UK/EU on the rise

The European venture capital investment scene has overcome numerous obstacles to become the powerhouse it is today. To provide you with some context, Dealroom reports that €49bn was raised by European start-ups in 1H’21 (vs. €17Bn in 1H’20). That’s 188% growth year over year!

By way of comparison, the entire European start-up market raised €4.6 billion in 2011. We will now take a deeper dive into what created the sentiment change in the markets and the positive impact of venture capital industry today

Source: Dealroom

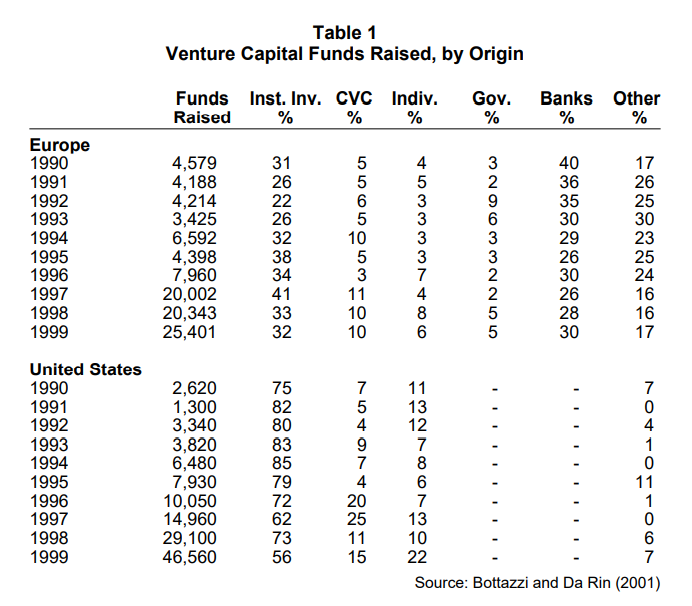

History: 1990-2000

Investors:

There was far less supply of capital that was pouring into the venture capital industry. European VC funds raised on average 32% and 31% of its capital from institutional investors and banks respectively.

As evidence shows, banks tend to be far less aggressive than institutional investors such as pension funds, investment banks, investment banks, and insurance companies.

With banks representing 30% of the investor base, they will have a strong sway on the investment strategy. This was vastly different from the US VC funds, where capital raised from institutional investors was 75%; 2.3x than in Europe.

Founders:

This was a different generation, where launching your start-up after graduation and fundraising for capital was considered a very risky venture. It was harder to find capital unless you had a strong personal network and even then, it was limited to your local geography.

Even though the internet was born in 1994, it was not rapidly adopted by the public and most certainly not used to help founders for fundraising.

There was a strong appeal to get an education and launch your career in large corporations with strong employer brands rather than entrepreneurship. Young professionals were seeking to be bankers & lawyers as dream jobs, not being a founder.

Ecosystem:

US universities played a key role in developing joint ventures with institutional investors and venture capital funds, whereas in the European universities, as explained by European Venture Capital Association (EVCA), "most courses on corporate finance deal only with quoted companies. Investing in non-quoted companies is perceived more as alchemy than science.”

Additionally, Europe has more tightly-regulated economies, where the State has been or remains a very powerful institution. Whereas, in the US and UK, capital markets were segmented by competition regulations. In Europe, universal banks dominated both the financing and governance of companies.

The importance for reliance on capital markets is that venture capital investors are attracted by exiting via IPO. Gompers (1995) finds conclusive evidence that IPOs offer a much larger return than any other forms of exit.

Growth: 2000-2010

Investors:

The rise of the internet led to major tech giants such as Google, Apple, & Microsoft, brewed a strong talent pool and culture of “give first.”

It also created tech entrepreneurs recycling capital by becoming angel investors and eventually VCs. Since the 2000’s, Europe VC value chain has become richer. The emergence of experienced ‘super angels’ has significantly improved seed financing, while corporate venture programs now provide another source of smart capital.

Founders:

Between 2004 and 2006, the proliferation of internet usage and advancing digitization got the tech ecosystem back on track.

In fact, many entrepreneurs with business models that had failed in the late 90s due to a lack of infrastructure and users were now taking off successfully with similar businesses that were scalable overseas. The US produced many tech leaders that landed success stories in Europe and inspired a new generation of entrepreneurs.

Ecosystem:

Promotion of entrepreneurship and innovation has become the primary initiative including the following policies: Risk Capital Action Plan and the Financial Services Action Plan. Although implemented in 1998 – the impacts were instrumental in four main areas:

-

Introduction of the Euro to eliminate exchange risk among participating countries to allow for ease of capital investments.

-

Structural reform to reduce national impediments to the development of venture capital investment by removing prohibition against investments in “private equity” by pension funds. The removal of complex regulations governing the creation of companies - and bankruptcy and insolvency procedures that varied from country to country.

-

Enhancing entrepreneurship and innovation through resources necessary to enhance human capital; acquisition, transmission, and application of knowledge; and the relationship between innovation production and markets.

-

A series of financial instruments managed by the European investment bank and the European investment fund.

Turning point: 2010 - Present

Investors:

There has been growth of domestic and foreign capital investments with investors from Americas, Asia & Middle East interested in investing into European start-ups. Big names such as Sequoia have come to fuel the EU venture capital ecosystem. The existing venture capitalists like the names of Accel, Index VC, & Balderton Capital have played a prominent role by investing in submarkets.

Founders:

If you look at where people in Silicon Valley came from – data will show not all of them were Americans. They came from all over the world – including EU nationals who’ve returned to their home countries and built companies that have become the next unicorns. Additionally, the ability to use scalable software such as AWS and global distribution such as Facebook & Google has allowed Europe to be entrepreneur friendly.

Ecosystem:

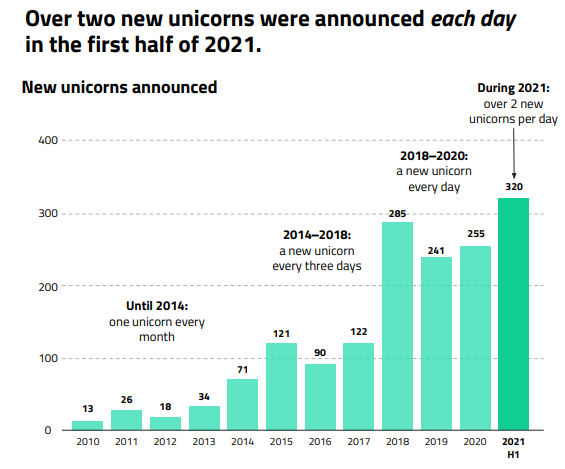

The real inflection point was around 2014 with a large population having access to the internet and/or smartphones (80% of adults today). From then on, the massive growth of the venture capital industry, support from technology innovation hubs and accelerators, and capital market efficiencies for exit opportunities compounded growth for the ecosystem.

Today

After a long period emerging from the Dot.com bubble, financial crisis, regulatory barriers – UK/EU venture capital is skyrocketing with 49Bn EUR raised by European start-ups and 320 unicorns in the first six months of 2021!

UK/EU produces great entrepreneurs with its high standard of education, government support, and innovation hubs. Venture Capital investing is bringing positive change to people's everyday lives. It is funding technology that allows people to work remotely, connect with people across the globe, eliminate waste, create jobs, and the list goes on.

This goes beyond the benefit of capital returns – and that’s why its growth in Europe can only be a good thing.

Notes:

For the purposes of research paper – UK is coined as part of the European / EU market for ease of reference (apologies to the politically correct individuals.)