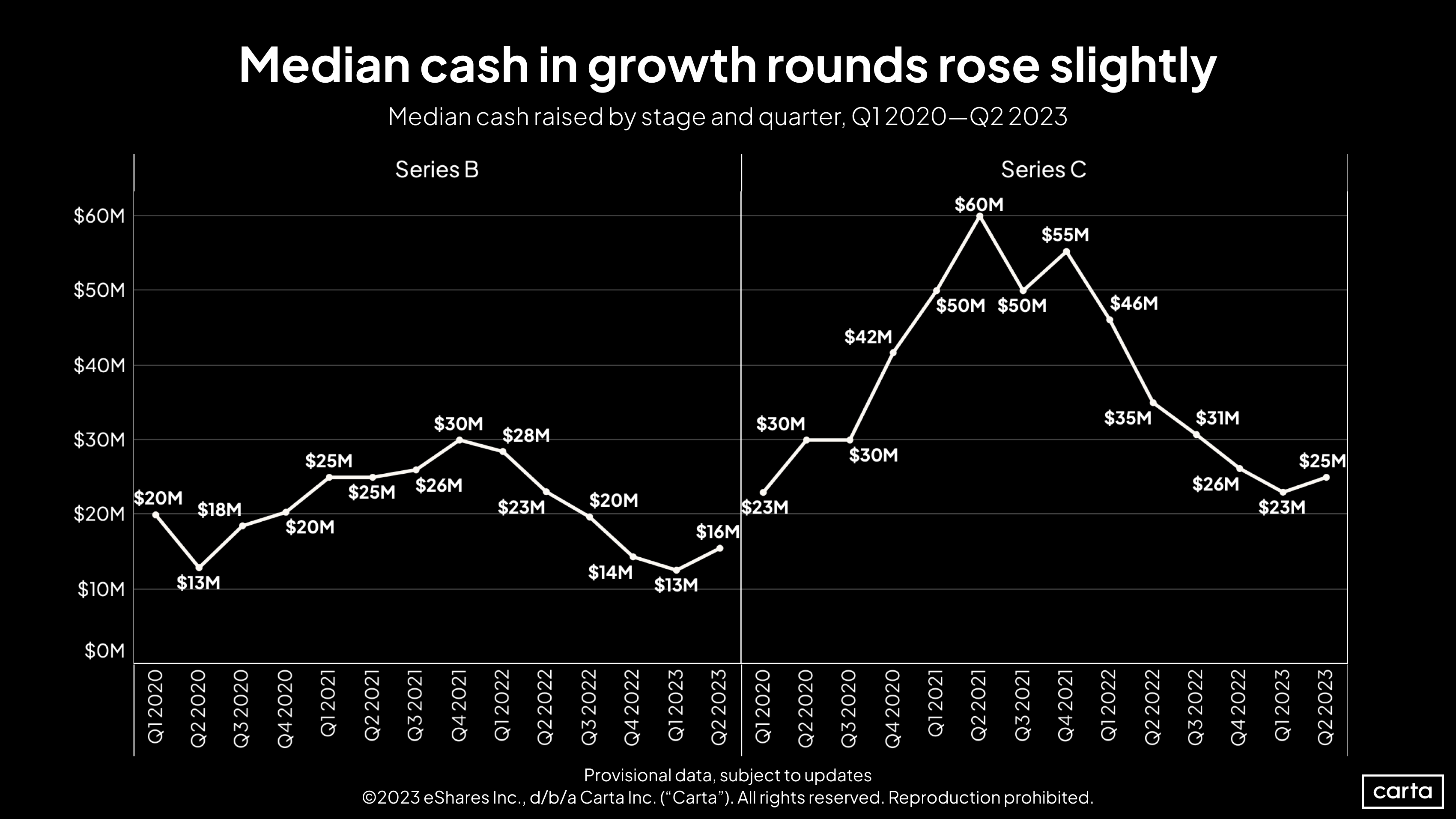

The median Series A funding round on Carta grew smaller for four consecutive quarters. The median Series B and Series C rounds each shrank for five straight quarters. Over the past year-plus, startup founders operated in an environment where raising new capital seemed to grow harder and harder.

But initial data shows those downward trends reversing course in the second quarter of 2023.

The median round size for Series A through Series C all increased for the first time in at least a year during Q2, led by a 23% uptick at Series B. For good measure, the median Series D deal size spiked by 83% in Q2, its second consecutive quarterly increase. These figures may still shift as additional transactions from Q2 are reported on Carta. But for now, it was the first time since Q4 2021 that the median round size increased at all four stages in the same quarter.

Those smaller round sizes in recent quarters have forced many founders and startups to tighten their belts and slow down their spending. If Q2’s trend of larger rounds continues, companies will start to have more money to spend on things like hiring and new growth initiatives.

That’s the glass-half-full takeaway for founders seeking to refill their coffers. But round sizes at each of Series A, B, C, and D remain low relative to quarterly figures dating back to the start of 2020. For instance, while the median Series A rose to $7.4 million in Q2, that’s still the third-lowest quarterly mark since the beginning of the decade.

Round sizes at the different stages from Series A to Series D have been trending in a similar direction—and at a similar speed—for several quarters now. All four increased this quarter, but before that, all four were steadily declining. After Q2’s uptick, the median Series A round size is now down 33% year over year. The median Series B is down 30%, the median Series C is down 29%, and the median Series D is down 24%.

Trends at the seed stage are slightly different. There, the median round size ticked down in Q2, from $3.1 million to $3 million. On an annual basis, seed round sizes have fallen by 16%, a smaller decline than the next four stages in the startup lifecycle.

These year-over-year declines in round size across all stages are evidence that the venture funding landscape is still more barren than founders and investors would prefer. But with Q2’s quarterly uptick, it looks like more green shoots are starting to break through.