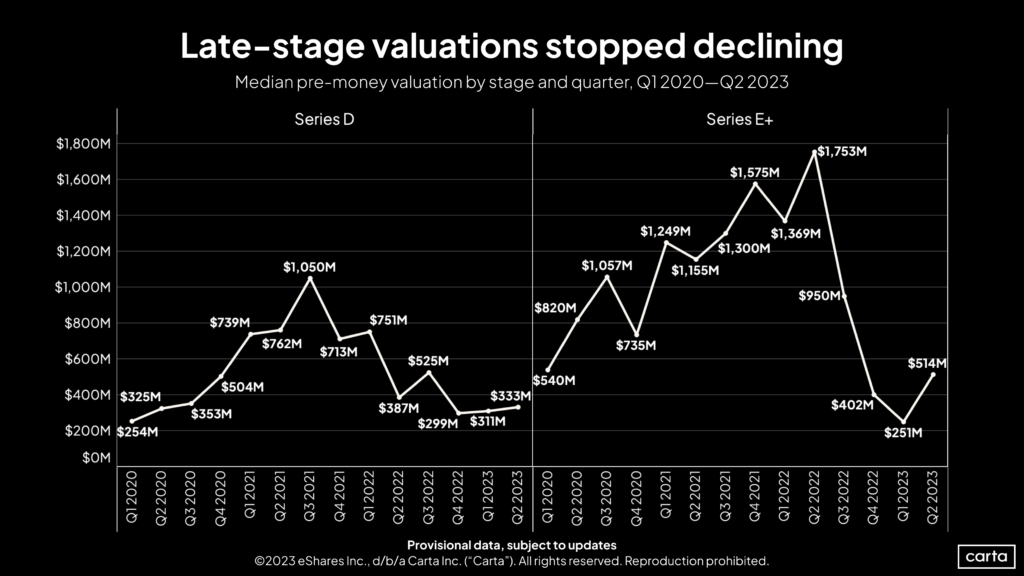

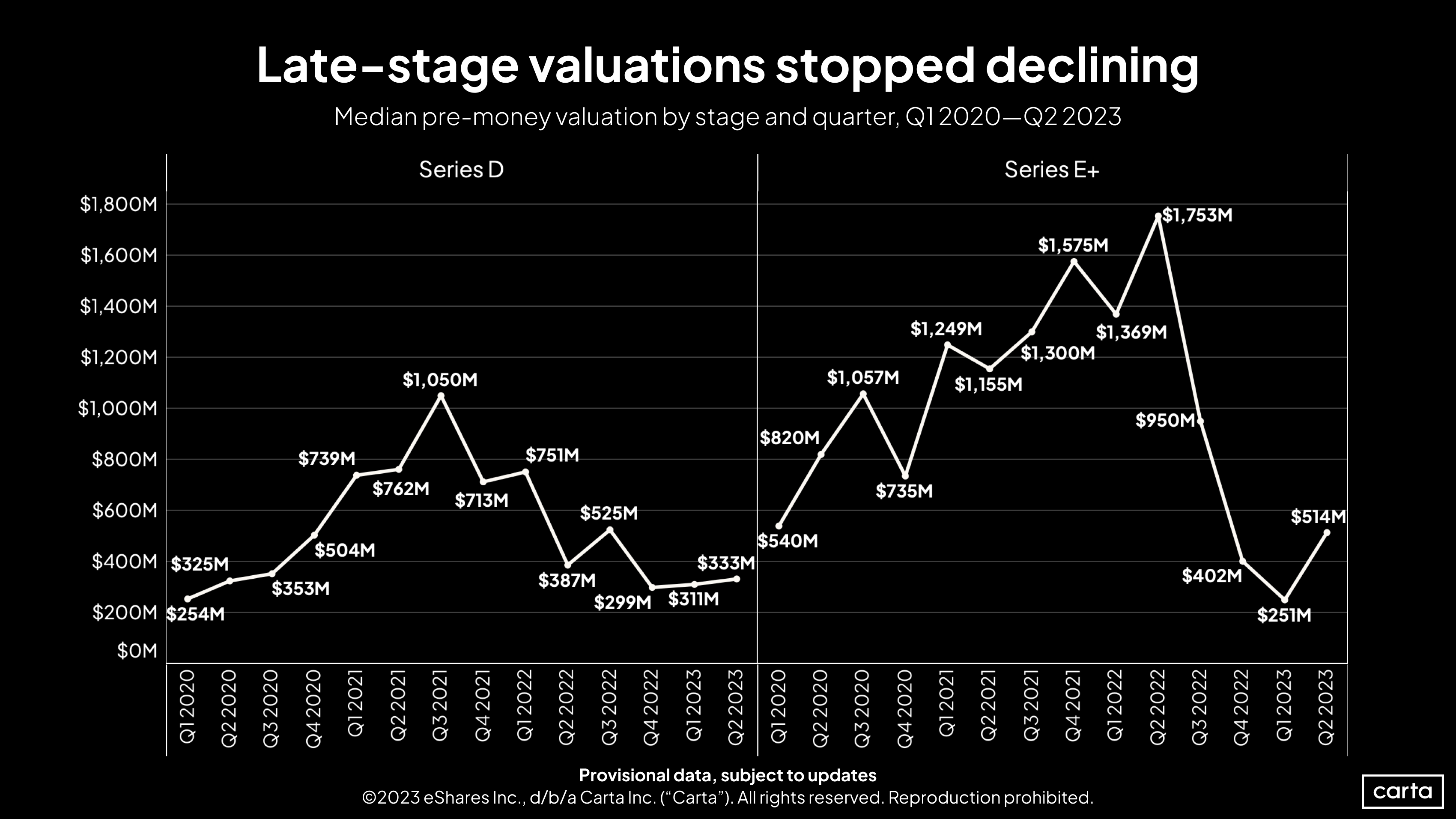

Late-stage startup valuations plummeted last year and into Q1 2023. But the downward spiral has finally subsided, according to the first cut of Carta’s Q2 data.

In Q2, the median pre-money valuation for Series E and beyond jumped 105% from Q1, going from $251 million to $514 million. For Series D deals, the bump in pre-money median valuation was less dramatic, increasing 7%, from $311 million in Q1 to $333 million in Q2.

That marked an important shift for both investment stages after a year in which market volatility, rising interest rates, and broad economic uncertainty forced late-stage VC investors to pull back from late-stage investments. Valuations at Series D and Series E and beyond are still down year over year, dipping 14% and 71%, respectively.

Late-stage startup valuations often mirror their public market counterparts, in part because late-stage startups have established business lines similar to public companies and because their valuation models incorporate data for public-market comparison companies—in large part because late-stage startups are typically closer to an IPO or acquisition than early-stage startups. Investors often view late-stage companies in a similar fashion to public competitors and are willing to pay comparable prices. Public tech companies have seen their share prices rise in 2023, with the tech-heavy NASDAQ composite increasing more than 30% year-to-date (and 13% in Q2).

Whether late-stage valuations continue their upward trend will likely depend on external factors, including the IPO market. In an attempt to drive down inflation, the Federal Reserve is planning at least two more interest-rate hikes before the end of the year. That outcome would still be suboptimal for unprofitable late-stage tech startups, which see their valuations fall when the cost of capital increases.

But there still remains ample dry powder in the ecosystem. And there are signs the IPO market is thawing: Cava raised more than $300 million in a June IPO that valued the fast-casual restaurant chain at $2.5 billion. Shares have surged nearly 78% since debuting at $22 per share. Other late-stage behemoths such as Instacart and Turo could IPO by the end of the year if market conditions allow it.

A revived IPO market would lead to a cash infusion for late-stage VCs who got hit hard over the past year—and bolster confidence at every stage of startup growth.

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: