~2% of venture-backed companies IPO.1 Very few startup employees will ever receive liquidity for their equity. The lucky few who do wait years, sometimes a decade, to get it. Worse, many employees forfeit their equity when leaving the company because they can’t afford to buy their options. For most, startup stock options are a mirage.

We live in a strange world where we have hyper-liquidity in public markets, zero-liquidity in private, and nothing in between. Liquidity is the ability to turn any asset into cash. Employees in private companies typically only get liquidity when a company goes public or gets acquired, but companies can also offer tender offers or allow options to be sold in secondary markets. Employees in public companies, can sell their stock whenever the market is open.

Back in the 1980s, tech employees never received options. It was unheard of until Fairchild Semiconductor and the Traiterous Eight started giving their employees equity. Employee equity quickly became a recruiting advantage. Other companies were forced to follow suit to stay competitive. Today it is unimaginable for a tech startup to not give employees stock options.

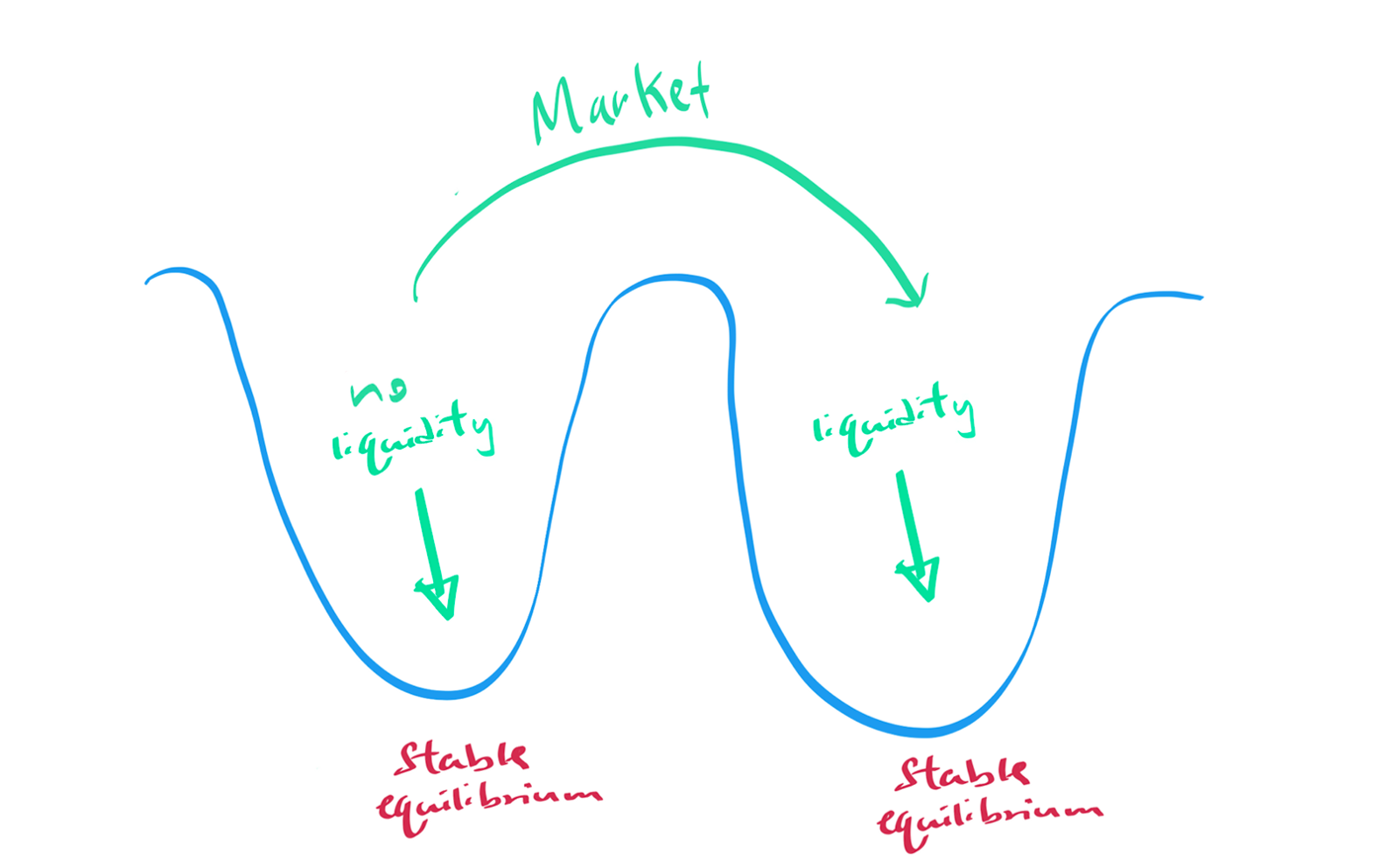

Prior to Fairchild Semiconductor, there was a stable equilibrium where no companies offered employee equity. They flipped the market to a new stable equilibrium where every tech company offered employee equity. Like driving on the left side or the right side of the road, there is no stable equilibrium in the middle where some companies offer equity and others don’t. Recruiting competition punishes the laggards.

The same will be true for liquidity. There will be a handful of forward-looking CEOs, and companies, who offer liquidity as an employee benefit to compete in today’s fierce talent market. Others will have to follow suit and the equilibrium will flip.

Today less than 1% of companies using Carta for cap table management offer any form of liquidity for employees. Like stock options the market will flip and ten years from now it will be unimaginable for companies to give employee options without the liquidity to redeem them. Our generation of companies will look primitive and unsophisticated to future generations.

At Carta we have an insatiable need for the incredibly talented. Our commitment to liquidity at Carta is one of the ways we attract the best people. Today, we are at a scale where we can offer liquidity every 12–18 months. All employees with vested shares are eligible. As we grow, we will be able to provide liquidity events more frequently. It is one of our employee benefits alongside healthcare, 401K matching, and free books.

Don’t wait years for an IPO. Don’t roll the dice to cash-in. Don’t worry your equity is worthless. Equity doesn’t have to be a mirage. Come work @ Carta and get the opportunity for liquidity.

This post was adapted from Henry’s Medium post.

¹ Using data from the NVCA 2018 Yearbook, we looked at the number of companies which had an IPO between 2016-2017 then divided it by the average number companies which raised their first round +/- 1 year from the median time to IPO. Each year was weighted based on the number of IPOs to arrive at 2.4%