During the middle of 2023, the Series A market began to show signs of bouncing back from a slump that had defined much of the past year.

That recovery continued in Q4.

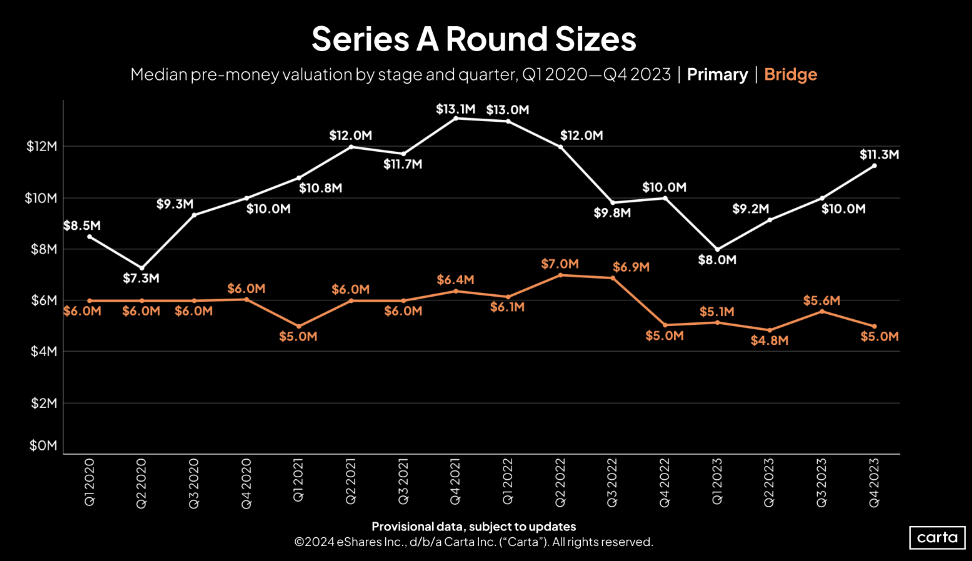

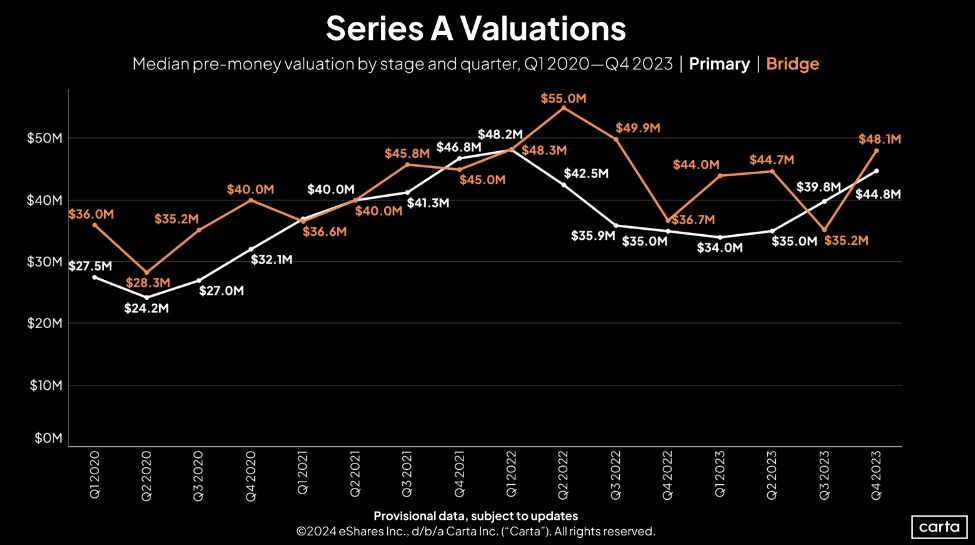

The median size of a primary Series A round on Carta climbed to $11.3 million in the final three months of the year, according to preliminary data from Q4. That’s up from $10 million in Q3. And the median primary Series A valuation reached $44.8 million, up from $39.8 million. Both of those figures have now increased in three consecutive quarters.

Signs of an upswing

Both the median round size and median valuation for primary Series A rounds still lag behind their recent highs. But the gap is swiftly closing. Last quarter’s median primary round size was just 14% off the high of $13.1 million reached back in Q4 2021. And the median primary valuation was just 7% off the high of $48.2 million from Q1 2022. In fact, Q4 registered the third-highest median valuation on primary Series A investments of any quarter so far this decade.

A big quarter for bridge rounds

Series A fundings come in two types: primary rounds and bridge rounds. Over the past several quarters, bridge rounds have become a much more common occurrence in the venture ecosystem. Faced with declining deal counts and falling valuations, companies have increasingly opted for extensions or add-ons to a prior round rather than raising an entirely new series. These bridge rounds proved bountiful in Q4. The median valuation in bridge rounds raised by Series A companies jumped by nearly 37%, reaching $48.1 million—the largest quarterly increase among either bridge or primary valuations at Series A in the past four years.

After the two trend lines inverted in Q3, the median bridge valuation at Series A was once again higher than the median primary valuation in Q4. This means that it’s less likely that a Series A startup raising bridge funding will have to do so at a lower valuation than their previous primary round—a very welcome development for founders who might aim to bring on bridge funding in the months to come.

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter: