Much of the framework for the modern venture capital industry is based on a simple numerical trend: Most of the time, when a startup raises a new round of venture capital funding, its valuation goes up.

This certainly isn’t always the case. To begin with, many startups trying to raise new capital don’t succeed. Even among those companies that are able to raise new funding, down rounds became an increasingly common presence on the VC landscape in 2023. But in general, as a startup progresses from the seed stage to Series A to Series B, its valuation tends to rise. It’s the prospect of these rising valuations (and the financial returns they create) that draws VCs to invest in startups in the first place.

But just how much can VCs and founders expect a startup’s valuation to grow as it moves from one stage of funding to the next? The answer has changed a lot over the past several months.

How step-up multiples shifted in 2023

Step-up multiples track how valuations compare across different stages. They’re calculated by dividing the valuation at one startup stage by the valuation at the previous stage. For instance, if a seed valuation is $10 million and the corresponding Series A valuation is $30 million, then the Series A step-up is 3x.

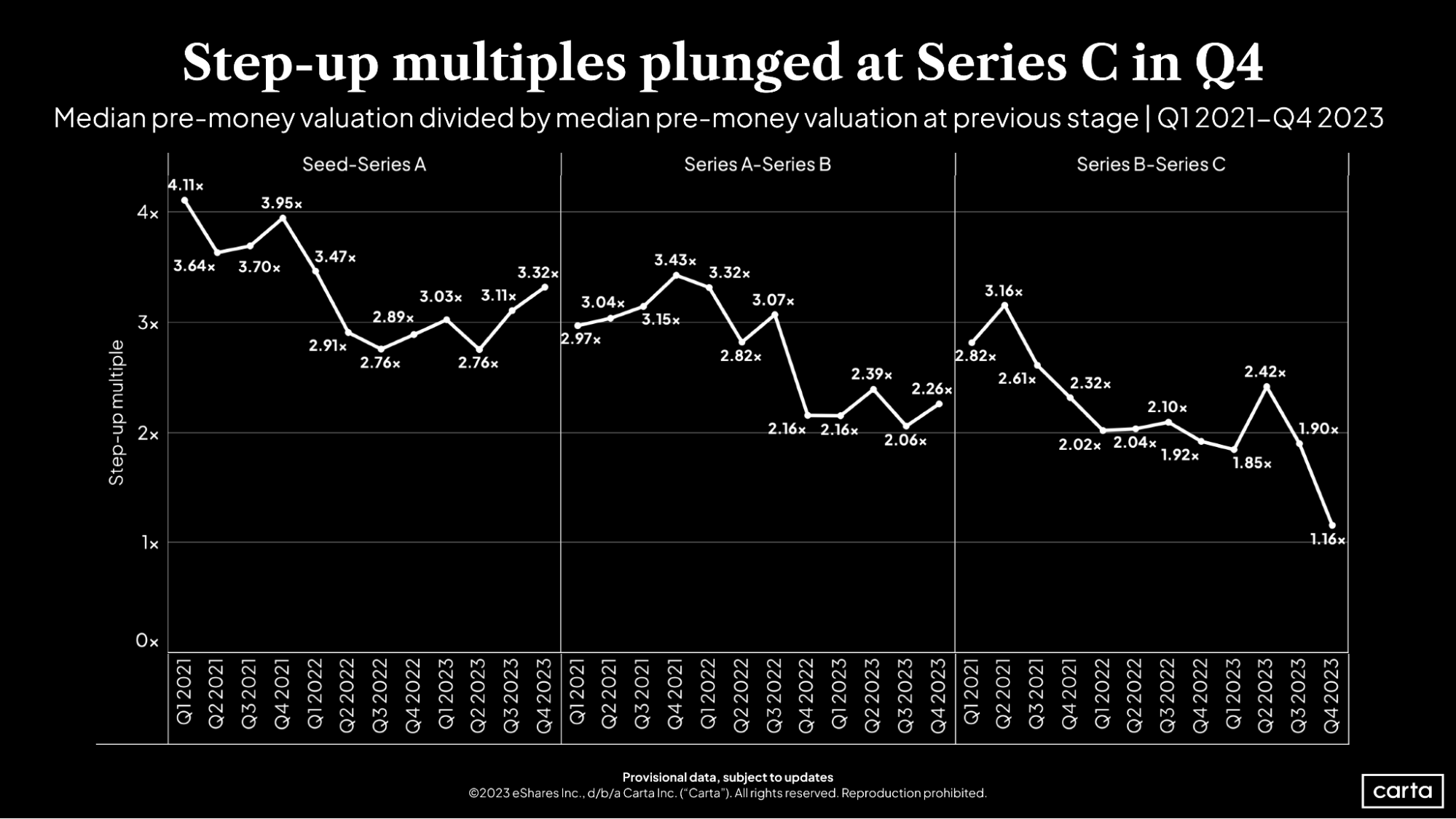

By this metric, valuation growth for startups is trending back up at the earlier stages. The median pre-money Series A valuation was 3.32x larger than the median seed valuation in Q4 2023, and the median step-up multiple between those two stages has increased in consecutive quarters.

At later stages, it’s a very different story. The median pre-money Series C valuation was just 1.16x bigger than median Series B, the smallest step-up multiple at that stage in at least the past five years. At every stage from Series A to Series C, step-up multiples have trended down from recent high points in 2021. But the scope of those declines vary drastically.

Combining step-up multiples across stages can demonstrate the compounding effects that changes in the valuation market have on a business. For example, take a startup that has raised seed funding at a $10 million valuation: If that company raised a Series A, Series B, and Series C at the median step-up multiples we saw in Q4 2023, its Series C valuation would be $87 million. If that same company had raised a Series A, Series B, and Series C at the median step-up multiples from Q4 2022, its Series C valuation would have been nearly $120 million.

Here’s a closer look at how step-up multiples have shifted at each stage over the past several years.

Seed to Series A

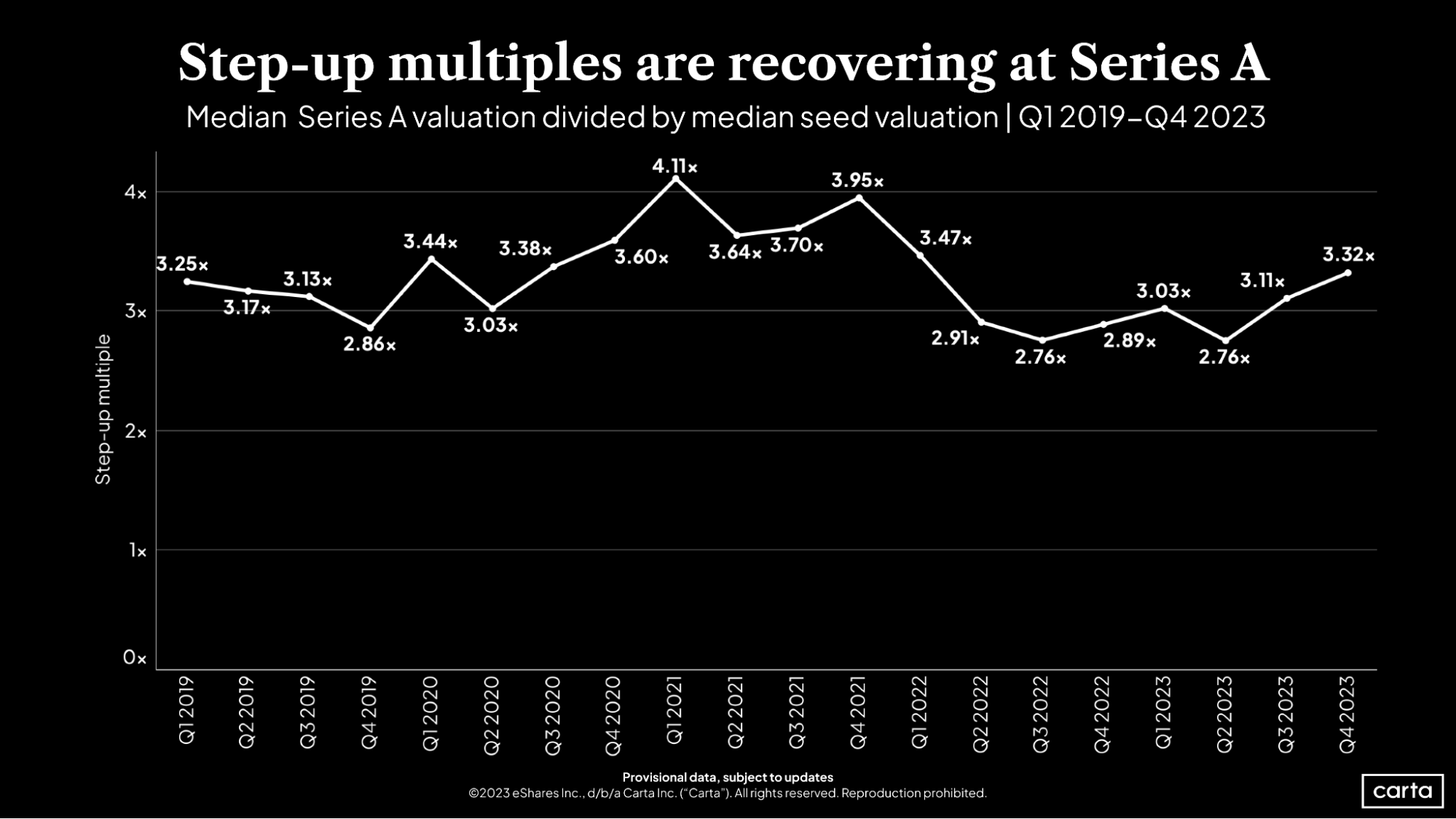

For the median startup, the transition from seed to Series A represents the largest valuation step-up that the company will experience. At every quarter in the past five years, the median step-up multiple was larger at Series A than at any other stage.

And in the back half of 2023, it got even larger. Back in Q2, the median step-up multiple at Series A descended to 2.76x, tied for its lowest point in the past five years. Now, after two straight quarterly increases, the median step-up has reached its highest point since Q1 2022.

This is largely due to a strong market at Series A. The median primary valuation for Series A rounds climbed to $44 million in Q4, the third-highest point in the past four years.

Series A to Series B

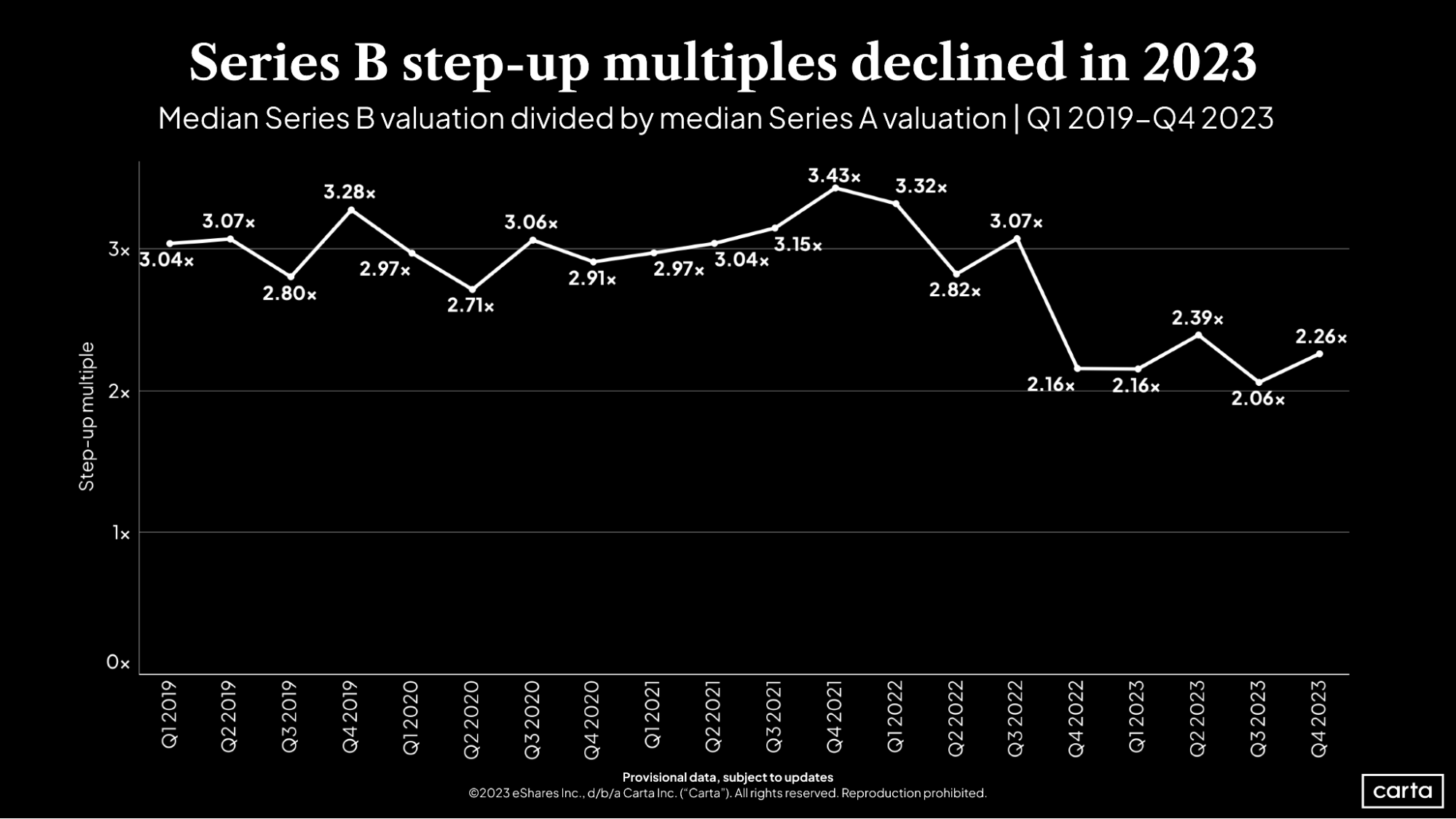

Between the start of 2019 and Q3 2022, the median step-up multiple at Series B landed between 2.71x and 3.43x for 15 quarters in a row. Since then, there’s been a clear shift: The median Series B step-up multiple has fallen below 2.4x in five consecutive quarters.

In Q4, the median primary valuation at Series B was $100 million, up 19% compared to the previous quarter. That helped drive a slight uptick in the median step-up multiple at this stage. But step-up multiples describe a relationship between two stages. Since the median valuation also trended up at Series A, step-up multiples at this stage remained relatively low.

Series B to Series C

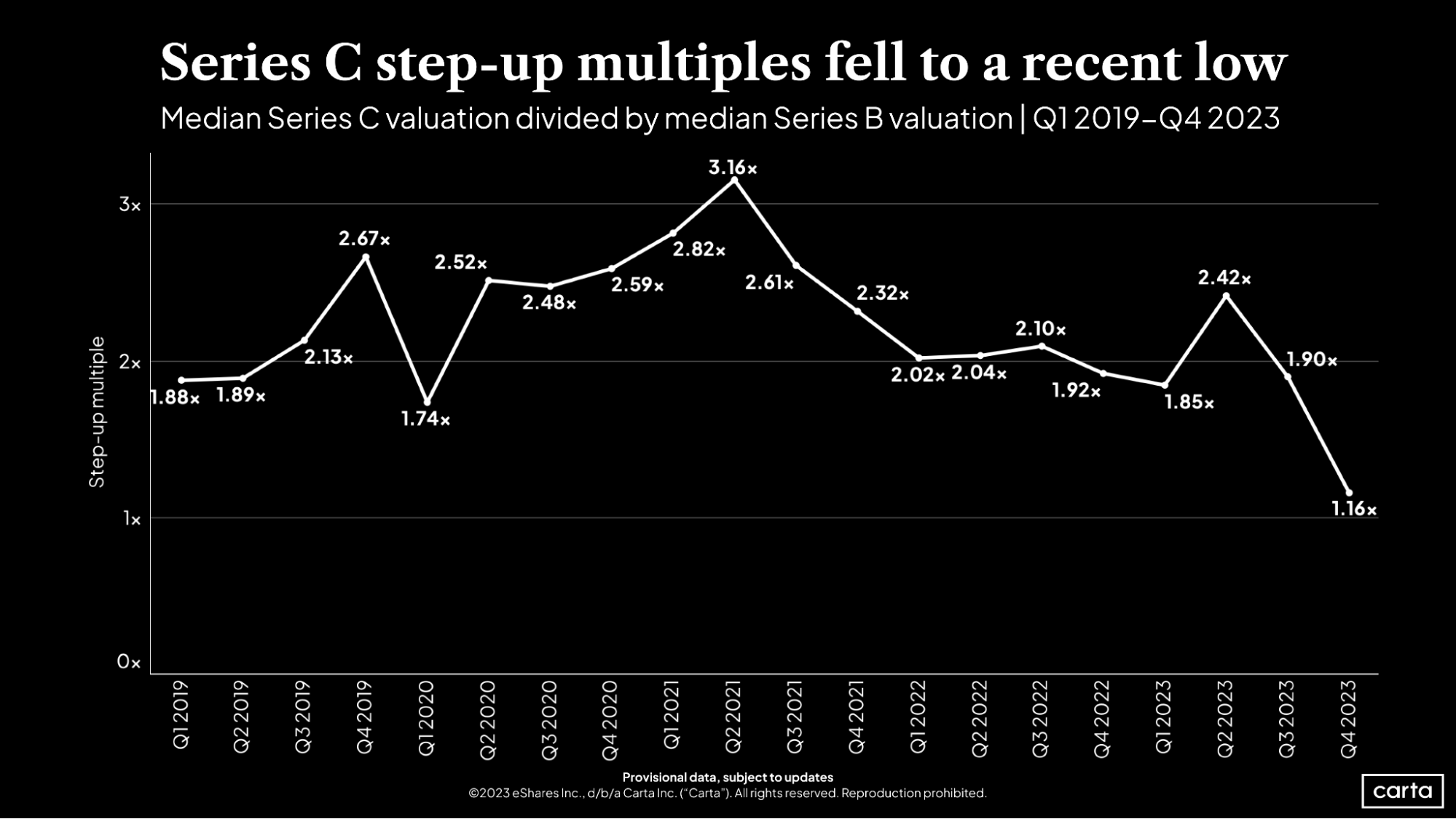

It was a painful Q4 for startups raising a Series C round. Series C was the only of these three stages where the median valuation decreased during the last three months of the year. As a result, the median step-up multiple plunged all the way to 1.16x, far and away its lowest point in the past five years. This means that there was barely any gap between valuations at Series B and Series C in Q4.

Back in Q2 2023, the median step-up multiple at Series C rose all the way to 2.42x, the highest rate since Q3 2021. At this point, though, that figure looks more like an outlier than the beginning of a new positive trend.

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter:

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. ("Carta"). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein. ©2024 eShares Inc., d/b/a Carta Inc. ("Carta"). All rights reserved. Reproduction prohibited.