Executive summary

Venture-backed startups have been on a valuations rollercoaster over the past two years. After rocketing to record highs throughout 2021 and into early 2022, pre-money valuations have slid at every fundraising stage—at Series D, valuations have fallen by more than 50% since Q1 2022. The volatility means it may be harder than ever to estimate the value of a tech startup.

Volatility in pre- and post-money valuations has knock-on effects for another key valuation metric for startups: 409A valuations. A 409A valuation is an independent appraisal of the fair market value (FMV) of a private company’s common stock. It has major implications for how much employees will need to pay to exercise their options, which in turn is a big factor in whether employees end up with any tangible value out of their startup equity.

We’ll take a spin through how the market for 409A valuations is shifting, the implications for companies across funding stage and industry, and the impact on employee decision-making.

Key insights

-

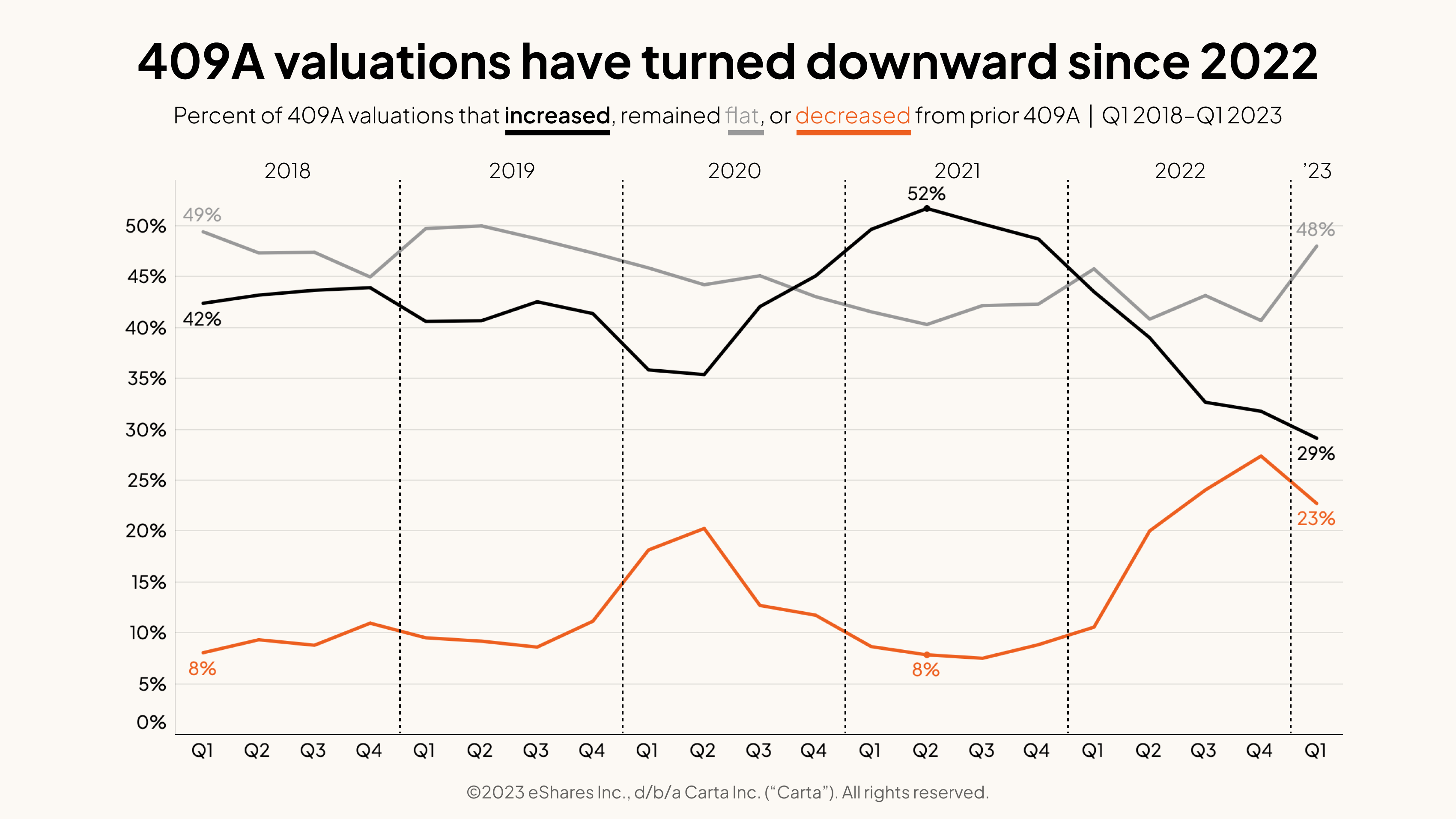

More 409As are declining: 23% of 409A valuations delivered in Q1 2023 declined from their prior value. That’s nearly 4 times the share from Q1 2021.

-

Later stages are more adversely affected: Only 19% of seed-stage 409As delivered in Q1 fell from the last valuation. In Series D, it was 45%.

-

More employees are deciding not to exercise their shares: 409A valuations determine the strike price for employee stock options—but as 409A valuations and strike prices decline, so does employee confidence in the eventual value of their equity. More employees are choosing to let their equity expire rather than pay the exercise cost.

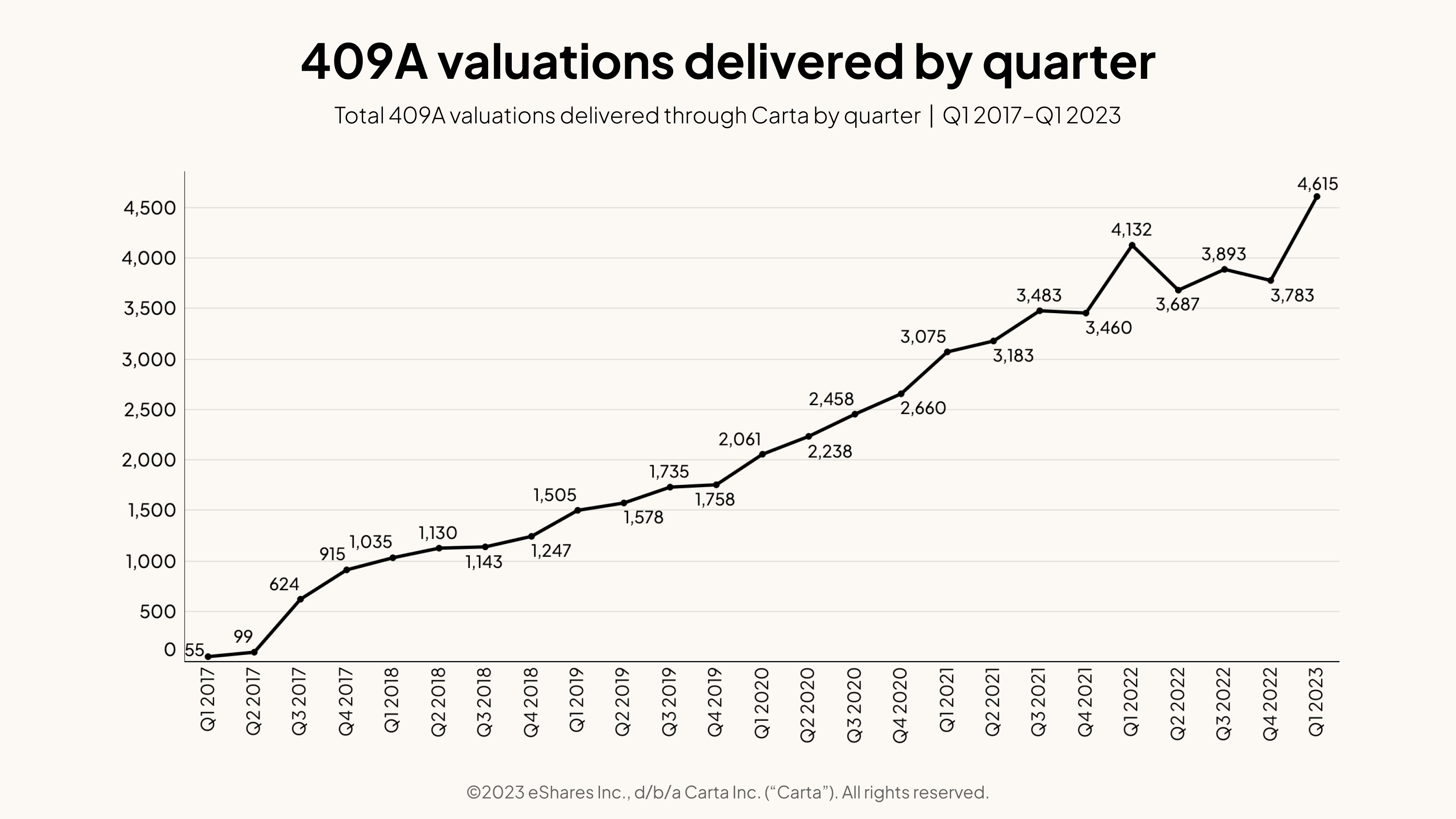

Carta delivers more 409A valuations per year than the next top 15 competitors combined. This density allows us to segment our valuations data in a more granular fashion.

Startups are required to receive a new 409A valuation either annually or following a material event such as a fundraise. Even though startup fundraising has slowed considerably, companies must still obtain refreshed 409A valuations.

More companies seeing declining 409A valuations

A higher share of 409A valuations decreased from prior levels in each of the past three quarters than ever before on Carta. Even the sharp volatility in public and private markets generated by a global pandemic in Q2 2020 failed to make this much of an impact on 409As.

409A valuations by stage

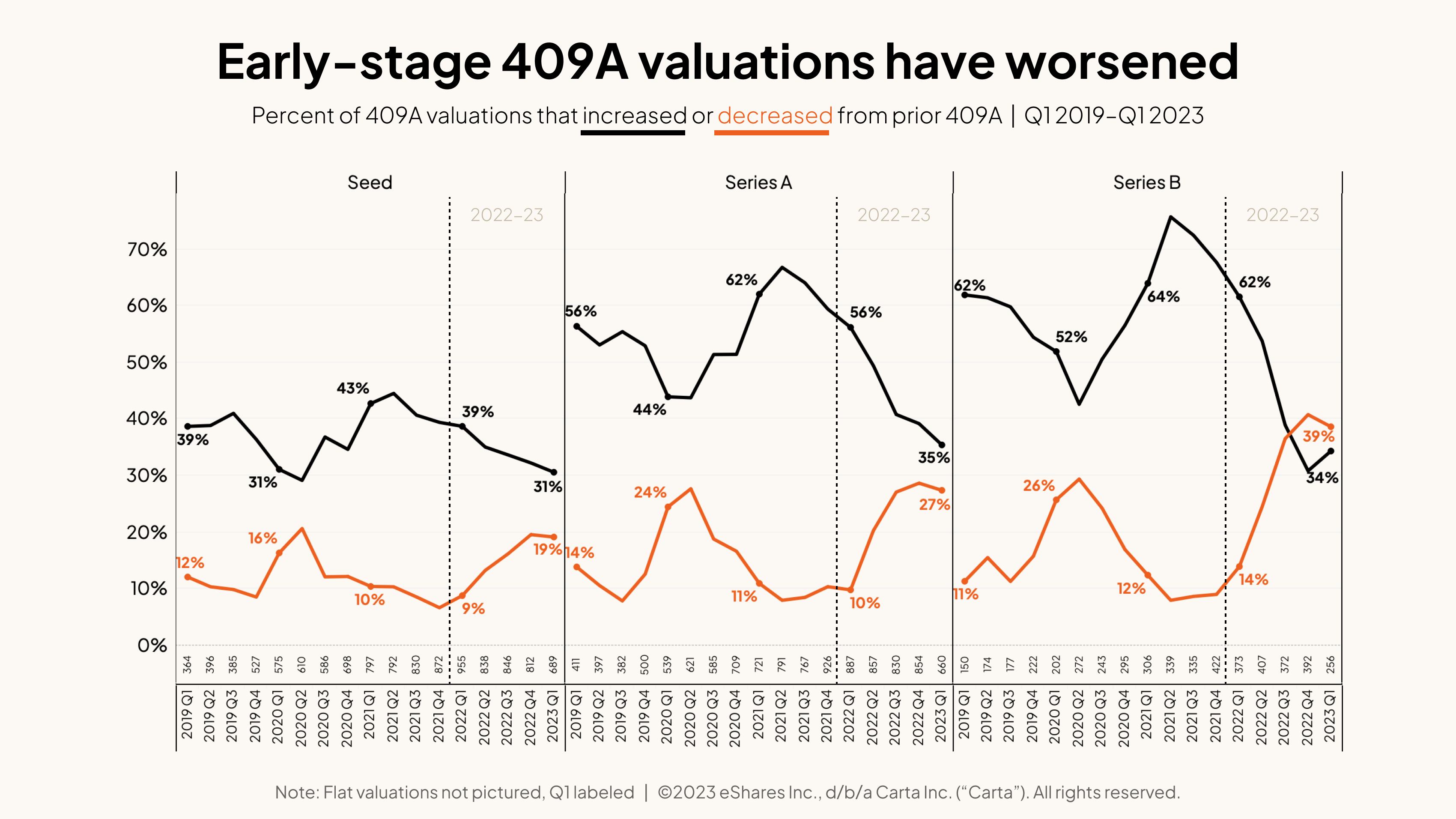

The situation differs depending on the funding stage of the company. While the venture downturn has made a reduced 409A more likely at all stages, the share of declining 409As rises as you move through the alphabetical funding stages.

For instance, 19% of seed-stage 409As declined in Q1 2023, but 39% of Series B 409As declined during the same period.

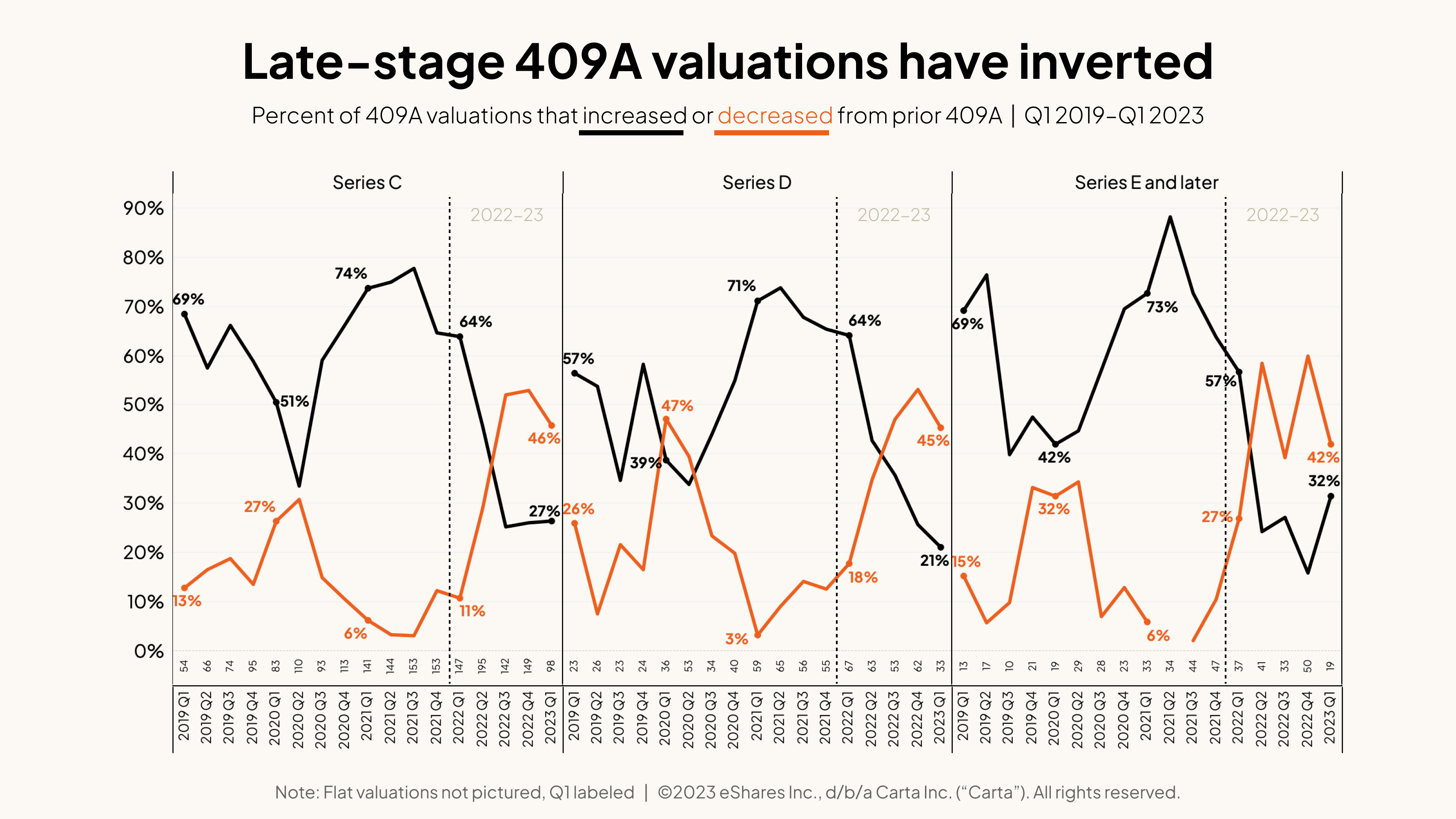

The share of 409As that increased or decreased in late-stage private companies inverted in the middle of 2022. It is now more common to see a declining 409A than a rising one across Series B, C, D, and E+.

The trend is all the more striking given that declining 409A valuations at the latest stages were exceedingly rare in early 2021. Less than 5% of all late-stage 409As declined in Q1 2021—but about 45% did so this past quarter.

409A valuations by sector

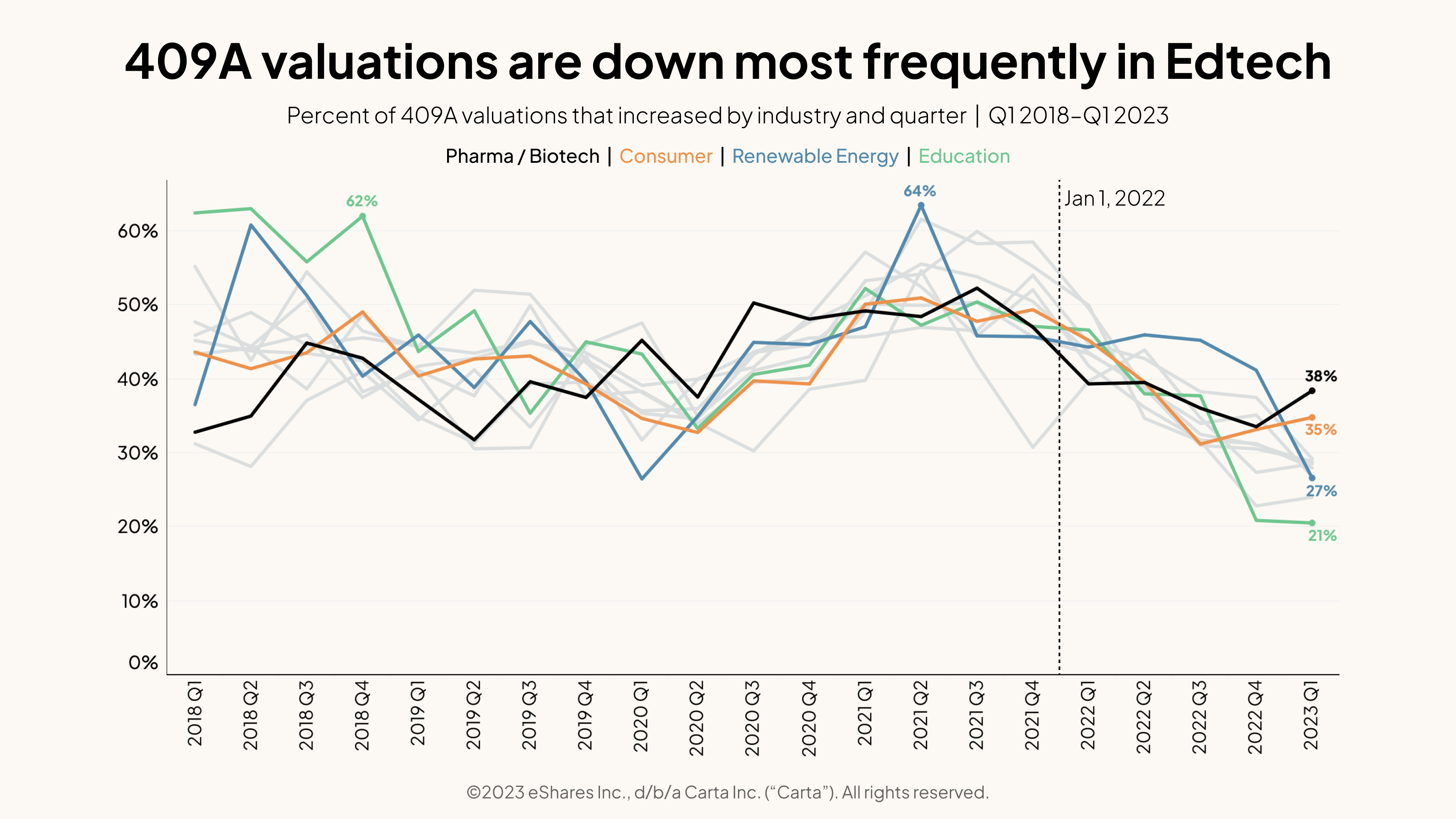

No startup sector has been immune to this downturn. Each line in the chart below represents a single industry of Carta startups. The percentage refers to the share of 409A valuations that increased from the prior 409A. While each industry follows its own pattern, the general trend was towards a higher share of rising 409As up until 2022; in Q1 2023, the share of rising 409A valuations in each sector has declined year over year.

Certain industries—pharmaceuticals and biotech in particular—seem to have avoided both the rapid rise in 409A valuations and the subsequent fall. Others, like education, have seen the proportion of increasing 409A valuations fall by more than half in less than a year.

The price of underwater stock options

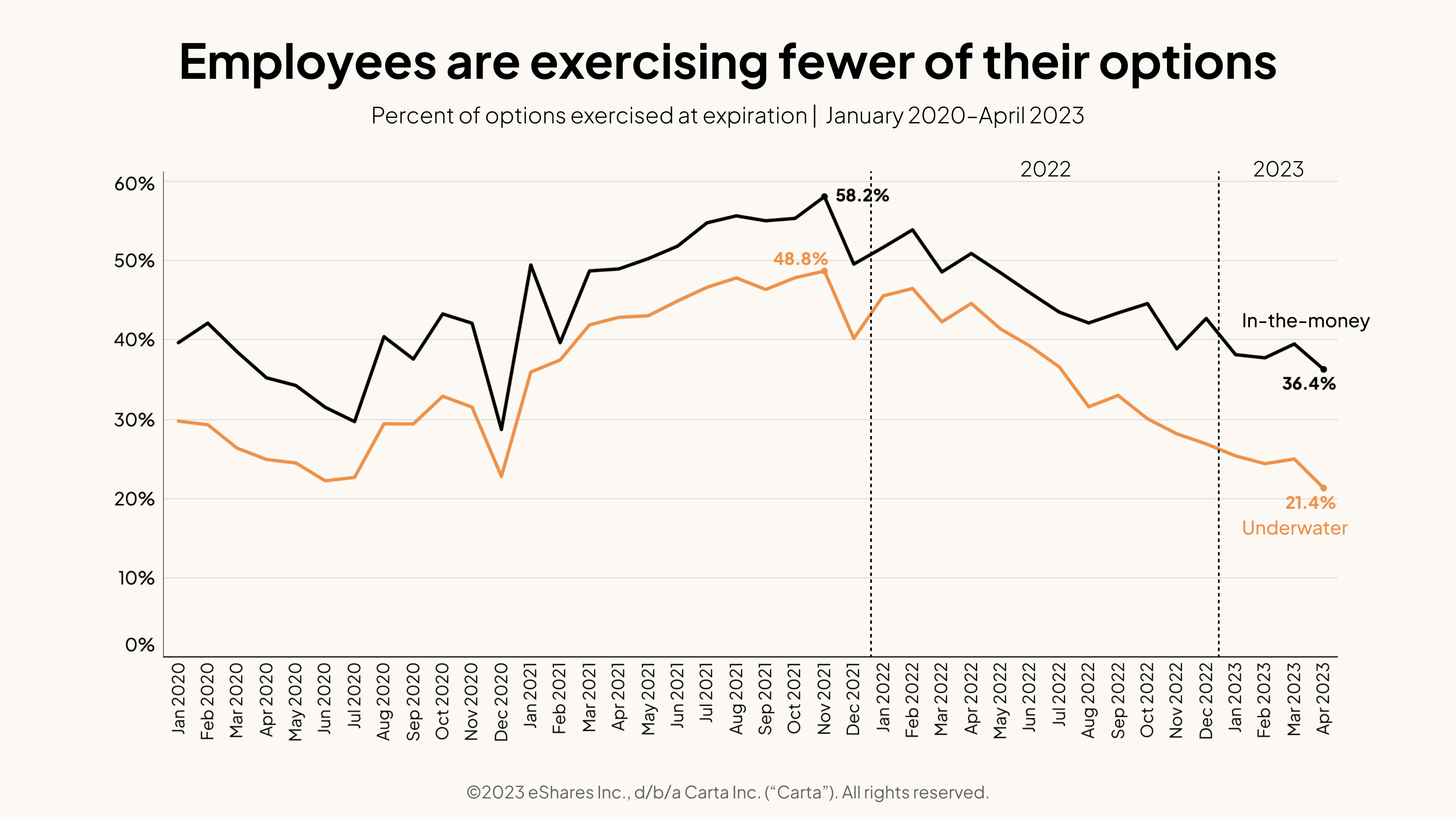

The primary impact of this turmoil in 409A valuations falls on employees. If an employee joined the company in late 2021 (when startup hiring was at an all-time peak), they likely received a stock option grant with fair market value derived from an elevated 409A.

Now those same stock options may be “underwater”—that is, the current FMV is below the strike price at which the options were issued. As you might expect, employees are far less likely to exercise underwater stock options.

If an employee leaves the company or is laid off, they typically only have 90 days to decide whether to exercise their equity. When you combine the larger number of underwater options with the recent spike in startup layoffs, the result is a growing number of startup employees for whom equity compensation has resulted in no real gain.

Option repricings

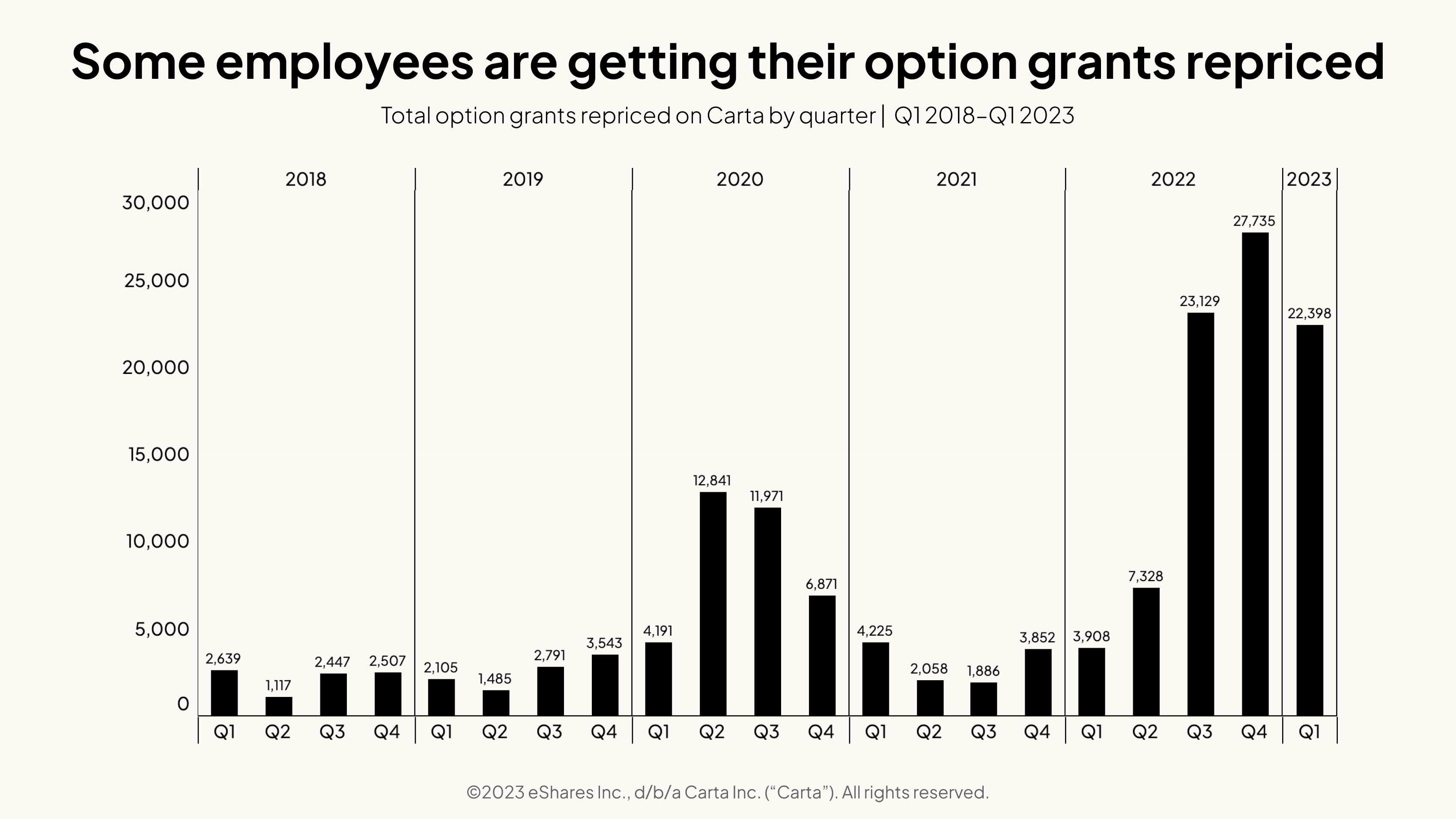

Given this climate, some companies are taking measures to ensure their employees maximize upside in their company equity even once the 409A valuation has declined. The primary approach is to reprice options.

Repricing is a process by which the company leadership (usually the CEO, CFO and the board of directors, with advice from outside legal counsel) lowers the strike price of existing stock options. This can be an administrative challenge, require delicate internal messaging and may have adverse tax implications for the changed grants.

Tens of thousands of option grants have been repriced on Carta in the past nine months. These spikes in option grant repricings far outpace the smaller uptick that corresponded to the onset of the pandemic.

More than 20,000 option grants were repriced on Carta over the past three quarters (Q3 2022–Q1 2023). That may sound like a lot, but only 603 companies undertook any repricings in that timeframe. The majority of employees are not being offered this benefit.

Equity compensation is a major allure for tech talent, particularly among startup workers. As company valuations continue to reset across the venture-backed startup world, ensuring that 409A valuations are updated to reflect the current reality will help keep employee incentives aligned to the long-term health of the business.

Methodology

This study uses an aggregated and anonymized set of Carta customer data. Companies that have contractually requested that we not use their data in anonymized and aggregated studies were not included in this analysis.

The data presented in this 409A report represents a snapshot as of May 31, 2023. Historical data may change in future studies. In addition, new companies signing up for Carta’s services will increase historical data available for the report.