In the first half of 2023, about 83% of all pre-seed investments on Carta were SAFEs, rather than convertible notes. The SAFE—short for Simple Agreement for Future Equity—has only existed for a decade. But it’s already become the most popular fundraising structure for young startups seeking their first outside capital.

Convertible notes used to be the standard way for startups to raise money without conducting a priced equity round. In exchange for their capital, investors receive debt notes that convert to equity in the future, with the specific terms of that conversion varying deal by deal. As its name implies, the SAFE was created to be a simpler, equity-based alternative that includes standardized deal terms and does not involve debt.

Download Carta’s first State of Pre-Seed Fundraising report

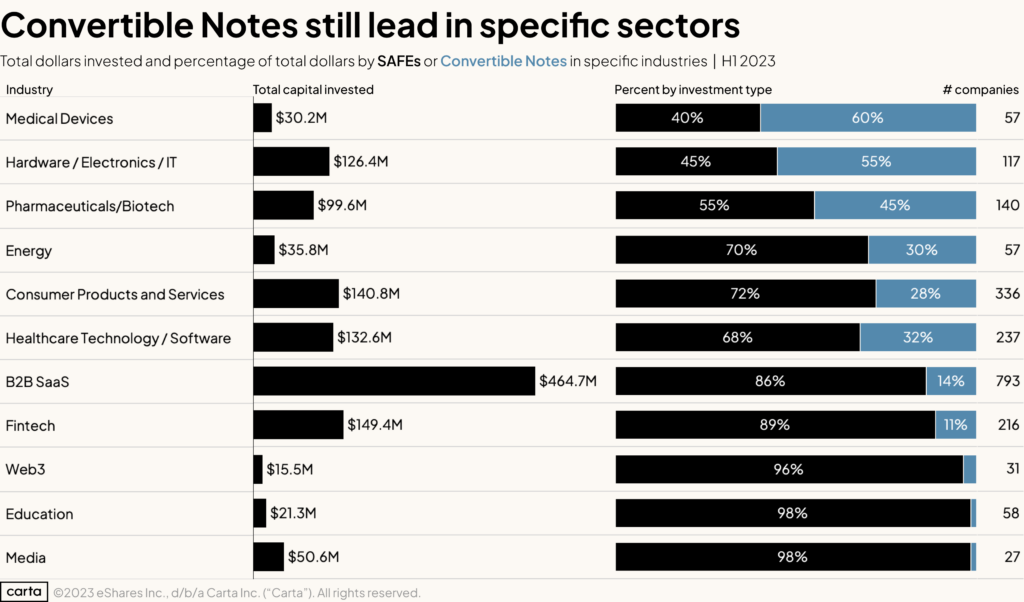

That simplicity has its appeal. In some startup sectors, such as education and media, SAFEs are nearly ubiquitous. In other industries, though, convertible notes are still quite common. And in two sectors—medical devices, and the catch-all category of hardware, electronics, and IT—convertible notes remain the preferred method of pre-seed funding.

Why is this the case? One factor may be the history of these specific industries. Medical devices, hardware, electronics, and pharmaceuticals are all sectors where venture capitalists have invested since the industry’s earliest days in the mid-20th century. Software-powered industries like SaaS and media have emerged to draw substantial VC attention only in the 21st century—or, in the case of Web3, in the 2020s.

These newer industries that have matured during the era of the SAFE seem more inclined to use it, while industries where investors and founders have worked with convertible notes for many years are more inclined to stick with what they know.

Along similar lines, the industries where convertible notes remain most popular are all fields where companies produce and manufacture physical products, whether that’s healthcare devices, medicine, or tech hardware. The industries where SAFEs dominate tend to be software-based fields.

A company that makes pharmaceuticals or computers often has a very different business model than a fintech or SaaS startup. They typically require higher upfront costs, and the weighing of risk and reward might be different—trying to bring a novel new drug to market, for instance, can be a boom-or-bust proposition.

It may be the case that investors and founders in these analog companies prefer the convertible note for its customizability, rather than the standardized structure of the SAFE. Setting specific conversion methods through a convertible note can allow participants in a deal to better account for a range of potential future outcomes.

The SAFE continues to grow more common across the venture capital landscape. But in some sectors, it’s clear that convertible notes still have their uses.

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: