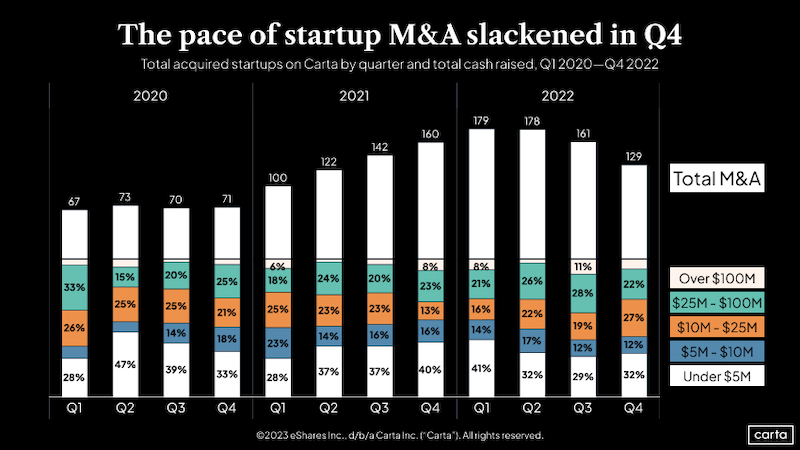

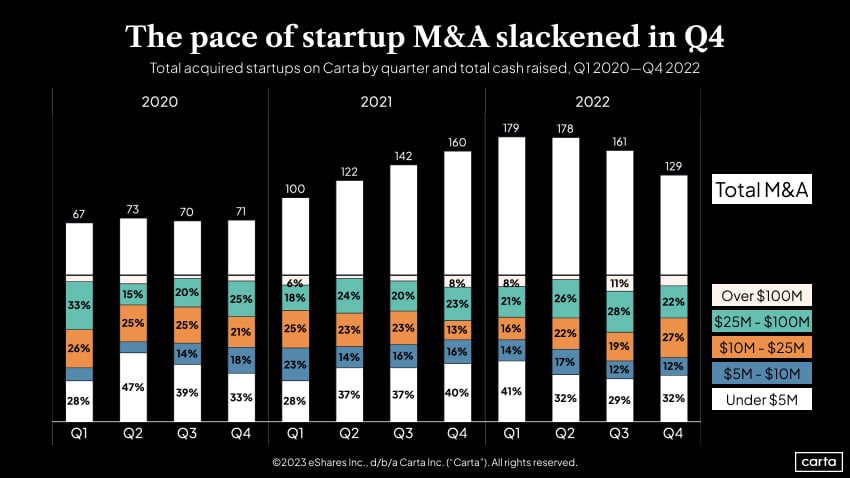

On an annual basis, startup M&A activity is surging. Private companies on Carta were the subject of 647 mergers and acquisitions during 2022, a 23% increase from 2021.

On a quarterly basis, however, deal counts are slipping. Just 129 of those 647 transactions took place during Q4 2022, compared to 179 in the first quarter of the year—a decrease of 28%. What’s behind the dropoff?

It isn’t a lack of potential targets, according to Jon Keidan, founder and managing partner at early-stage firm Torch Capital. For many founders, a tightening market for raising new venture funding has actually made the idea of a sale more appealing.

”I think founders are much more open to being acquired than they were,” Keidan says. “Because they’ll have trouble raising money, or if they raise money, they know it’s going to be a very long slog to get to the next level.”

Instead, the decline is largely due to factors outside founders’ control. One culprit is the Federal Reserve. A series of sharp rate hikes in 2022 made it much more difficult and expensive for potential buyers to raise the sorts of large loans that fuel the merger market.

“One of the challenges for larger acquisitions is that debt is usually one of the tools for them,” says Devon Kirk, partner and co-head of capital solutions at Portage, which specializes in fintech and financial services. “And the debt market has been much less constructive recently. I expect that you will start to see more large M&A and take-privates happening as the debt markets recover.”

Another major headwind to M&A: A steep decline in tech valuations. In some ways, it’s the same situation that’s led to declining deal counts in the market for both primary venture fundings and secondary transactions. Investors saw public tech valuations plunge and sought commensurate discounts in the private markets. Private companies resisted the idea of slashing their valuations. That disagreement led to fewer deals.

>>Read more: State of private markets: Q4 and 2022 in review

It isn’t only startups. Rising interest rates and valuation volatility are depressing the market for merger activity across private equity and the public markets, too. M&A activity of all kinds fell 33% between the first half of 2022 and the second half, the biggest mid-year reversal since at least 1980.

To sell, or not to sell?

The shift in valuations means that many current M&A targets aren’t operating from a position of strength, according to Kirk. Most companies with ample financial runway are choosing to wait out the market rather than sell at a discount to their last valuation.

“If you’ve got capital backing and a business plan that you have conviction in, it’s probably not an ideal time to sell,” Kirk says.

From a founder’s perspective, however, some potential buyer profiles might be more appealing than others. The objective of an acquisition matters.

The takeover math has changed significantly for a purely financial acquirer, such as a private equity firm, says Keidan. Much like venture investors, these financial buyers are now more focused on current profitability and less on future growth than they were during the frothier market of 2021. Many are seeking to buy at substantial discounts, because their pricing is driven by the need to turn around and sell the target company for a profit in the near future.

There might be different considerations for a strategic acquirer, such as a corporation that absorbs a startup into its larger organization. These deals are driven by a desire to improve the acquiring company, whether through offering a new product, moving into a new market, consolidating market share, or creating other synergies. Since these buyers aren’t counting on profits from a future sale, they can be less tied to the market’s ebbs and flows.

“They’re less worried about profitability and much more worried about, how potent and unique is this target?” Keidan says. “How much can it really move the needle?”

The megadeal market

The complexion of deals getting done also shifted during the final months of 2022.

Transactions worth less than $5 million accounted for 55% of M&A activity in Q1, but that figure fell to 44% in Q4. Meanwhile, the rate of megadeals over $100 million jumped from just 3% to 11% in Q3, only to fall back to 7% in Q4.

As 2023 unfolds, Keidan expects to see more of these large mergers and acquisitions—particularly sales to strategic buyers. If the IPO market remains as chilly as predicted, late-stage founders in need of an exit might consider other paths.

”If you’re between $100 million and $1 billion (in valuation), I think strategic acquisitions are going to start to get really interesting and will make more and more sense,” Keidan says. “It allows you to do what you’re doing as the founder, but just on a much bigger platform.”

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: