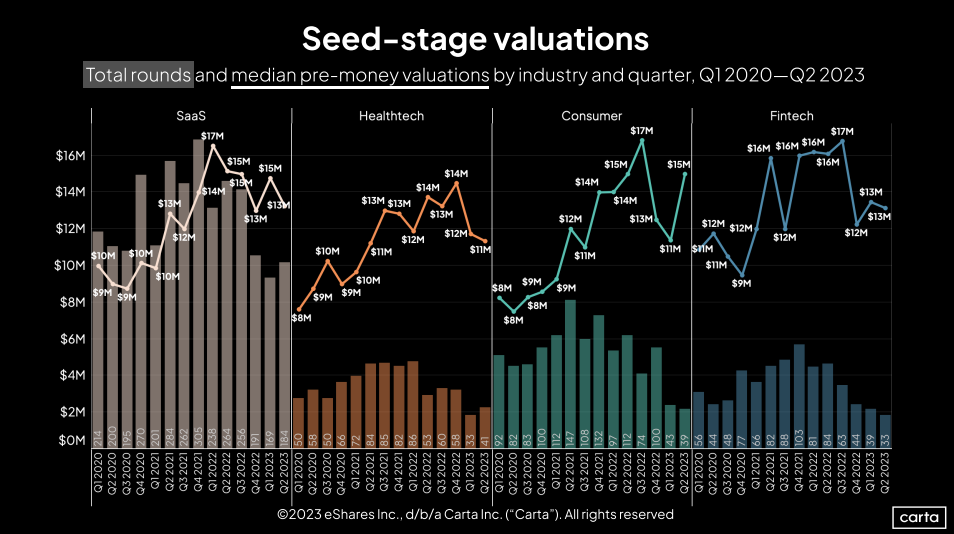

Across all sectors, the median pre-money seed valuation on Carta was $13.7 million in Q2, up from $13 million the quarter before. This uptick continues a trend: As headwinds have gusted across the venture landscape during the past year-plus of the market downturn, seed startups have proven less likely than later-stage startups to be blown off course.

Not every sector, however, has navigated those headwinds the same way. Here’s a look at how seed valuations and seed deal counts have progressed in recent quarters in four of the most common sectors for startup fundraising, followed by four takeaways from how the numbers shifted in Q2.

1. Consumer valuations take a leap

After falling in each of the two prior quarters, the median seed valuation in the consumer sector rose to $15 million in Q2, a 36% increase. That’s the largest quarterly climb the sector has seen at the seed stage so far this decade.

This increase came in a quarter when U.S. gross domestic product grew by 2.4%, outpacing economist expectations and reducing fears of a recession. At the same time, U.S. consumer spending rose by just 1.6% in Q2, slower growth than the 4.2% rate from Q1.

2. SaaS, healthtech, and fintech fall off

In each of these other three common sectors, median seed valuations declined—running counter to the overall trend of seed valuations rising in Q2. The median seed valuation fell by 13% from the prior quarter in the SaaS sector, by 8% in healthtech, and by 5% in fintech.

3. Seed valuations are topping pre-crisis highs

Compared to the bull market of 2021 and 2022, valuations have declined in all four of these sectors. However, compared to Q1 2020, valuations in all four sectors have increased. These different points of reference tell different stories: In the short term, the valuation climate has cooled. But in the medium term of a few years (dating back to the quarter when the Covid-19 pandemic began in earnest) the line of best fit on each of these sector-by-sector valuation graphs is still trending up.

To frame it another way: In the big picture, taking two steps forward followed by one step back still amounts to progress.

4. The end of healthtech’s ascent

The median seed valuation in healthtech fell to $11 million in Q2, its second straight quarterly decline. This ends a period of steady (if not quite constant) growth: Over the three-year period between Q1 2020 and Q4 2022, the median seed valuation in healthtech grew from $8 million to $14 million. The Q2 median seed valuation of $11 million still represents an increase of 75% since Q1 2020.

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: