Topline

-

Financial policy leader Patrick McHenry to retire from Congress

-

Private market reforms remain focus for SEC

-

Gensler warns of ‘AI washing,’ signaling potential enforcement efforts

-

Supreme Court case could have broad implications for passthrough taxation

-

Carta joins group of small business advocates regarding SBA’s revised rule on affiliation

Patrick McHenry, HFSC Chairman and innovation champion, to retire from Congress

House Financial Services Committee Chairman Patrick McHenry announced he will retire from Congress at the end of this term. McHenry’s departure is an immense loss for the institution. He is respected by lawmakers across the political spectrum and has earned the reputation of being a thoughtful, pragmatic, bipartisan dealmaker. This Congress, he helped broker deals to prevent national default and guided the House through the turmoil of electing a new speaker after Kevin McCarthy—who also announced his departure from Congress this week—was ousted.

During his career and as HFSC Chairman, McHenry has been a champion of the venture ecosystem and broader innovation in the financial services sector, driving efforts to support entrepreneurs, promote capital formation, and boost investment opportunities. His work has facilitated more effective equity crowdfunding, access to capital for growth-stage companies, and private market liquidity. Put simply, Chairman McHenry has sought to steer policy to ensure that regulation contains appropriate safeguards while enabling innovation.

The committee has advanced a number of policy proposals to this end, including:

-

Investor access: Increasing accredited investor on ramps, including through tests and other qualifications

-

Bolstering venture capital: Expanding the ability for venture capital funds to invest in secondaries and fund of funds and increasing the size and investor caps for qualifying venture capital funds to help drive capital to emerging ecosystems and fund managers (McHenry also was responsible for creating the concept of qualifying venture capital funds)

-

Digital assets: Creating a regulatory framework for digital assets and stablecoins

While McHenry’s departure is a loss for the ecosystem, it could provide an opportunity for some of these policy priorities to gain momentum and advance. The Carta Policy Team will continue working to support these efforts, and we thank Chairman McHenry for his leadership and work to support the startup ecosystem.

Private market reforms remain focus for SEC

The SEC released its latest regulatory agenda this week, and private market reforms will remain an area of focus for rulemaking activity. Here are a few highlights and potential implications for the ecosystem:

-

Private fund advisers: On top of the sweeping private fund adviser rules that the Commission adopted earlier this year, the SEC is expected to finalize proposals that would impose a host of new compliance obligations on SEC-registered private fund advisers related to cybersecurity risk management, vendor due diligence, custody, ESG disclosures, and enhanced Form PF reporting.

-

Regulation D: The SEC is expected to propose reforms to Regulation D, the primary vehicle through which companies and funds raise capital in private markets. Such reforms may include requiring more disclosures from private issuers on Form D, requiring pre-filing or closing amendments, and conditioning the use of the exemption on a Form D filing. These changes would represent wide departures from how capital is raised under Reg D, and additional friction points will likely constrain access.

-

Accredited investors: The SEC is expected to consider reforms to the accredited investor standard, including increasing the financial thresholds. Any increase in the threshold would lessen the number of individuals that would qualify and be able to access private market investment opportunities, reducing an important source of capital for founders and fund managers, particularly in lower-income regions that may lack access to established capital-raising networks.

-

12(g) holders of record: The SEC is expected to propose changing the way “holders of record” are counted under Section 12(g), which could push more private companies into the public markets before they are ready, reduce competition, and constrain investor access if the use of SPVs and other fund structures is constrained.

Why it matters: We are seeing a sea change in the way the SEC approaches private market regulation. These anticipated actions, alongside the new private fund advisers rules, will have a widespread impact on the entire private market ecosystem, in terms of both access to capital and investment opportunities. Chair Gensler will most likely have the support necessary to advance these priorities, but bipartisan pushback and industry feedback could help moderate some of the more unworkable aspects of these policies. Engagement will remain critical.

Gensler warns of “AI washing,” signaling potential enforcement efforts to come

In remarks this week, SEC Chair Gary Gensler cautioned companies and funds against “AI washing,” or making exaggerated or unfounded artificial intelligence claims to investors. Gensler’s warning comes as the increasing use of AI has led to concerns that marketing claims might not match what companies are delivering to customers. The FTC has also expressed similar concern, publishing a memo in February warning companies that it would be looking out for false advertising claims regarding AI.

Why it matters: Gensler has been outspoken around the potential risks that AI poses to financial markets. Gensler’s latest comments signal we could see the SEC take a similar approach to “AI washing” as it has taken on greenwashing, so expect to see more targeted examination and enforcement efforts in this space.

The SEC has also used its rulemaking tools to target the increasing adoption of AI. In July, the SEC proposed rules to require investment professionals to assess whether the use of AI or predictive data analytics poses any conflict of interest, and if so, eliminate or neutralize those conflicts. These efforts have been widely criticized by the industry and policymakers as overly broad and unworkable. This week, the SEC’s Investor Advisory Committee—which is generally aligned with Gensler’s policy positions— raised concerns the proposal could have unintended adverse impacts on investors and suggested the SEC narrow its focus and use its existing rules to address potential conflicts.

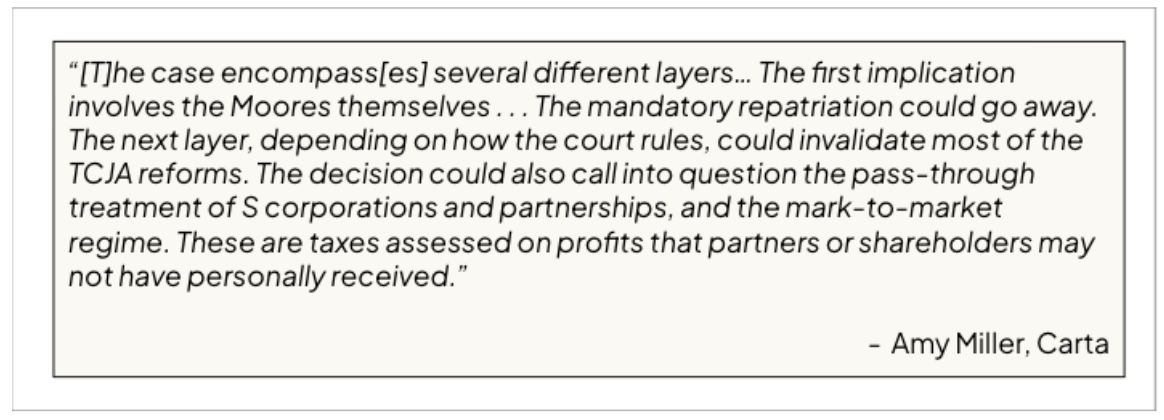

Supreme Court case could have broad implications for passthrough taxation

The U.S. Supreme Court heard arguments this week on Moore v. United States, a tax case to determine whether an individual or business can be taxed on unrealized gains.

The issue at stake is whether the mandatory repatriation tax, under the Tax Cuts and Jobs Act—which requires U.S. shareholders to pay a one-time tax on foreign earnings—is constitutional under the Sixteenth Amendment. But the case could have broader implications, as Amy Miller, Carta’s Director of Public Policy, discussed with Accounting Today.

What’s next: During the hearing, the justices’ inquiries indicated their apprehension about making a sweeping decision in favor of the Moores that could either exempt all unrealized gains from taxation or grant excessive authority to Congress to impose broader taxes on unrealized gains. The final decision is expected next year.

Carta releases annual equity report for 2023

Every year, Carta examines equity ownership across race, gender, geography, and ethnicity. The goal of this study is to highlight where inequities exist in order to facilitate positive change so more people from more places have the opportunity to participate in the venture capital ecosystem and ownership economy. Rising interest rates and a pullback in venture investing has made it harder for all founders to start and grow their businesses, but the current environment has had an outsized impact on women founders and founders of color—despite progress that has been made in previous years.

Here are a few takeaways:

-

Younger founders are more diverse. For founders in their 20s, just 42% (dating back to 2018) are white. Whereas 74% of founders aged 60+ are white.

-

The proportion of hires from diverse backgrounds increased for 8 years (2013-2021). It has now fallen 2 consecutive years (2022, 2023).

-

Over the past 11 years, 34% of new hires who received equity were women.

-

Overall, women-only founding teams raised less capital this year, but for priced seed rounds, the percentage of funding raised by women-led and mixed-gender teams improved.

Carta joins group of small business advocates in support of SBA’s revised rule on affiliation

This week, Carta joined a group of signatories on a letter to the House Small Business Committee expressing support for a recent rule change that impacts SBA loan programs.

The updated rule, which took effect in May 2023, clarifies definitions around which small businesses are eligible for SBA loans, particularly when a small business may be “affiliated” with another entity that may have ownership in it. This clarity is particularly helpful for venture-backed companies. Traditional lenders are pushing to rescind aspects of the rule, and Carta and our innovation partners want to ensure startups, small business, and venture-backed firms have clear rules of the road to access capital.

News to know

-

Senators launch bipartisan probe of private equity's growing role in U.S. health care. The probe is specifically looking at documentation concerning the role that several major private equity firms, including Apollo Global Management, have played in a series of failures within health care systems.

-

Congressional leaders release draft bill to fix SECURE 2.0 errors. A bipartisan group of congressional members released an updated draft of the comprehensive retirement security package for public feedback. This follows guidance from the IRS in August that delays the provision’s effective date for two years.

-

House Oversight and Accountability Committee holds hearing on AI and questions level of industry input. At the hearing, committee members questioned industry experts on the government’s current approach to regulating AI, questioning if there was enough industry input on the White House’s recent AI executive order before it was published.

-

LinkedIn and Zoom may be a new target for enforcement surrounding recordkeeping. Financial firm communications on platforms like LinkedIn and Zoom may be an upcoming focus for regulators after a series of enforcement actions against other communications applications, such as WhatsApp, according to a new report.

-

Bank CEOs appear before the Senate. The leaders of the nation’s largest banks testified before the Senate Banking Committee, the group’s third annual congressional appearance. The path of the economy was a looming concern during the event; Citigroup warned that typical warning signs of a potential recession are emerging, but Goldman Sachs said the chances of a recession have fallen as the economy proves more resilient than expected. The group is not slated to appear before the House Financial Services Committee this year.

Upcoming events

-

The Atlantic Council: Debating the Dollar: Who Wants It, Who Doesn't, and What Comes Next? - December 12 at 6:30 a.m. PT / 9:30 a.m. ET

-

House Committee on Small Business hearing: A Year in Review: The State of Small Business in America - December 12 at 7:00 a.m. PT / 10:00 a.m. ET

-

The Federalist Society webinar FSOC’s Updated Approach for Responding to Financial Stability Risks: New Guidance on Nonbank “SIFI” Designations - December 12 at 9 a.m. PT / 12:00 p.m. ET

-

House Financial Services Committee hearing: Examining the Agenda of Regulators, SROs, and Standards-Setters for Accounting, Auditing - December 12 at 11:00 a.m. PT / 2:00 p.m. ET

-

The Peterson Institute for International Economics discussion: The U.S. Debate About the Final Basel III Accord - December 13 at 6:00 a.m. PT / 9:00 a.m. ET

-

Federal Open Market Committee Press Conference - December 13 at 11:00 a.m. PT / 2:00 p.m. ET

-

Senate Judiciary Committee hearing: The New Invisible Hand? The Impact of Algorithms on Competition and Consumer Rights - December 13 at 12:00 p.m. PT / 3:00 p.m. ET

-

SEC Open Meeting - December 13 at 7:00 a.m. PT / 10:00 a.m. ET

-

CFTC Commission Open Meeting - December 13 at 6:30 a.m. PT / 9:30 a.m. ET

-

Brookings Institution: The importance of financial data collection and standardization - December 14 at 6:00 a.m. PT / 9:00 a.m. ET