Thanks to Silicon Valley’s role as the startup capital of the world, California has long been home to far more venture capital activity than any other state. Over the course of 2022, more than 45% of capital raised in the U.S. went to California companies. No other state topped 13%.

In Q1 2023, however, California’s share of venture dollars slipped. And in the South, a new startup hotspot continued to gobble up market share.

About 40.7% of all U.S. venture capital raised on Carta in Q1 went to companies headquartered in California—still far more than any other state, but down from a recent high of 51% in both 2018 and 2019. (Part of this long-term shift is likely due to the growth and geographic diversification of Carta’s dataset.) Texas, meanwhile, claimed nearly 7.2% of all VC capital raised in Q1, a huge leap from its 3.2% share during 2022.

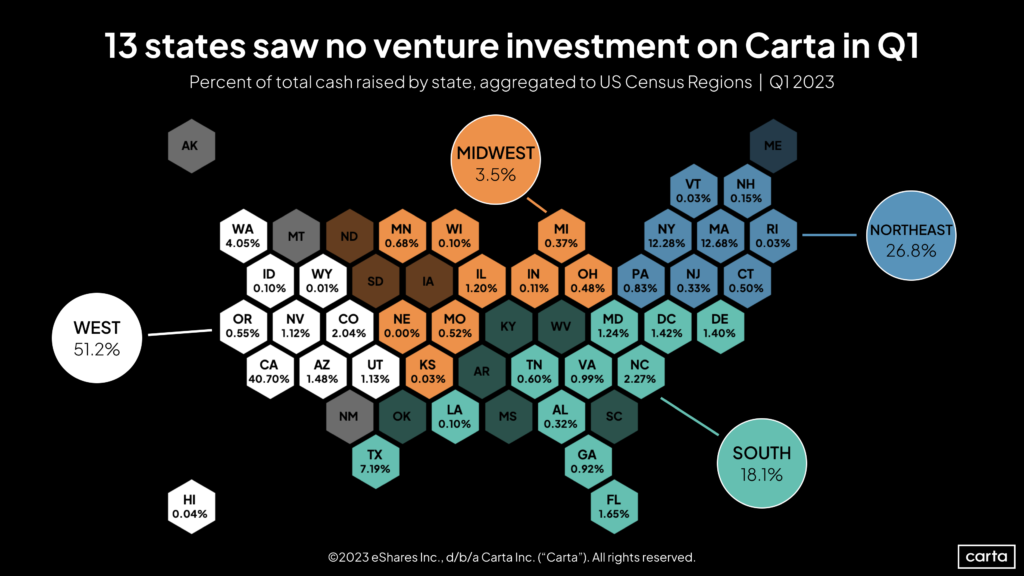

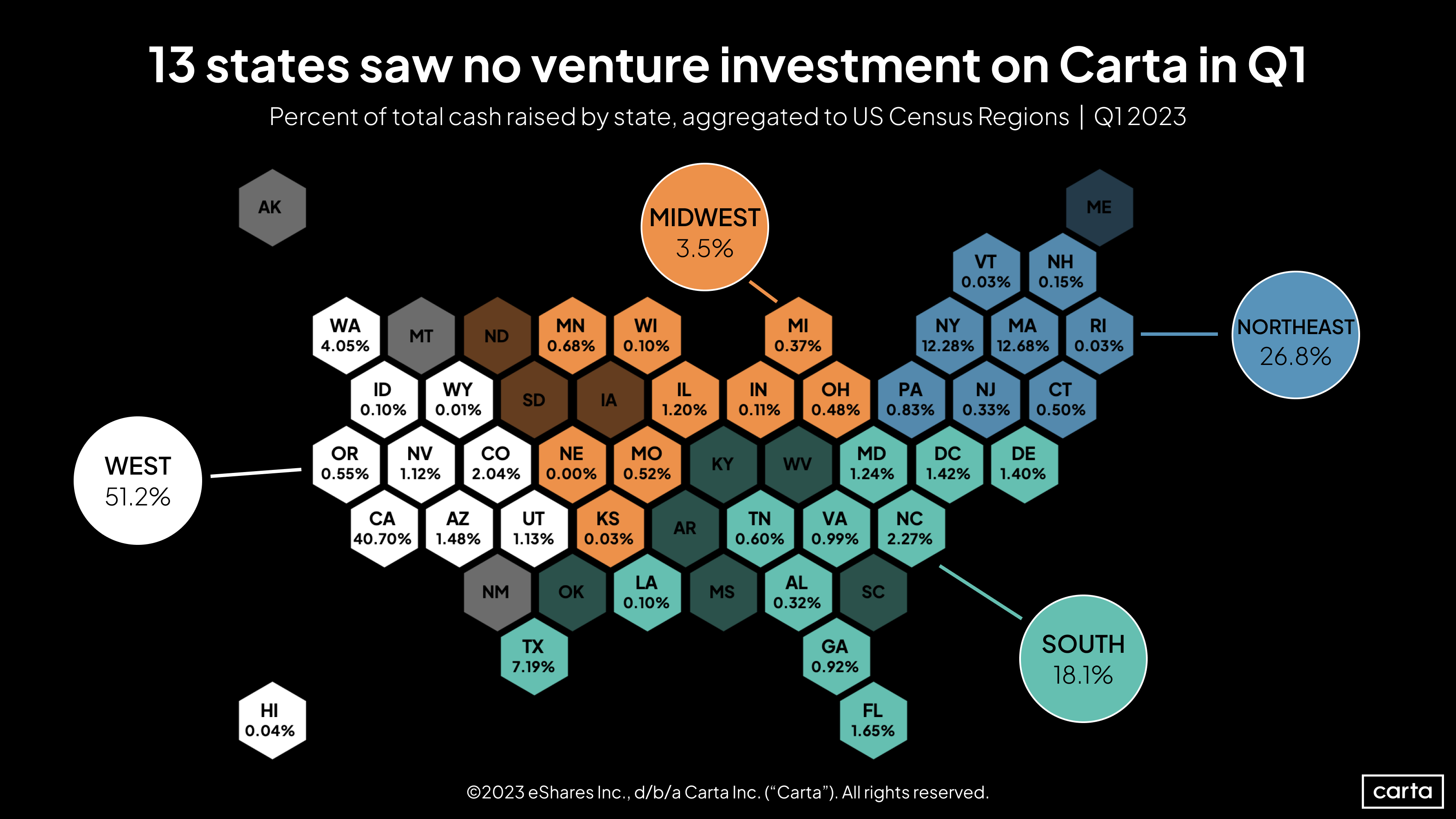

This was part of a larger southern and eastern shift in capital raised during the first three months of the year. The West census region as a whole saw 51.2% of VC raised during Q1, down from 55% for all of 2022. Meanwhile, the South’s market share rose from 15.5% to 18.1%, and the Northeast climbed from 24.5% to 26.8%. The Midwest continued to lag behind, falling from 4.8% to 3.5%.

This change in the market is in line with recent population trends in the U.S. Texas was the fastest growing state in the country during 2022, according to the U.S. Census Bureau, joining California as one of only two states with populations north of 30 million. And the South was the fastest-growing of the four census regions, with population expansion of nearly 1.4 million over the course of 2022, a 1.1% increase. By comparison, populations in the Midwest and Northeast both got smaller last year.

As it so happens, many of those Texas transplants were former Californians. Between 2019 and 2022, more than 11% of all new Texas residents came from California, a higher proportion than from any other state.

The same sort of movement has occurred on a corporate level. Researchers at the Hoover Institution at Stanford University identified 265 companies that moved their corporate headquarters out of California between 2018 and 2021. Of that sample, 114 relocated to Texas.

One factor drawing some former California tech workers to Texas is the lower cost of living, which allows the typical startup salary to go much further than in other locales. Another attraction for both tech executives and rank-and-file workers is taxes. While they say that everything’s bigger in Texas, that’s often not true when it comes to your personal income tax bill.

There’s still a long way to go before Texas could credibly challenge California for startup supremacy. With its recent gains, the Lone Star State now ranks fourth among all states in terms of capital raised, trailing biotech hotspot Massachusetts (12.7% of capital raised in Q1) and New York (12.3%).

But it’s beginning to look like the recent growth of Texas could have a lasting impact on the VC ecosystem. In the recent past, California, Massachusetts, and New York formed an unofficial Big Three states for startup investors. Thanks to Texas, it’s now looking more like a Big Four.