Startup valuations remain well below the lofty heights they reached at the peak of 2021’s bull market. But in the first quarter of 2023, there were signs that the VC valuation environment is growing friendlier.

The median valuation increased at each of Series A, Series B, Series C, and Series D during Q1, the first time that’s been true at all four stages since Q2 2021. The largest uptick came at Series C, where the median valuation jumped by 21%.

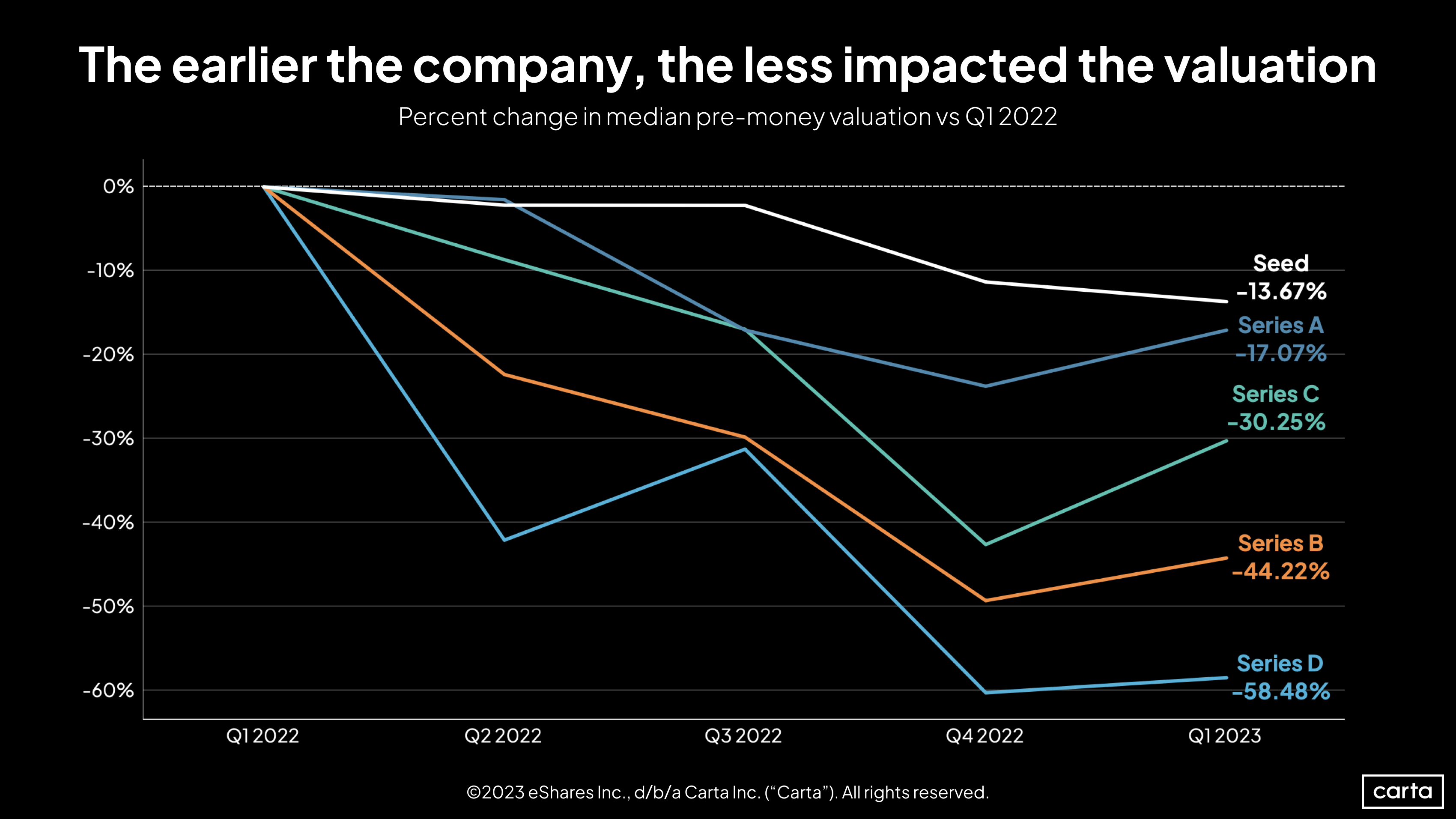

Even with last quarter’s upward movement, however, valuations are down across the board compared to this time last year, with later-stage companies seeing the largest differentials.

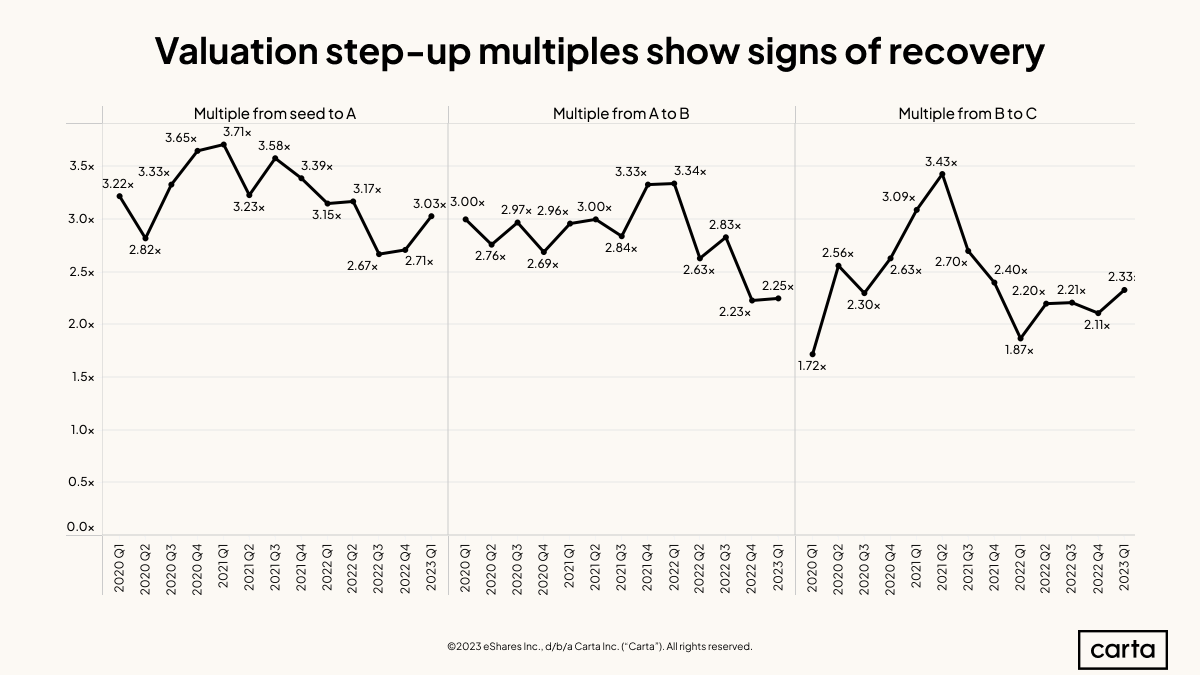

Valuation step-up multiples rebound

Concurrent with Q1’s uptick in valuations, the median valuation step-up multiple also increased in Q1 at each of Series A, Series B, and Series C. This means that companies raising a new venture round at these stages could expect a larger valuation increase over their prior round compared to what they might have achieved in Q4 2022.

For instance, the median Series A valuation in Q1 was 3.03x higher than the median seed valuation, the first time since Q2 2022 that ratio has risen above 3x. The median multiple going from Series B to Series C rose to 2.33x, its highest point since 2021.

Step-up multiples can be a useful tool for comparing valuation trends at different stages. When multiples are high across several stages, companies can expect their valuations to grow more quickly as they move through different phases of the startup lifecycle. When multiples are lower, valuations don’t grow as fast.

Valuation step-up multiples, of course, are a function of valuations themselves, and thus trends in the two statistics tend to be correlated. Last year’s lower valuations and lower multiples were one cause of the ongoing slowdown in venture activity, with some companies delaying their next funding round until a more favorable valuation environment emerges.

Read more: As VC valuation step-up multiples shrink, startups feel the squeeze

Lower step-up multiples can have a compounding effect. Say a startup raises seed funding at a $10 million valuation. If it raised its next round at a 3.03x step-up multiple—the median figure from Q1—its Series A valuation would be $30.3 million. If it also raised its next two rounds at the median step-up multiples from Q1, the startup would be valued at about $159 million with its Series C.

If that same $10 million seed startup raised its next three rounds at the step-up multiples from Q4 2022, it would be valued at just $128 million after its Series C. That’s a major decline from a year earlier: If the same startup raised three rounds at the step-up multiples from Q4 2021, it would be valued at $271 million after its Series C.

Just like with valuations, step-up multiples are still lagging behind where they were a year ago. But for startups and investors searching for positive signs, last quarter’s movement was a step in the right direction.

Learn more

-

The 2023 Enterprise Tech 30 list: How does the ET30 universe compare?

-

In late-stage VC valuations, what went up has come down—and then some

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: